Pakistanis, on average, earn $1,629 a year

Govt fails to achieve investment and savings targets set for the outgoing fiscal year

PHOTO: AFP

Failure to achieve these two crucial targets limit the government’s ability to spend on deteriorating infrastructure and increases its reliance on external and domestic sources to meet its requirements.

Situation in the case of private investment is even more alarming as it has declined in terms of total size of the economy compared to the previous fiscal year despite hype around the $54 billion China-Pakistan Economic Corridor.

Finance minister Dar says 6% GDP growth possible

The government’s inability to increase investment as a percentage of the total size of the national economy remains its biggest failure on the economic front, suggesting that structural obstacles remain unaddressed despite undertaking so-called reforms under the $6.2 billion International Monetary Fund programme.

Pakistan has one of the lowest investment and savings rates in the region and the world, obstructing progress towards sustainable inclusive economic growth path.

Per capita income

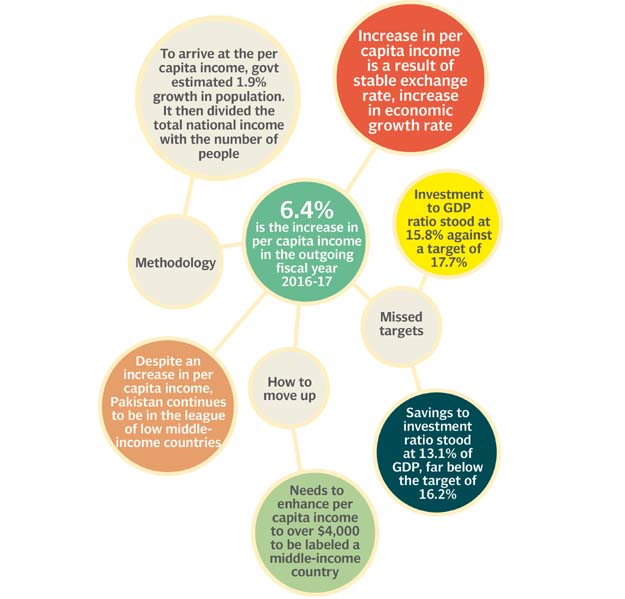

Officials said that in dollar terms the per capita income has grown by 6.4% to $1,629 - up $98 per person in the outgoing fiscal year 2016-17. Relatively stable exchange rate of Pakistani rupee against the US dollar, low population growth rate and an increase in economic growth rate are said to be reasons behind 6.4% increase in per capita income.

Despite an increase in per capita income, the country continues to be in the league of low middle-income countries. It needs to enhance per capita income to over $4,000 to be labeled a middle-income country.

In rupee terms, there was a 6.9% growth in per capita income that increased to Rs170,556 in the outgoing fiscal year.

To arrive at the per capita income figure, the Pakistan Bureau of Statistics - the government’s statistical arm - estimated 1.9% growth in the country’s population that reached 197.3 million this year. It then divided the total national income with the number of people and arrived at per capita income of $1,629.

In absolute terms, the PBS has estimated an addition of 3.7 million people in a single year. However, a more accurate population figure will only be known by July this year when results of the ongoing census are available.

Investment, savings

Investment to GDP ratio stood at 15.8% against a target of 17.7%, said the sources. The ratio was almost equivalent to last-year’s revised rate of 15.6%. Savings slipped even below last year’s level and stood at 13.1% of the GDP, far below the target of 16.2%. In the last fiscal year, savings had been recorded at 14.3% of GDP.

Cabinet sets 6% growth rate as target for next fiscal year

The fixed investment remained at 14.2% of GDP against the target of 16.1%. It was up 0.2% from last-year’s level. Public investment increased to 4.3% of GDP, which was better than the 3.9% target.

The target of private investment was also missed with a wide margin, which stood at 9.9% of GDP as against the target of 12.2%. The results are worse than last year when private investment had been estimated at 10.2%.

Raising doubt

Improving investment climate was one of the top four priority areas of the IMF and missing these targets also brings under discussion the certificates of good health of the economy given by the global lender in the past three years.

This has also put a question mark on the working of the Board of Investment whose sole job is attracting and facilitating investment. Investors term governance issue as one of the key factors holding back new investment in the country.

The BoI’s one-window facility to facilitate investors remains on paper and investors have to deal with dozens of federal and provincial departments to start a new business.

Published in The Express Tribune, May 19th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ