KSE-100 gains 729 points as value-picking helps recovery

Benchmark-100 index closes at 45,394.06

PHOTO: AFP

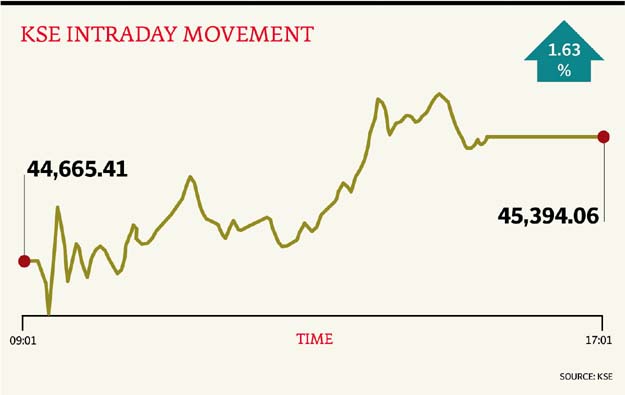

A brief ride in the negative was followed by a gradual increase as investors took advantage of attractive valuations, cherry-picking stocks to take the benchmark-100 index over the 45,000-point level.

At close of trading, the benchmark KSE 100-share Index finished with a gain of 728.65 points or 1.63% to end at 45,394.06.

Elixir Securities stated in its report that equities closed higher after covering some of the previous day’s losses through slightly improved turnover.

“Market opened on a sideways note and witnessed sharp volatility in the early hours as stocks carried bearish momentum on the prevailing political noise.

“The benchmark KSE-100 Index dipped in the red zone to test support near 44,300, followed by institutional buying mid-day that helped the index close 1.6% up near 45,400,” the report stated.

Oils, cements and fertilisers saw institutional flows and led gains while industrial and consumer sideboards also followed suit and edged up on retail churning.

“Despite the pullback, we expect market to remain under pressure and trade volatile in the near term with investors eagerly waiting for clarity on domestic political front before any aggressive buying,” the report added.

JS Global analyst Arhum Ghous echoed similar sentiments and cited banks as the major growth driver.

“Buying was largely driven by value hunters with heavyweight commercial banks MCB (+0.59%), UBL (+0.65%), ABL (+4.08%) and NBP (+2.49%) leading the charts,” he said.

E&P sector gained points to close (+3.6%) higher than its previous day’s close as crude oil prices continued to trend upwards. PPL (+5%), POL (+1.9%) and OGDC (+3.32%) were the major gainers of the aforementioned sector.

PIBTL (+4.96) gained on account of successful completion of its project (i.e. bulk cargo vessels handling terminal at Port Qasim) and start of commercial operations. Volume stood low at 190 million shares. EPCL led volumes with 15 million shares changing hands.

“Going forward, we recommend investors to stay cautious and avoid taking intraday positions,” he added.

Overall, trading volumes rose to 190 million shares compared with Monday’s tally of 156 million.

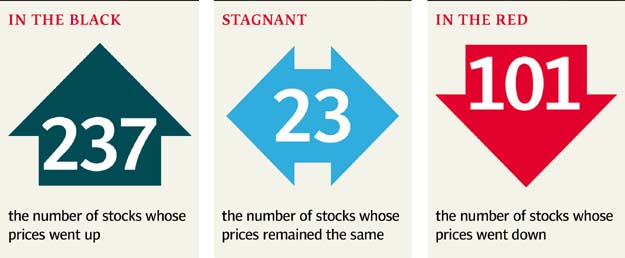

Shares of 361 companies were traded. At the end of the day, value of 237 stocks closed higher, 101 declined while 23 remained unchanged. The value of shares traded during the day was Rs9.7 billion.

Engro Polymer was the volume leader with 14.7 million shares, gaining Rs0.22 to close at Rs34.90. It was followed by TRG Pak Ltd with 14.2 million shares, losing Rs0.10 to close at Rs37.99 and K-Electric Ltd with 13.4 million shares, gaining Rs0.02 to close at Rs6.84.

Foreign institutional investors were net sellers of Rs737 million during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, July 5th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ