Reliance on borrowing: Cost of public debt eats up 45% of revenues

Country pays Rs1.41tr in debt servicing in Jul-Mar FY17 against annual budgeted estimate of Rs1.95tr

PHOTO: REUTERS

The government consumed around 45% of total revenues to repay the debt and make interest payments in the first nine months of current fiscal year, according to the Pakistan Economic Survey 2016-17 released on Thursday. Last year, the debt servicing cost stood slightly up at 46% of total revenues.

Pakistan aims to borrow another $8.1b in the coming year

Public debt servicing ate up Rs1,410 billion in July-March FY17 compared to the annual budgeted estimate of Rs1,945 billion.

Of the total debt servicing, interest payments on domestic debt accounted for about 72% as domestic borrowing had a higher share in the public debt portfolio.

Domestic interest payments were Rs1,010 billion in July-March FY17 compared with Rs1,003 billion in the same period of previous year. This increase was mainly driven by the rise in the domestic debt stock.

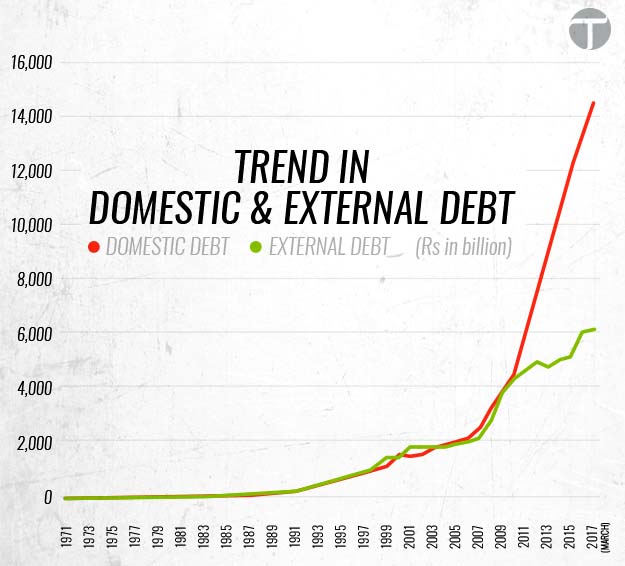

The domestic debt swelled Rs1,121 billion in July-March FY17, but it was lower than the increase of Rs1,200 billion in the same period of last year.

External public debt servicing dropped to $4,340 million in 2015-16 compared to $4,475 million in 2014-15. The decline was mainly due to lower principal repayment to the International Monetary Fund (IMF).

In July-March FY17, the servicing of external public debt was recorded at $3,883 million including repayment of $3,008 million in respect of maturing debt and interest payments worth $875 million.

Among the principal repayments, $1,000 million of multilateral debt and $500 million of Safe China Deposit accounted for most of the share.

The government believes that there will be limited pressure from external debt repayments over the medium term.

Projected principal repayments to the IMF against the Extended Fund Facility are stretched over a longer time frame, starting from $0.2 billion in 2018 and rising to $0.8 billion in 2020, with final payment due in 2025.

An amount of $0.75 billion in this fiscal year is the only Eurobond maturing until 2019. Repayments for the official development assistance from the Paris Club began in 2016, which were spread over a period of 23 years.

According to the Economic Survey 2016-17, the external debt repayment obligations for Pakistan are not more than an average of $4.3 billion per annum until 2022 based on the outstanding debt at the end of March 2017.

Keeping in view the track record, these repayments should not raise any concern as Pakistan has successfully met higher repayment obligations of $4.8 billion and $5.2 billion in 2013 and 2014 respectively, even with much smaller foreign exchange reserves.

External inflows

The government has anticipated that average yearly external inflows will be around $6.7 billion until 2022 against expected annual average repayment obligations of $4.3 billion, indicating inflows will be sufficient to meet the repayment obligations.

Gross public debt amounted to Rs20,873 billion at the end of March 2017 while net public debt stood at Rs18,893 billion. The gross debt grew Rs1,194 billion in July-March FY17.

PML-N’s priorities versus allocations

Of this increase, the domestic debt rose Rs1,121 billion as government borrowing from domestic sources for financing the fiscal deficit reached Rs1,018 billion. Similarly, the external debt rose Rs73 billion.

Liabilities

According to the survey, the public debt analysis may be incomplete without reporting contingent liabilities. These liabilities are not added to the overall debt, therefore, public disclosure of information about guarantees is an essential component of fiscal transparency. Contingent liabilities of Pakistan are guarantees issued to the public sector enterprises. In the first half of FY17, the government issued fresh/rollover guarantees amounting to Rs368 billion or 1.2% of Gross Domestic Product.

The outstanding stock of government guarantees at the end of December 2016 was Rs838 billion.

In July-March FY17, disbursements against external public debt stood at $4,955 million. Pakistan mobilised $1,000 million as proceeds of an international Sukuk, $757 million from the Asian Development Bank including $188 million for social protection development and the remaining was dominated by proceeds from the power sector programme.

Disbursements from China reached $1,033 million, an increase of $432 million compared to last year. This occurred in line with the pickup in China-Pakistan Economic Corridor-related activities. The government also borrowed $1,315 million from commercial lenders.

Published in The Express Tribune, May 26th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ