Current account deficit widens 210%, stands at $2.05b

Govt needs to take steps like rupee depreciation, duty on non-essential imports, dollar bonds

PHOTO: REUTERS

“The government needs to take assertive actions as soon as possible to arrest CAD and control the decline in foreign exchange reserves,” a Topline Securities report said on Monday.

Some of the measures that the government must take immediately, the report added, could be rupee devaluation, levy of regulatory duty on non-essential imports, export promotion, floating dollar bonds, bilateral borrowing, etc.

Pakistan has already posted a much higher-than-expected CAD of $12.1 billion (4% of gross domestic product - GDP) in the previous fiscal year ended June 30, 2017.

The report predicted that this year’s CAD may reach $16 billion (5% of GDP), the highest since fiscal year 2008, which would be subject to revision if the above trend persisted.

Experts divided as Pakistan’s current account deficit balloons 205%

With the difference between exports and imports being the biggest determinant of the current account balance, a deficit or surplus reflects whether a country is a net borrower or net lender with respect to the rest of the world.

The enormous increase in the deficit suggests that the government has been unable to manage its balance of payments position over the medium and long run.

The deficit is growing due to heavy debt servicing, recovering oil prices and weak exports. Analysts say in the current scenario of falling foreign currency reserves, the rupee’s depreciation and monetary tightening in the next few months cannot be ruled out.

As a percentage of GDP, the deficit rose to 7.2% in July 2017 as opposed to just 2.6% in the same month of previous year.

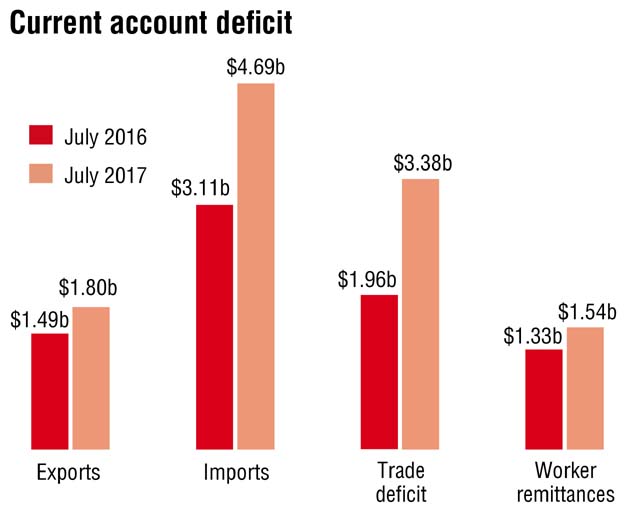

In the first month (July) of fiscal year 2017-18, Pakistan exported goods worth $1.80 billion compared to exports valuing $1.49 billion in July 2016, reflecting a reasonable year-on-year increase of 21%.

However, imports in July 2017 jumped much faster to $4.69 billion as opposed to $3.11 billion in the comparable period of last year, up 51%. Balance of trade in both goods and services in July was negative $3.38 billion compared with a deficit of $1.96 billion in the same month of previous year.

Worker remittances amounted to $1.54 billion in July 2017, up 16% from the same period of previous year, when they totalled $1.33 billion.

Pakistan’s trade deficit reaches record high

Remittances make up almost half of the import bill of Pakistan and cover the deficit in the trade of goods account. Some experts believe that any slowdown in remittances is a worrying sign for the country.

Moreover, Pakistan has also been facing low levels of foreign direct investment (FDI) in recent years.

In FY17, the FDI increased just 5% to $2.41 billion compared to $2.30 billion in the previous year.

According to the Board of Investment, Pakistan received a record high FDI of $5.4 billion in fiscal year 2008, but since then the country has been struggling to touch even half of that milestone.

Published in The Express Tribune, August 22nd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ