KSE-100 ends with 23% gain as fiscal year ends

Eventful 12 months for PSX with further advance halted due to political uncertainty and negative budget measures

Eventful 12 months for PSX with further advance halted due to political uncertainty and negative budget measures. PHOTO: INP

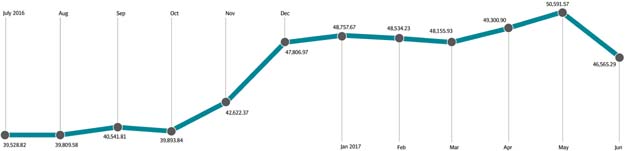

From being Asia’s best performing market in calendar year 2016, the KSE-100 Index - a benchmark for market performance - has remained under pressure in the last three months.

Political pressure and huge amounts of foreign selling in the wake of Pakistan’s reclassification as MSCI Emerging Market have meant that share prices did not enjoy the kind of northward journey they did in the earlier half of the fiscal year.

Nevertheless, the KSE 100-Index concluded 2016-17 with a gain of 23%, finishing at 46,565.29 points on June 30.

An unfriendly budget, post MSCI-reclassification correction and increased political noise due to the ongoing Panama case have taken the shine off an otherwise impressive year for the PSX.

But the gains were far higher at one point in time. The KSE-100 had climbed over 40% in the first eleven months, reaching an all-time high of 53,127.24 points during intra-day trading in the last week of May.

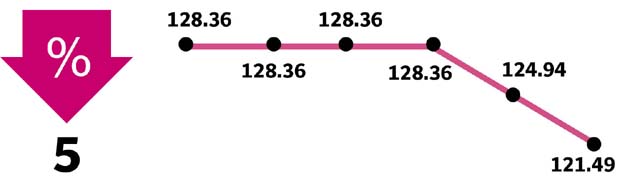

Topline Securities’ analyst Adnan Sami Sheikh said in a note to clients that “bulk of the sell-off was seen in June 17 (worst June since 1999 and worst month since March 15), with the index falling 8% due to a plethora of negative news and events that missed expectations.”

In FY17, the index rose 23% vs. 10% in FY16, he said.

Towards the end of May, the index rallied as investors were gripped by euphoria stemming in anticipation of foreign inflows on the back of the MSCI upgrade.

Expectations were first dashed when the government announced the Federal Budget, excluding key proposals from the PSX, while tightening tax measures for investors and companies alike.

The second shock to sentiment came when MSCI upgraded Pakistan to the EM status. While the industry was convinced that there would be net inflows - with estimates ranging wildly based on MSCI literature, historical comparison with Qatar/UAE, corroboration with foreign fund managers and research houses - the actual situation was that there was in fact a net outflow.

Even the country’s prime minister recently acknowledged while speaking to media in London that the stock exchange index had nosedived due to the ongoing political situation in Pakistan. He, however, vowed to undertake all measures to ensure stability.

11 months of gain

Arif Habib Limited Head of Research Shahbaz Ashraf said the other day that a 40-year low interest rate had helped the market outperform several other asset-class markets in the first eleven months of the recently-concluded fiscal year.

“Rupee remained stable so money market’s investors relocated their portfolios to the stock market. In addition, real estate sector also moved their investment into the PSX due to confusion {on taxation},” he said.

Mutual funds appeared as the single largest investor at PSX in the 11-month period, as they received huge funds from institutional and individual investors. The market recorded trade transactions of over $41 billion during the 11 months, according to the National Clearing Company of Pakistan Limited.

The market attracted huge liquidity with significant support of robust financial reporting by companies listed, project expansion stories mainly from cement, steel and automotive sectors, improvement in political maturity and the then upcoming PSX up-gradation to MSCI Emerging Market on June 1, 2017.

The euphoria related to PSX’s reclassification had played a critical role in pushing the KSE-100 up prior to the actual inclusion day, after which profit-taking began.

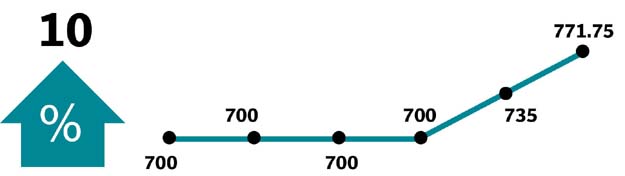

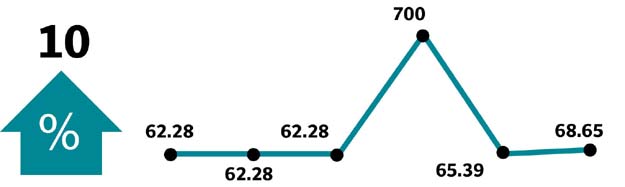

Winners of the week

Murree Brewery

Murree Brewery Company Limited specialises in the manufacture of beer and Pakistan made foreign liquor. The group also has juice extraction and food manufacturing divisions, located at Rawalpindi and Hattar respectively. Their glass division manufactures all the group’s bottles and jars.

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a Polyester Staple Fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Ltd also owns an in-house power generation plant.

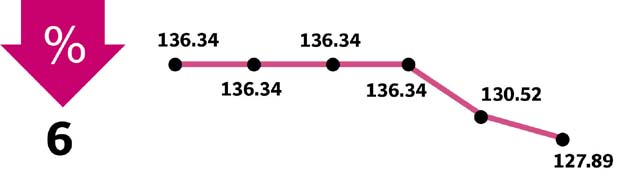

Losers of the week

International Steel

International Steels Ltd manufactures steel. The company produces cold rolled sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements and packaging industries.

Engro Foods

Engro Foods Ltd produces a wide range of dairy products. The company’s products include ice cream, flavoured milk, fruit juices and milk powders.

Published in The Express Tribune, July 2nd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ