Weekly review: Index ends 2017’s first week at record high

KSE-100 index gained 2.6% week-on-week, closing at 49,038 points

KSE-100 index gained 2.6% week-on-week, closing at 49,038 points.

Stocks rode on the positive momentum and continued with the re-rating story this week. Even investors’ cautiousness over an expected technical correction did not hamper the upward march.

Market watch: In a first, index finishes over 49,000

Continuation of the positivity surrounding the re-rating theme led the index to close yet another week at an all-time high.

However, the mid-week witnessed some profit taking and cautious buying while investors keenly tracked the developments on Panama case hearings. Steady flows from both local and foreign investors were witnessed during the week, particularly in blue chips.

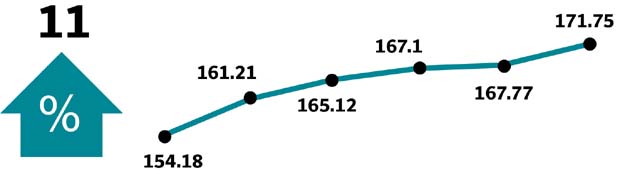

Steel sector remained in the limelight, gaining 7%, following announcement by Dost Steel notifying commencement date of its operations as of May 2017 while Amreli Steel gained on the back of rumours of significant discounts driving healthy volumes for the company.

Market watch: Investors tread with caution, index ends almost flat

Cement sector surged 2% in anticipation of increase in prices in North region by Rs15-20/bag while expectation of healthy off take numbers for December attracted investors' interest

Additionally, fertilisers garnered investors’ attention in the initial trading sessions as strong sales numbers for December built expectations of margin improvement for the fertiliser companies.

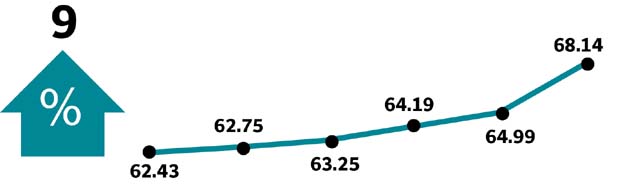

Banks (+1.9%) were another major sector that provided impetus to the index where stocks were in limelight again on expectations of earlier than expected interest rate reversal and robust advances growth in December.

Oil marketing companies posted positive returns on the back of increasing oil prices which lead to inventory gains for the sector.

Market activity picked up significantly during the week with average daily volume increasing by 43% week-on-week, primarily due to low trading activity in the previous week owing to year end.

PSX emerges as Asia’s best-performing market in 2016

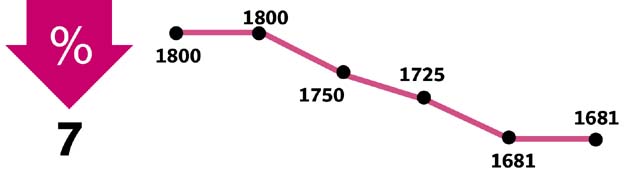

Foreigners remained net sellers during the week; however, the quantum was much lower, offloading $2.0 million worth of shares, with selling primarily in concentrated in oils ($6.9 million).

Winners of the week

Crescent Steel

Crescent Steel & Allied Products Limited manufactures steel lined pipes and multi-layer pipe coatings, which are used for water, oil and gas transmission. The company also has a cotton division that manufactures cotton yarn.

Fauji Fertilizer

Fauji Fertilizer Company Limited manufactures, purchases and markets fertilisers.

Nishat (Chunian) Limited

Nishat Chunian Limited manufactures and sells yarn and fabric. The company operates spinning, weaving, dyeing, and finishing units

Losers of the week

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes

Colgate Palmolive

Colgate-Palmolive Pakistan Limited manufactures and sells detergents, personal hygiene, and a variety of other products.

Rafhan Maize

Rafhan Maize Products Company produces corn oil, industrial starches, liquid glucose, dextrin, gluten meals and other corn-related products. The company also produces a wide range of co-products such as gluten feeds, meals and hydrol.

Published in The Express Tribune, January 8th, 2017.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ