Construction cost to go higher as govt withdraws ‘special tax regime’

Move comes after builders and developers contribute a meagre Rs112 million in tax collection during 2016-17

PHOTO: REUTERS

In a brief moment of anger, Dar said the government collected only Rs112 million under the new tax regime against a conservative estimate of Rs8 billion. “Due to this, the regime will be withdrawn,” said the finance minister during his budget speech on the floor of the National Assembly.

‘Historic’ Rs1.001 trillion allocated for development budget

Earlier this month, The Express Tribune reported that the government was considering taking back the new tax regime because it failed to meet even conservative government estimates of Rs8 billion. The government introduced a new tax regime for the construction sector, aiming to incentivise builders and developers through lower tax rates. The government hoped revenue would jump due to greater construction activity.

However, calculations fell flat on their face as the government collected less than what it generated from the sector under the old tax regime. The construction sector had paid Rs2.6 billion during fiscal year 2015-16.

Background

Finance ministry officials say the new tax regime had been offered to the influential land mafia under pressure. Therefore, the government’s move to scrap the new regime in the budget will infuriate builders and developers.

“The Federal Board of Revenue (FBR) never wanted this scheme to succeed,” Association of Builders and Developers of Pakistan (ABAD) Senior Vice Chairman Muhammad Hassan Bakshi told The Express Tribune.

ABAD, which represents about 700 builders and developers, negotiated with the government and convinced it that the authorities would collect up to Rs28 billion due to the new regime.

Bakshi accepted that ABAD was expecting up to Rs20 billion tax collection after the new regime, but said that there were some preconditions that were never met.

“When we asked the government to give us time so that we clarify the reasons of low tax collection, they never heard us,” he added.

Prices of cement and steel

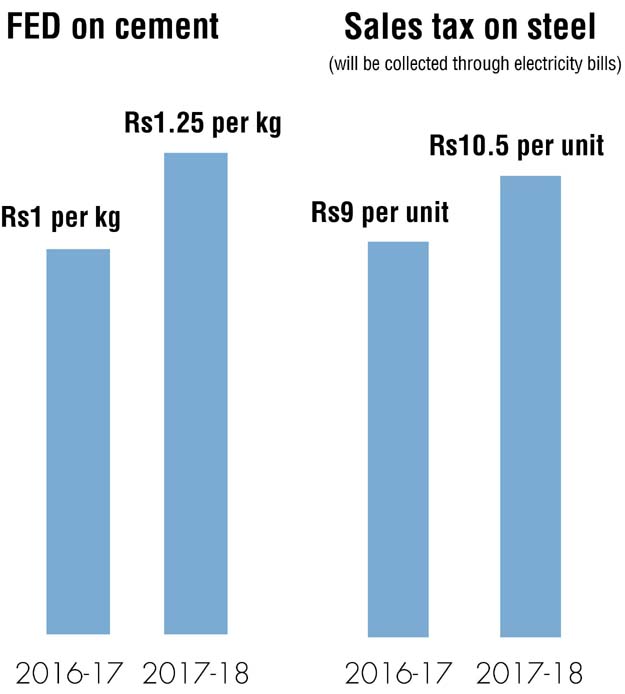

The government has also decided to increase Federal Excise Duty (FED) on cement sector from Rs1 per kg to Rs1.25 per kg. This will increase the current FED of Rs50 for a 50kg bag to Rs62.5 per bag.

However, analysts say this will not have a major impact on the industry.

“The industry will pass this on to the consumers so it will not affect the profitability of the cement industry,” commented Sherman Securities analyst Saqib Hussain Khan.

According to the speech Dar read on the assembly floor, the cement industry is growing and hence, it should contribute to government revenue. However, the government ‘hopes’ that this will not result in an increase in cement prices and the industry will ‘absorb’ this additional FED burden.

Pakistan's real estate sector booming but growth not showing on PSX

Similarly, Dar said that the government has decided to increase sales tax rates for the steel industry from the current Rs9 per unit to Rs10.5 per unit.

The government collects General Sales Tax (GST) from the steel industry through electricity bills.

However, this move will most probably increase steel prices in the coming months.

Dar claimed that the government took this decision in consultation with the industry and that the corresponding increase shall be made in ship-breaking and other allied industries.

Published in The Express Tribune, May 27th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ