Experts divided as Pakistan’s current account deficit balloons 205%

While worrying, some say it is being led by investment and not consumption

PHOTO: AFP

With the difference between exports and imports being the biggest determinant of the current account balance, a deficit or surplus reflects whether a country is a net borrower or net lender with respect to the rest of the world.

Pakistan’s trade deficit reaches record high

The enormous increase in the deficit suggests the government has been unable to manage the balance of payments position over the period.

“I warned the government last year about the phenomenal rise in the current account deficit, but they said I was creating despondency,” said Dr Ashfaque Hasan Khan, an Islamabad-based economist.

My numbers stand vindicated, said Khan, adding that in November he predicted a current account deficit of $7.5 billion that would now reach slightly over $8 billion by the end of June 2017.

“I was not destabilising the government. Rather, I was presenting the true picture of the economy,” he stressed.

Analysts say the deficit is growing due to heavy debt servicing, recovering oil prices and weak exports.

However, according to some experts, there are many positives in the present situation as Pakistan’s economy is being led by investment instead of consumption.

The country is experiencing more outflows than inflows in the wake of the ongoing construction phase of the China-Pakistan Economic Corridor (CPEC), which needs heavy and sophisticated machinery for swift work.

Some experts believe the situation is expected to change once CPEC starts producing positive returns for the economy. Pakistan’s current account deficit in fiscal year 2015-16 stood at $3.39 billion. As a percentage of gross domestic product (GDP), the deficit rose to 2.7% in the first 10 months of 2016-17 as opposed to 1% in the same period of previous year.

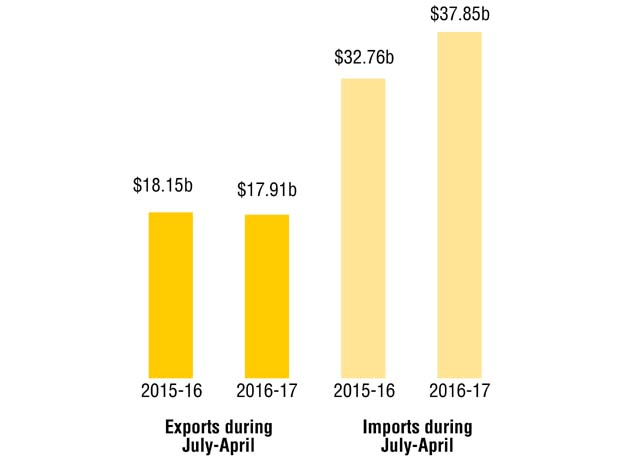

Between July and April of fiscal year 2016-17, Pakistan exported goods worth $17.91 billion compared to exports valuing $18.15 billion in the comparable period of 2015-16, reflecting a year-on-year decrease of 1.3%.

However, total imports were valued at $37.85 billion as opposed to $32.76 billion in the comparable period of 2015-16, a significant increase of 15.5%.

Balance of trade in both goods and services at the end of first 10 months was recorded at a negative $22.25 billion compared with a deficit of $16.86 billion in the same period of the previous fiscal year.

Worker remittances amounted to $15.60 billion in Jul-Apr of 2016-17, down 2.8% from the same period of previous year, when they totalled $16.05 billion.

Towering current account deficit raises alarm bells

Remittances make up almost half of the import bill of Pakistan and cover the deficit in trade of goods account. Some experts believe that the slowdown in remittances is another worrying sign for the country.

Moreover, Pakistan has also been facing low levels of foreign direct investment (FDI) in recent years.

According to the Board of Investment, Pakistan received a record high FDI of $5.4 billion in fiscal year 2008, but since then the country has been struggling to touch even half of the milestone.

Published in The Express Tribune, May 18th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ