Despite tax-free system, renewable energy tariffs are high in Pakistan

NEPRA has always faced pressure to set twice the tariff compared to other countries

PHOTO: AFP

This is a 50% decrease in the last one year. Only several months ago, Pakistani solar companies (local and foreign) were not prepared to accept Rs10 (10 cents) per kWh. What is so wrong in Pakistan to get this kind of out-of-sync response from companies? There is nothing wrong with Pakistan.

Experts highlight benefits of utilising renewable energy

If there is something wrong, it is with local investors and companies who want to indulge in excessive profiteering. Their reference point is perhaps the dream price of Rs15 per unit (plus) of the Quaid-e-Azam (QA) Solar Park.

If anything, the solar and even wind power prices should be lower in Pakistan since interest rates here are far below those in India.

There cannot be as secure and risk-free tariff regime as is available in Pakistan. Almost all variables are covered and paid for (adjustable) including variations in exchange rate, fuel prices, operation and maintenance cost, etc and even climate variations.

In India and even in Brazil, South Africa and Mexico, there are all kinds of requirements and constraints such as local content and local equity. There is no adjustment for inflation in India, whereas inflation rates there are higher than market economies.

In Pakistan, there is no such constraint. There can be 100% foreign equity and profits and equity can be repatriated. There is no tax except 7% advance income tax on dividends and even that has been waived in some cases. One cannot expect more. And both the wind and solar resources are of higher intensity and quality, with higher capacity factors of 35% and 19% respectively, only second to the Middle East, Australia and parts of the US.

There is only one country ie USA which offers an additional incentive in the form of PTC (Production Tax Credit) of 30%. Resultantly, prices of renewables have been lower eg three cents of wind power tariff for quite some time now.

Pakistan’s drawbacks

In Pakistan, nothing seems to be enough. They have always pressurised National Electric Power Regulatory Authority (Nepra) to give twice as high tariff.

When it was 12 cents everywhere, they asked for 22 cents and even brought German experts to support them. When it was 10 cents, they asked for 20 cents and now it is 3-5 cents, they want 8-10 cents. Who has suffered? The companies themselves.

Solar sector has not grown despite potential and thus has lost opportunities and profits. The disease is deep in the system - the habit of capital padding and jacking up capital expenditure (capex). No professional can get a job or consultant contract, if he is not prepared to participate in this white collar crime.

Corruption has seeped into almost all levels of government, even PM Nawaz Sharif has acknowledged it recently. Corruption breeds when there is too much cream and margin being made by investors. Everybody wants to have a share in the booty.

Land prices for renewables have gone up for this reason and tremendous hostility has developed against renewable energy due to expensive tariffs.

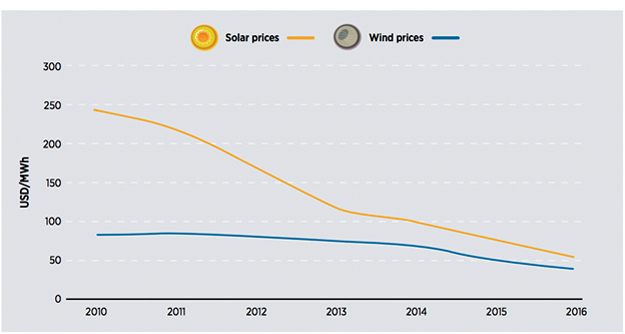

Average Prices Resulting from Auctions, 2010-16

Source: IRENA 2017, Renewable Energy Auctions

The QA Solar Park despite being a pioneer project has developed a bad image and similarly others. The solar tariff was so unbelievably high that when it was denied to an investor he went to court and has now come back to Nepra opposing the auction.

Pakistan has ‘2.9 million MW solar energy potential’

However, there is always light at the end of the tunnel. Zorlu, a Turkish firm, has recently signed an agreement with the Punjab government to install a solar PV plant in Bahawalpur of 100MW at a levellised tariff of 6 cents.

There is a consensus that unrealistic prices have been expected. There may be pressures coming in on provincial grounds or others to slip in a few projects at high tariff. Reverse auction may be delayed or frustrated. Such pressures must be resisted by those at the helm of affairs. In any case, when new power purchase agreements are not being signed due to expected glut in 2017-18, there is no justification of haste in the intervening period. Many wind power plants cannot dispatch power due to transmission issues, but tariff is being paid due to standard Take or Pay clauses.

In order to compete with conventional energy, there has to be some margin between the two prices to balance the requirement of additional capital expenditure due to intermittency, seasonality and diurnal variations in production. There should be around 5 cents of solar and wind power tariff vis-à-vis 8-10 cents of fossil and hydro as there will be a market of 5,000 to 10,000MW in the next ten years and even more if anti-coal sentiments and international policies and pressures intensify.

This is a good market size around which many policy objectives can be entertained. One of those would be pursuit of local content in wind power, if not in solar PV.

The writer has been member energy at the Planning Commission until recently

Published in The Express Tribune, May 22nd, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ