The KSE-100 Index remained volatile through the week on account of speculation over outcome of the Joint Investigation Team’s (JIT) findings on Sharif Family case. The week opened on a negative note as the index declined almost 1,944 points on the first two days of trading due to foreign selling.

However, Wednesday was an epic session with the index reversing directions seven times and forming a strong bottom. It ended its five-day losing streak that day and managed to close in the green zone for another session, recovering 1,418 points owing to foreign interest.

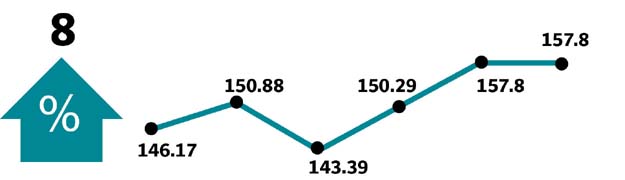

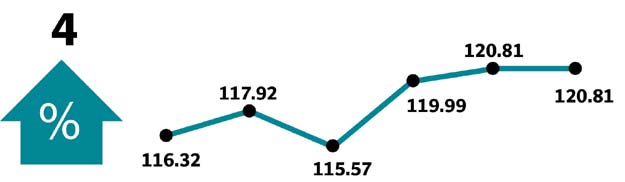

Overall activity also improved during the week with average volume and value clocking-in at 277 million (+8% week-on-week) and $124 million (+21% week-on-week) respectively, as valuations opened up and activity returned to main board items.

Not surprisingly, almost all major index heavyweights such as Oil & Gas Exploration (-1.4%), OMCs (-1.1%), fertilisers (-0.4%) and cements (-1.2%) among others continued to extend losses.

Major sectors that dragged the index down were commercial banks (-94 points), oil and gas exploration companies (-90 points), automobile assembler (-68 points), pharmaceuticals (-56 points)

On the other hand, sectors that contributed positively during the week were; power generation and distribution (+62 points) and textile composite (+42 points).

Stocks-wise, HBL (-86pts), SEARL (-46pts), PPL (-46pts), FFC (-44pts) and PSEL (-38pts) were among the losers, whereas positive contribution came from HUBC (+68pts), UBL (+45pts), NML (+41pts), ENGRO (+17pts) and LUCK (+16pts).

The market remained under pressure over political uncertainty and mutual fund redemptions.

Among key highlights of the week were; the current account gap widened to $8.93 billion - highest since 2008, 24% anti-dumping duty was imposed on China’s steel billets, FBR imposed up to 60% regulatory duty on old vehicle imports, millers refused to export and foreign direct investment figures were released (up 22% year-on-year in 11MFY17 to $2 billion).

Second tier stocks remained the volume leaders with KEL (124 million), TRG (58 million), BOP (43 million), EPCL (38 million) and WTL (34 million).

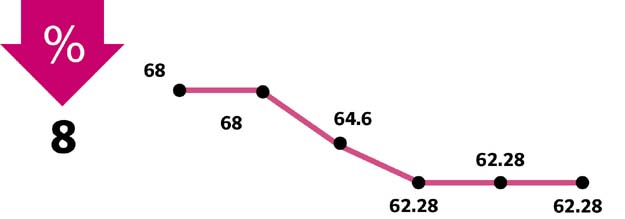

Individuals and mutual funds were major sellers of stocks worth $24.78 million and $12.25 million, respectively.

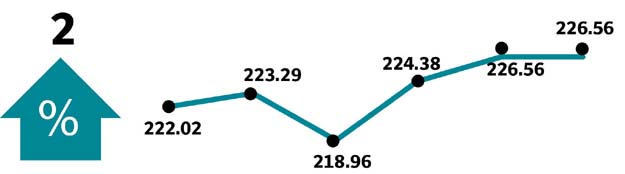

Foreign investors remained on a buying spree this week, scooping up value buys amidst relentless selling. Overall FIPI during the week clocked-in at $9.2 million as against $9.5 million of net selling recorded in the last week.

On the local front, the largest accumulators were banks/Development Financial Institutions of 10.59 million.

Winners of the week

Nishat Mills

Nishat Mills Limited is a textile manufacturing company. The company spins, combs, weaves, bleaches, dyes, prints and buys and sells yarn, linen, other cloth and goods. Nishat Mill’s products and fabrics are made from raw cotton and synthetic fibre. The company also owns a power plant that generates, accumulates, distributes and supplies electricity.

Hub Power Company

Hub Power Company Limited owns, operates and maintains an oil-fired power station in Pakistan. The company delivers electricity for distribution to industrial, commerce, agricultural and domestic customers. Hub’s clients include Wapda.

United Bank Limited

United Bank Ltd provides commercial banking and related services. The bank offers a wide range of banking and financial services, including brokerage services.

Losers of the week

JDW Sugar

JDW Sugar Mills Ltd produces and sells crystalline sugar. The company is located in District Rahim Yar Khan and formerly named United Sugar Mills Limited.

National Foods

National Foods Limited is a diversified food manufacturer. The group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts and a number of kinds of health foods.

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres Ltd also owns an in-house power generation plant.

Published in The Express Tribune, June 25th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1734676636-0/Untitled-(73)1734676636-0-165x106.webp)

1734511806-0/Untitled-design-(5)1734511806-0-270x192.webp)

1734587529-0/Express-Tribune-(1)1734587529-0-270x192.webp)

1734606611-0/Express-Tribune-(8)1734606611-0-270x192.webp)

1734468458-0/Copy-of-Untitled-(50)1734468458-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ