KSE-100 finishes with 1,140-point gain as Panama case verdict announced

Benchmark KSE 100-share Index rises 2.39%, closes at 48,743.56

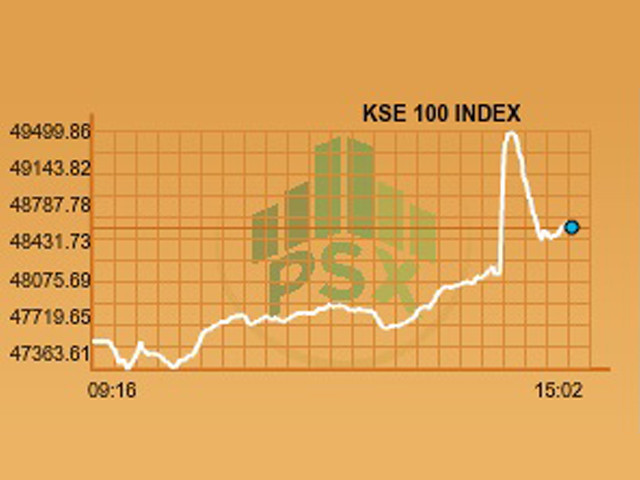

PHOTO:PSX

Side-lined by political uncertainty, investors dreaded the worst - disqualification of the prime minister - but the formation of a joint investigation team that would further probe allegations of money-laundering against the First Family was seen as a positive.

Market watch: KSE-100 undergoes most volatile session in six months

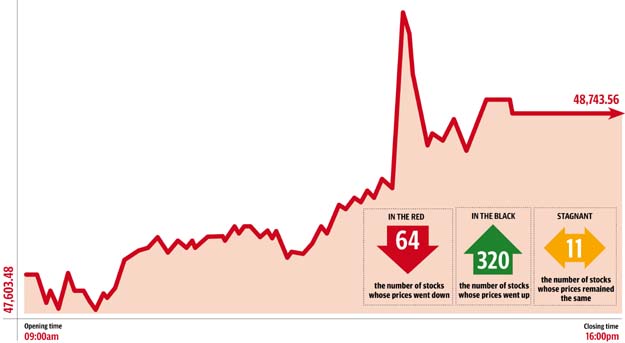

Participants came out of their shell to buy in droves as the KSE-100 Index at one point rose over 1,900 points in intra-day trading, translating to an increase of close to 4%, coinciding with the verdict of the Panama case.

At close, the Pakistan Stock Exchange’s (PSX) benchmark-100 share index ended with a rise of 1,140.08 points or 2.39% to end at 48,743.56, retreating from its intra-day high of 49,509.30.

Buying across the board meant stocks hit their upper lock, which meant a maximum gain of 5%, before profit-taking caused the index to dip.

Investors roared when TV screens inside the trading hall flashed that the verdict was out and that the prime minister had not been disqualified.

“Business community has taken the decision positively,” said Arif Habib Group Director Ahsan Mehanti. “The decision has reduced pressure created due to political uncertainty.”

A wave of positive sentiment prevailed as investors cheered the outcome, which had been pending since February, triggering a long bearish run that saw the index dip close to the 46,000 level.

Elixir Securities, in its report, stated Pakistan equities closed a “thunderous Thursday” positive after taking investors for an unprecedented and the wildest ride ever as benchmark KSE-100 Index witnessed a record move of near 2,150 points on the day.

“Trading started cautiously as investors awaited Supreme Court’s verdict, however, institutional flows primarily led by locals helped wider market post modest gains by mid-day,” said analyst Faisal Bilwani.

“Fresh wave of buying followed Court’s decision that averted threat of PM Nawaz’s disqualification and ordered further probe into allegations against PM and his family.

Market watch: Stocks fall for fourth straight session, end below 47,000

“Benchmark KSE-100 index at its peak gained by as much as 4% or 1,900 points where profit bookers and reportedly foreign investors took advantage and off-loaded, while earnings by Habib Bank that were in line with expectations was largely and understandably ignored by the market,” Bilwani added.

“Given no immediate threat to PM and despite calls by Imran Khan led PTI for prime minister to resign, we see market to cheer the clarity in the short term with KSE-100 index likely re-testing previous highs of 50,000,” he commented.

“Having said this, news flow over probe will continue to challenge upside and trigger resistances given fortnightly hearings on probe by investigative agencies.

“Ongoing earnings season and budget related expectations will certainly attempt to regain more limelight in the days ahead and we are confident that MSCI EM upgrade related excitement will help channel fresh liquidity both from domestic and foreign investors,” the analyst stated. AKY CEO Amin Yousuf was of the view, “Investors are upbeat and the market is set to go north from here.”

“But nobody knows how much,” he commented.

“It’s a huge relief for those who have invested in the market,” PSX Member Zafar Moti said. “Uncertainty is always bad for investors and the market.”

Overall, trading volumes rose to 408 million shares compared with Wednesday’s tally of 265 million.

Shares of 395 companies were traded. At the end of the day, 320 stocks closed higher, 64 declined while 11 remained unchanged. The value of shares traded during the day was Rs25.7 billion.

K-Electric Limited was the volume leader with 29 million shares, losing Rs0.06 to close at Rs8.18. It was followed by Engro Polymer with 27.6 million shares, gaining Rs0.51 to close at Rs26.18 and TRG Pakistan Limited with 20.97 million shares, gaining Rs2.33 to close at Rs52.83.

Foreign institutional investors were net sellers of Rs600 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, April 21st, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ