Pakistan received $5.4 billion in fiscal year 2007-08, which is the highest amount in the country’s history, according to the Board of Investment (BoI).

However, the country has been recording low levels of foreign investment since 2008. Many foreign investors, especially from western countries, have pulled out due to the persistent energy crisis, poor governance and security challenges.

CPEC praised for enhancing regional connectivity

China dominates with 49% share

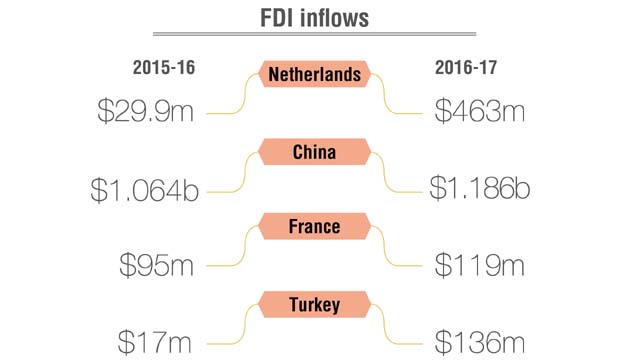

Chinese investors are pouring cash due to the China-Pakistan Economic Corridor (CPEC) projects mainly in major infrastructure projects. Pakistan’s eastern neighbour leads the list of individual countries pouring investment in FY17 with $1.186 billion, up by 11% from $1.064 billion in the last year.

In June 2017 alone, the country received net FDI of $104 million from China.

Netherlands emerged as the second leading country with FDI of $463 million in FY17 compared to just $29.9 million in the same period of last year. This comes on the back of a $448-million acquisition of Engro Foods by FrieslandCampina - a Dutch food company.

Turkey came at number three with $136 million in FY17 compared to just $17 million in the same period of last year while France brought in investments of $119 million compared with $95 million in the corresponding period.

Major decline from Norway, Egypt, UK and UAE

Fiscal year 2017 saw a major decline in FDI coming from Norway, which dropped to a negative $13 million from $172 million in FY16. Similarly, this year Pakistan did not receive any FDI from Egypt though it got a decent FDI of $141 million from the North African country in 2016.

The FDI coming from UK declined to $69 million in FY17, down 54% from $151 million in last year. Likewise, the country received just $59 million from the UAE in FY17, down 46% compared to $110 in the previous year.

Overseas investors find 94% reduction in crime

Sector breakdown

Power sector received the highest FDI of $795 million in FY17, but it was still significantly down from $1.159 billion from the previous year.

This was followed by the food sector where the country received $493 million in FY17 compared to net outflow of $56 million in the previous year.

Surprisingly, construction was also among the fastest growing sectors in FY17; receiving a significant $468 million compared to just $46 million in FY16. The electronics sector also received a respectable $143 million compared to just $34 million in FY16.

Published in The Express Tribune, July 18th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ