Weekly review: Uncertainty erodes away gains, KSE-100 ends almost flat

Benchmark index loses 37 points or 0.1% in the outgoing week

Stock exchange. PHOTO: AFP

What could have been a five-day streak in the green was marred by economic and political ups and downs. The KSE-100 index settled at 42,750.19 points, failing to sustain its level over the 43,000 mark during the outgoing week.

The week kicked-off on a positive note, as the positive streak witnessed in the previous week continued on the back of foreign buying. The momentum built further as the following two sessions also witnessed decent gains, with the index crossing the 43,000 barrier.

However, the seven-day winning streak came to an end, on account of orders issued by the Lahore High Court to make the Model Town incident inquiry public. In addition, the issuance of bailable warrants against Finance Minister Ishaq Dar also increased anxiety among investors. The index lost 597 points cumulatively on the last two days of trading.

Market watch: KSE-100 touches new peak with handsome gain

Market participation improved as investors looked to gamble in penny stocks; average volumes were up 9% to 171 million shares while value rose 3% to $85 million. Pertinently, this week volume leaders remained WTL, TRG, DSL, EPCL and KEL, capturing 29% of average volumes.

The stock market was buoyed by news of current account deficit contracting by 73% month-on-month in Aug 2017, power generation increased by 19% year-on-year in Aug 2017, Large Scale Manufacturing posted a 13% upturn year-on-year in July 2017, and international urea prices rose to $252/ton from $240/ton a week earlier.

Key performers, on the sector front, were refineries up 4% week-on-week, followed by fertilisers 3% week-on-week. On the flip side, cements shed 3%, E&Ps were down a percent while banks were almost flat (-0.3%)

In terms of scrips, pressure to the downside was led by HBL (-153 points) on account of a downgrade in its rating by Moody’s, LUCK (55 points) and MEBL (48 points). Whereas, positive contributions to the bourse came from DAWH (72 points), MCB (70 points), and FFC (59 points).

Foreign buying was recorded at $0.4 million during this week compared to $27.7 million last week. Buying was concentrated in fertiliser ($4.8 million) in line with the global rally sparked by higher prices, followed by OMCs ($1.7 million) and cement ($1.6 million), while foreigners sold $4.2 million worth of E&Ps followed by power ($1.4 million).

On the domestic front, insurance companies loaded up $4.2 million worth of Pakistan equities, while net selling was led by mutual funds worth of $4.5 million and $3.3 million by brokers.

Among major highlights of the week were; IMF said that Pakistan can manage without its support, textiles exports improved by 9.3% YoY to $1.17 billion in Aug 2017, oil and related imports increased by 47.9% YoY to $1.08 billion in Aug 2017, Ogra gave 6.3% UFG allowance to gas utilities, Miftah Ismail likely to replace Ishaq Dar as Finance Minister.

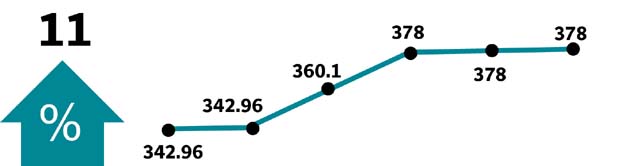

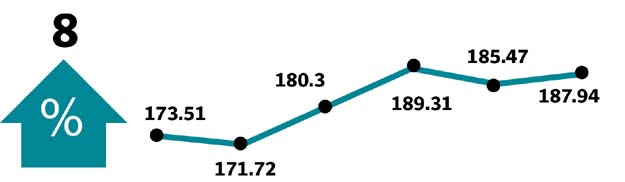

Winners of the week

JDW Sugar

JDW Sugar Mills Ltd produces and sells crystalline sugar. The company is located in District Rahim Yar Khan and was formerly named United Sugar Mills Limited.

Market watch: KSE-100 undergoes most volatile session in six months

Dawood Hercules

Dawood Hercules Corporation Ltd produces urea fertilisers. The company also produces anhydrous ammonia for manufacturers of soda ash, fructose and other chemicals.

GlaxoSmithKline (Pak)

GlaxoSmithKline Pakistan Limited manufactures and markets pharmaceuticals and animal health products.

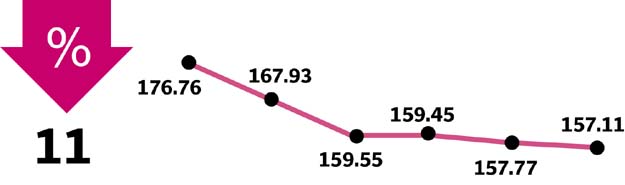

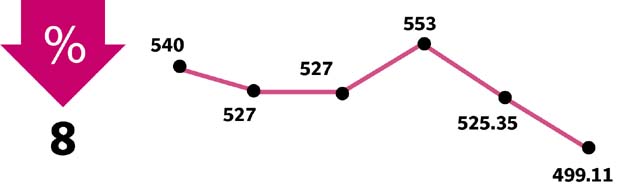

Losers of the week

Kohat Cement

Kohat Cement Company Limited manufactures and sells grey cement.t

Meezan Bank

Meezan Bank Limited is a commercial bank dedicated to Islamic banking. The bank provides a range of deposit products, loans, and other products through offices located throughout Pakistan.

Indus Dyeing

Indus Dyeing and Manufacturing Company Ltd manufactures and sells yarn.

Published in The Express Tribune, September 24th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ