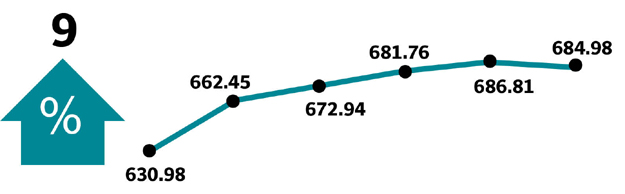

Weekly review: KSE-100 index recovers from last week’s hefty losses, rises 2%

Overall investor sentiments remained mixed as average traded volumes and value declined 19%

Overall investor sentiments remained mixed as average traded volumes and value declined 19%. PHOTO: INP

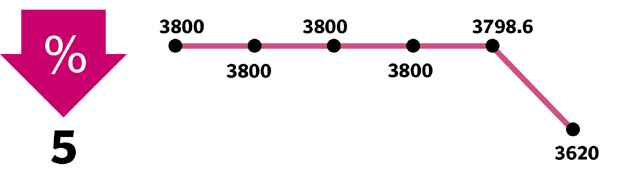

The week opened on a positive note with the index gaining 1,565 points, but activity in the following sessions remained subdued.

Market participants opted for value hunting where steep discounts available in the MSCI large and mid-cap stocks contributed the most to the index.

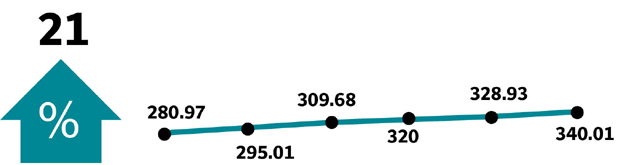

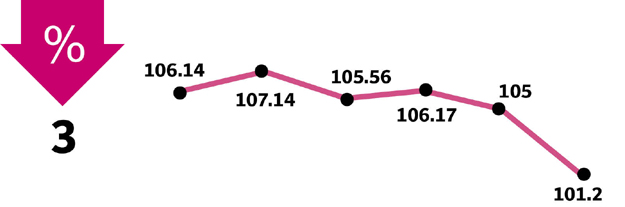

Average daily volumes shrank 19% over the week to 239 million shares compared to 295 million while retail favourites dominated the volume charts with Engro Polymer and Chemicals, Dost Steels, Dewan Farooque Spinning, Azgard Nine and Aisha Steel Mills accounting for 28% of the total volumes.

Lucky Cement, United Bank and Engro cumulatively added 260 points while other major stocks including Mari Petroleum and Bank Al Habib contributed 85 points to the index.

On the other hand, Oil and Gas Development Company, Kohinoor Textile Mills, Hub Power, Nishat Mills and Sui Northern Gas Pipelines dragged the index down by 107.64 points.

Key sector outperformers during the week were automobile assemblers (+4% week-on-week) in anticipation of strong May 2017 sales numbers followed by pharmaceuticals (+3%).

However, sectors that underperformed were cement (-2%) due to unexciting May sales and oil and gas exploration (-2%) on the back of decline in international crude prices as Saudi Arabia and other Arab states severed ties with Qatar.

Crude oil prices have tumbled to their lowest level this year as it appears that it will now be even harder for the Organisation of Petroleum Exporting Countries to agree on further cuts in oil production.

Stock-wise, Engro Polymer (+18% WoW) was the key performer as PVC-ethylene prices continued to go upwards.

Among key highlights of the week, Moody’s and World Bank had positive comments on Pakistan’s state of economy, the Sindh government allocated Rs2 billion in subsidy for tractor purchase and Engro hinted at shutting down its milk production plant in Sukkur due to tax policies. Foreign currency reserves in the week ended June 2 dipped $1.25 billion on account of debt payments to a total of $20.5 billion.

Encouragingly, there was some respite in foreign selling as offshore investors turned net buyers of $14 million during the week.

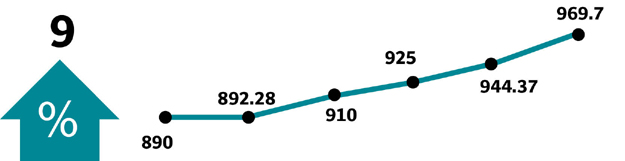

However, overall investor sentiments remained mixed as average traded volumes and value declined 19% week-on-week to 239 million shares per day and 53% week-on-week to $112 million per day, respectively.

Local individuals were net sellers of $20 million.

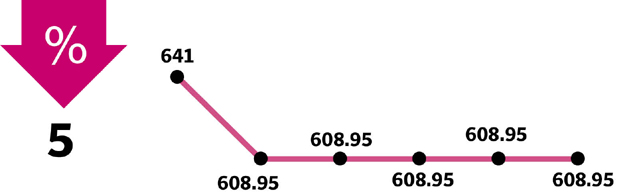

Winners of the week

Shifa International Hospitals

Shifa International Hospitals Limited establishes and runs medical centres and hospitals in Pakistan. The company’s clinical services include medicines, paediatrics, surgical, obstetrics and gynaecology, dentistry, rehabilitation services and ophthalmology.

Abbott Laboratories

Abbott Laboratories (Pakistan) Limited manufactures, imports and markets research based pharmaceutical, nutritional, diagnostic, hospital and consumer products. The company’s key products include antibiotics for respiratory tract infections, peptic ulcer disease and dental infections.

Thal Limited

Thal Limited manufactures jute goods. The company also undertakes engineering projects.

Losers of the week

Indus Dyeing

Indus Dyeing and Manufacturing Company Limited manufactures and sells yarn.

Bata (Pakistan)

Bata Pakistan Limited manufactures and sells rubber, leather and microlon sandals and shoes.

Kohinoor Textile

Kohinoor Textile Mills Limited produces textiles. The company weaves, dyes and prints natural and synthetic fibres.

Published in The Express Tribune, June 11th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ