Current account deficit widens 178%, stands at $8.93b

Gap widening due to heavy debt servicing, recovering oil prices and weak exports

Despite the wide current account gap, the SBP's foreign currency reserves increased to $16.4 billion in May 2017 compared to $16.1 billion in April 2017 mainly due to a surge in fresh short and long-term loans. PHOTO: REUTERS

The enormous increase in the deficit suggests that the government has been unable to manage its balance of payments position over the 11-month period.

With the difference between exports and imports being the biggest determinant of the current account balance, a deficit or surplus reflects whether a country is a net borrower or net lender with respect to the rest of the world.

The widening of current account deficit in April and May even exceeded the estimates of experts like Dr Ashfaque Hasan Khan, an Islamabad-based economist, who earlier warned the government that the deficit could go beyond $8 billion by the end of June 2017.

Experts divided as Pakistan’s current account deficit balloons 205%

Analysts say the deficit is growing due to heavy debt servicing, recovering oil prices and weak exports. Pakistan's current account deficit in fiscal year 2015-16 stood at $3.39 billion.

The deficit touched $1.58 billion in May 2017, the third highest level in any month in the history of Pakistan, compared to $1.2 billion in April 2017. The highest-ever deficit was recorded in October 2008 when it touched $2.4 billion. It hit the second highest level of $1.7 billion in November 2007.

Despite the wide current account gap, the SBP's foreign currency reserves increased to $16.4 billion in May 2017 compared to $16.1 billion in April 2017 mainly due to a surge in fresh short and long-term loans amounting to $1.85 billion and some increase in foreign direct investment (FDI), according to a report of Insight Securities issued on Thursday.

"It may be difficult to keep meeting the current account deficit through new loans as we expect fiscal year 2017-18 deficit to cross $11 billion. In the current scenario of falling reserves, the Pakistan rupee's depreciation and monetary tightening in the next few months cannot be ruled out," the report added.

‘Current account deficit could top $7b till end of FY17’

As a percentage of gross domestic product (GDP), the deficit rose to 3.2% in the first 11 months of 2016-17 as opposed to just 1.3% in the same period of previous year.

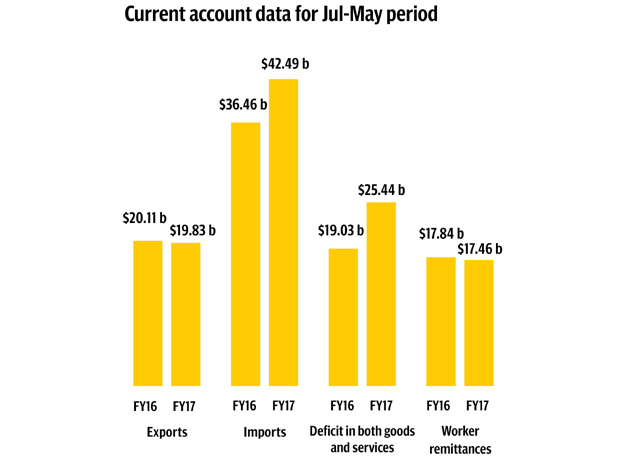

Between July and May FY17, Pakistan exported goods worth $19.83 billion compared to exports valuing $20.11 billion in the comparable period of 2015-16, reflecting a year-on-year decrease of 1.4%.

However, total imports were valued at $42.49 billion as opposed to $36.46 billion in the comparable period of 2015-16, up 16.5%.

Balance of trade in both goods and services at the end of first 11 months was negative $25.44 billion compared with a deficit of $19.03 billion in the same period of previous fiscal year.

Worker remittances amounted to $17.46 billion in Jul-May FY17, down 2.13% from the same period of previous year, when they totalled $17.84 billion.

Pakistan’s current account deficit widens 121%

Remittances make up almost half of the import bill of Pakistan and cover the deficit in trade of goods account. Some experts believe that the slowdown in remittances is another worrying sign for the country.

Moreover, Pakistan has also been facing low levels of FDI in recent years.

According to the Board of Investment, Pakistan received a record high FDI of $5.4 billion in fiscal year 2008, but since then the country has been struggling to touch even half of that milestone.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ