After 9 years, Pakistan gearing up for entry in MSCI’s Emerging Markets

Institutional investors maintain bullish stance despite regional tension, political uncertainty

PHOTO: ADB

The KSE-100 Index, a benchmark for market performance, has gained 5.1% in four sessions alone, prompting a fresh reminder as to why the Pakistan Stock Exchange was the top-performing market in Asia in 2016. It is currently positioned at a record high of 51,073.14 points.

PSX to assist SMEs in raising capital

The positive streak is in stark contrast to the stock market’s performance in the previous three months in which it retreated from close to 50,000 points to near 46,000 - a noticeable 8% decrease.

So what has changed?

For one, Pakistan is set to be reclassified from a frontier market to the MSCI Emerging Markets Index that foreigners track with a capital of $1.4-1.7 trillion in hand. We will officially be in the big boys’ club at the end of May.

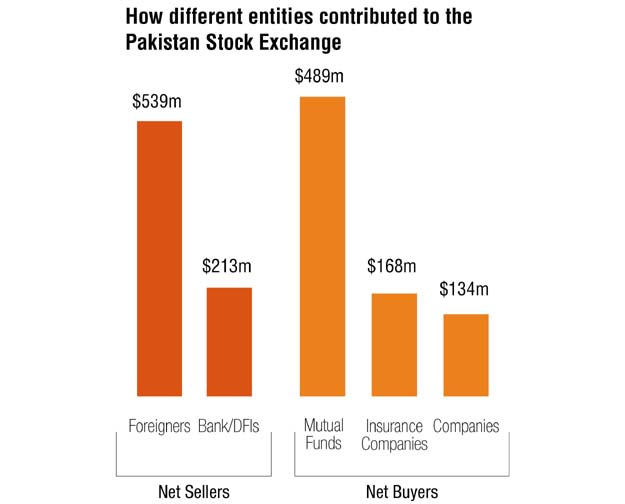

SOURCE: NATIONAL CLEARING COMPANY OF PAKISTAN LIMITED

While foreign investors are set to take a closer look at Pakistan with a fistful of cash, local companies and individuals are already factoring in the inflow.

However, questions arise as to how much money would Pakistan actually attract.

Foreign investors have been net sellers of over half-a-billion dollars’ worth of stocks at the PSX since MSCI announced that it would upgrade Pakistan last June.

With such heavy offloading, the KSE-100 Index has done well to power through to a record high. But it has been a bumpy ride.

The country has endured political uncertainty with Prime Minister Nawaz Sharif likely to appear before a Joint Investigation Team to prove innocence in graft cases. Efforts to patch civil-military ties are also under way. If this wasn’t enough, Pakistan is also at the receiving end of threats by neighbouring countries, fueling regional tension.

Despite all this, institutional investors and brokerage houses maintain their bullish stance. After all, Pakistan will reclassified as an emerging market after nine years of exclusion.

The reason is simple - fundamentals and outlook remain intact.

“It (upgrade) is obviously very good news. It will attract foreign investors,” National Investment Trust (NIT) Chief Operating Officer Manzoor Ahmed told The Express Tribune.

NIT is the largest asset management company in Pakistan with funds over Rs120 billion. It is a leading investor at the PSX.

“Political situation has never remained ideal in Pakistan. It’s built-in in our stock prices,” he added.

The other stock markets of the world, which were upgraded to the Emerging Markets status, have also attracted foreigner investors subsequently. The same is expected here, he said. Stocks fundamentals play a leading role in driving the markets, and corporate earnings, dividend yield and price-to-earnings ratio of stocks at PSX remain attractive, he said.

Arif Habib Limited Research AVP Tahir Abbas said technically, there are separate categories of foreign investors for both - MSCI Emerging Market and MSCI Frontier Market.

The announcement to exclude Pakistan from the MSCI Frontier Market (and upgrade it to the Emerging Market) has meant that passive investors, who specifically track the frontier market index, have made an exit.

This has resulted in net foreign selling of $522 million since the announcement on June 14, 2016 to last Friday (May 5). Those passive foreign investors who specifically track Emerging Market would start buying stocks once Pakistan’s reclassification to this market is notified on May 15.

Some six large- and mid-cap Pakistani stocks (Oil and Gas Development Company, United Bank Limited, Lucky Cement, Habib Bank Limited, Engro Corporation and Fauji Fertilizer Company) would become part of the market with effect from June 1, 2017. They carry 0.17% weightage in the MSCI EM as on Monday. Besides, numerous small-cap stocks would also be included in the market on the same date. However, they are not assigned weightage.

Making changes: PSX initiates process to launch derivatives

The large and mid-cap stocks to be included in MSCI Emerging Market hold 85% weightage in the PSX benchmark KSE 100-Index. These stocks have attracted the most interest in the last three sessions and gave a cumulative gain 5.1%. Such stocks had remained under pressure due to political uncertainty, and small-cap stocks took over the show. The situation seems to have reversed now.

Abbas added “passive funds would definitely invest in Pakistani names in MSCI EM as per their weightage in the market [0.17%] to develop their portfolios accordingly”.

“Investment/divestment by active foreign funds may not reflect sharply because they play in both markets; MSCI EM and FM simultaneously. They may virtually transfer their investment from FM to EM,” he said.

“Every country has its own political dynamics, but passive funds are long-time investors. They would invest here for sure,” he said

Topline Securities said in a note to its investors that total funds tracking MSCI-EM are $1.4-1.7 trillion out of which around $350 billion (20-25%) are passive. “Net inflow from foreigners during 2017 could be in the range of $100-200 million [into PSX].”

Published in The Express Tribune, May 10th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ