Weekly review: A week of positives and record highs

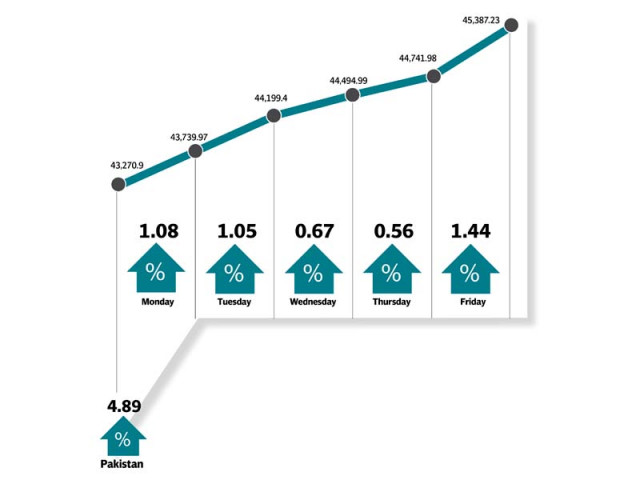

KSE-100 index gained 4.9% week-on-week, closing at 45,387 points

KSE-100 index gained 4.9% week-on-week, closing at 45,387 points

The KSE-100 index closed at 45,387 points, with the market up 645 points (+1.44%) on Friday as the Supreme Court adjourned Panama gate hearing till January. The Panama case hearing was the only event that had investors nervous, but it turned out to be a non-event after the hearing was postponed, fueling the already high enthusiasm of investors.

The exuberant performance in the benchmark index was primarily led by cements (+11.6%) and banks, adding more than 1,000 points to the index.

Cements stocks rallied in the outgoing week on account of robust dispatch growth and decline in international coal prices. Lucky Cement contributed 307 points to the gain and was in limelight primarily on the back of major announcements of investment in multiple business ventures including automobile venture.

Oil and gas sector also performed positively with growing confidence among investors for a successful implementation of the OPEC deal, leading to surge in oil prices to $51.

Among exploration and production Mari petroleum stood out with weekly gain of 10.1%. Nishat Power Limited (NPL) also displayed positive movement after it announced the plans to set up a 660 megawatt coal-fired power plant at Liaqatpur Tehsil in Rahim Yar Khan.

Overall, activity was witnessed across the board with major performance posted by the main board stocks.

Strong performance was mainly led by heavy buying from the local asset management companies (AMCs) as they looked to allocate influx of huge liquidity to their respective portfolios.

A massive $40 million of net buying by local AMCs was recorded during the week as compared to $19 million witnessed in the previous week. Local Individuals also jumped the bandwagon and followed with net buying of $2 million during the week.

Average trading volume depicted a significant expansion rising by 20% week-on-week to 393 million shares as compared to 493 million in the previous week, while retail favorites dominated the volume charts accounting for 25% of the overall volumes. Average daily value increased 23% week-on-week to Rs19 billion/$177 million over the week.

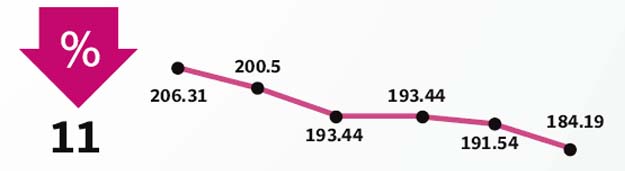

Foreigners remained net sellers of $24.9mn during the week. Oil and gas exploration, cement and textile sectors saw major net selling of $9.7 million, $4.6 million and $2.7 million, respectively while buying was seen in oil and gas marketing of $3.5 million.

Winners of the week

National Foods

National Foods Limited is a diversified food manufacturer. The group’s products include recipe blends, dehydrated vegetables, pickles, salts, snack foods, desserts, and a number of kinds of health foods.

Bestway Cement

Bestway Cement Limited produces and sells cement.

Lucky Cement

Lucky Cement Limited manufactures and sells cement. The company’s cement brands include Lucky Gold Brand, Lucky Brand, Lucky Star Brand. Lucky Cement’s main plant site is located at the District Lucky Marwat district in Khyber-Pakhtunkhwa.

Losers of the week

Feroze 1888

Feroze 1888 Mills Ltd manufactures and sells a wide range of cotton towels and fabrics.

Ibrahim Fibres

Ibrahim Fibres Limited, a part of the Ibrahim Group, operates a polyester staple fibre manufacturing plant. The company manufactures a wide range of polyester staple fibre and it also manufactures a variety of blended as well as pure synthetic yarns. Ibrahim Fibres also owns an in-house power generation plant.

The Bank Of Punjab

The Bank of Punjab (Pakistan) operates under the status of a scheduled bank in Pakistan. The bank provides commercial banking services.

Published in The Express Tribune, December 11th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ