Fauji Fertiliser Bin Qasim earns Rs518m in 3Q2017

Higher DAP sales, significant cost cuts contribute to higher profit

A farmer spreads fertiliser in his rice field. PHOTO: REUTERS

Earnings per share (EPS) increased to Rs0.76 in Jul-Sep 2017 compared with an EPS of Rs0.29 in the corresponding quarter of last year.

Fauji Meat officially begins commercial operations

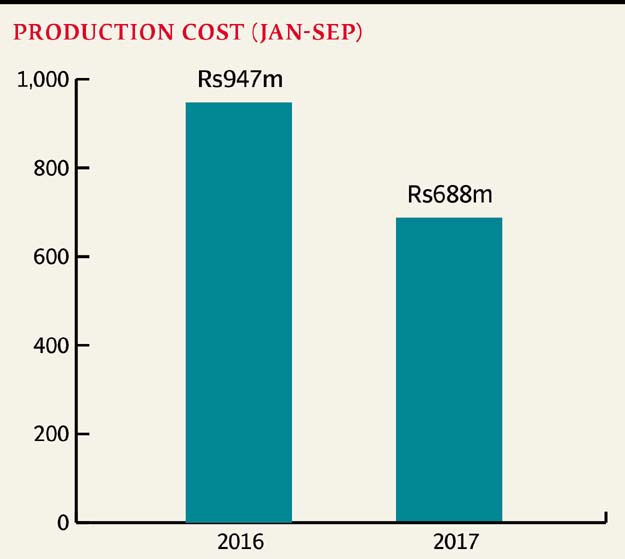

The company succeeded in reducing its production costs to Rs688 million in the first nine months of calendar year 2017 from Rs947 million in the same period of last year. Its share price on the KSE-100 index closed at Rs35.15 on Thursday, up 4.3%.

Sales of the company grew 32% year-on-year in the third quarter of 2017 to Rs15.1 billion, of which Rs11.5 billion was contributed by the core fertiliser business, up 13% year-on-year.

As per provisional September 2017 fertiliser sales figures, the company’s DAP sales rose 14% year-on-year to 162,000 tons while urea sales were down around 7% to 145,000 tons, according to a Topline Securities’ report.

Food business contributed Rs1.9 billion to sales, up 119% year-on-year, while FFBL Power Company added the remaining Rs1.6 billion, which was absent last year as the power plant commenced operations in the second quarter of 2017, the report added.

Tax Filing Drive: FBR team visits Fauji Fertiliser

Gross margins improved from 6% last year to 19% in the Jul-Sep 2017 quarter likely due to higher proportion of DAP sales, lower phosphoric acid prices, lower costs of coal-based power along with contribution of the power plant itself.

Consequently, gross profits ballooned more than three-fold to Rs2.9 billion. Gross profit has shown a significant recovery after seven quarters.

Finance cost went up 69% year-on-year to Rs1.2 billion as the company took a Rs21-billion loan last year to fund its coal project.

Other income dived 69% due to receipt of lower subsidy from the government.

“Persistent production levels leading to higher inventories and volatility in price level of phosphoric acid - the primary raw material - are two key risks for the company,” the report said.

Published in The Express Tribune, October 20th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ