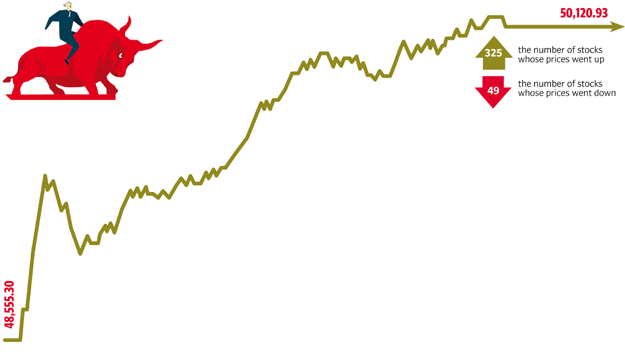

Market watch: KSE-100 ends seven-day losing streak with 1,566-point gain

Benchmark index increases 3.22%, settles over 50,100

Benchmark-100 share index finishes with 1,565.63-point gain on Monday. PHOTO: FILE

Banking, cement and oil stocks propelled the index forward as shares included in the MSCI Pakistan Index led the gains

By close on Monday, the benchmark KSE 100-share Index increased 1,565.63 points or 3.22% to close at 50,120.93.

Elixir Securities, in its report, stated Pakistan equities broke the seven-day losing streak after opening gap up.

"The index increased steadily during the day as notable blue chips across major sectors including MSCI EM constituents bounced back on buying reportedly by locals institutional investors as they cherry-picked names after the recent bout of heavy FII sell off in days leading up to and post MSCI transition," said analyst Ali Raza.

Emerging market investors to return over time, says PSX

"Investors also tracked news flow pertaining to global crude, where Saudi-led alliance cut ties with Qatar that led to an intra-day surge in crude prices, and built position in local energy stocks.

"At session's end, all major sectors closed in green zone led by financials where index heavy Habib Bank (HBL +4.2%) and United Bank (UBL PA +5%) contributed most to day's gains.

"[We] see gains to consolidate above 50,000 level in the near-term while institutional activity both from foreign and local investors will guide the market in the medium-term.

"Moreover, successful implementation of leveraged product planned for early next week is also expected to channel fresh liquidity in the system and will help absorb and counter any concerns on recent foreign outflow," Raza added.

Weekly review: Worst week since Feb 2009 as $6.8b wiped off stock market

JS Global analyst Arhum Ghous said that in-line with expectations, market recovered in Monday's session, closing at 50,121 (+1,565 points).

"All sectors contributed positive with commercial banks cumulatively contributing (+320) points to the KSE-100 index. HBL (+4.15%), UBL (+4.97%), MCB (+2.60%), and NBP (+4.25%) were the major contributors of the aforementioned sector," he added.

"On the back of news of deferment of decrease of duty on imported cars, stocks in auto sector witnessed a rally where PSMC, INDU and HCAR closed on their respective upper circuits.

"The decrease in GST to 5% from 16% for construction industry in Punjab was also taken as a positive stimulus for cement and steel sector. DGKC (+4.94%) in cement sector closed close to its upper circuit while LUCK (+3.47%), FCCL (+4.41%), MLCF (+4.96%) and PIOC (+2.90%) also heavily contributed to the index," said Ghous.

"We expect further recovery in the market and recommend selling on strength," said the analyst.

Market watch: KSE-100 index struggles to find direction

Overall, trading volumes rose to 255 million shares compared with Friday's tally of 221 million.

Shares of 391 companies were traded. At the end of the day, 325 stocks closed higher and 49 declined while 17 remained unchanged. The value of shares traded during the day was Rs13.9 billion.

Bank of Punjab was the volume leader with 26 million shares, gaining Rs0.27 to close at Rs1.56. It was followed by Power Cement (right shares) with 19.8 million shares, gaining Rs0.23 to close at Rs2.32 and K-Electric Limited with 14.1 million shares, gaining Rs0.33 to close at Rs7.58.

Foreign institutional investors were net sellers of Rs873 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ