market watch: Oil, cement stocks drive index to another record high

Benchmark KSE 100-share Index rises 469.07 points

Equities gained on excitement over reported buying by foreign investors in select sectors before a further push came mid-day in the index-heavy oil and gas stocks.

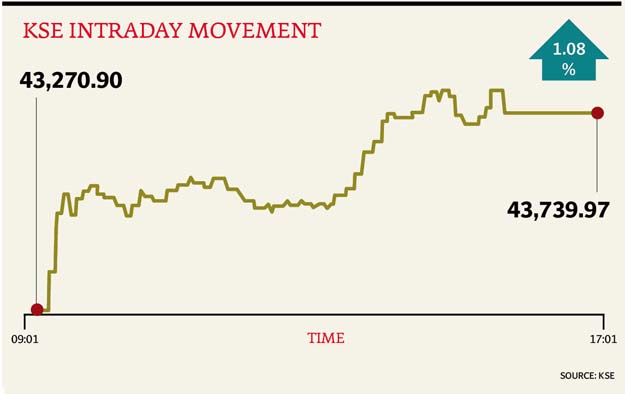

At close, the Pakistan Stock Exchange’s benchmark KSE 100-share Index recorded a rise of 1.08% or 469.07 points to finish at 43,739.97.

Elixir Securities Ali Raza said Pakistan equities maintained their northbound ride heading into the new week with benchmark KSE100 index settling at a new record high near 43,800.

“Stocks opened higher carrying momentum and index heavy financials led early gains on reported foreigners interest namely in United Bank (UBL, +1.3%) and MCB Bank (MCB, +1%),” said Raza.

“Select cements and fertilisers also edged up and supported the ride with former over expectations of record offtake for the outgoing month while latter gained traction as investors cheered weekend news of exports approval being considered for fertiliser sectors.

“Mid-day surge and the real action came from exploration and production (+3.2%) that tracked global crude with Oil & Gas Dev Co (OGDC,+4.9%), Pakistan Petroleum (PPL,+3.7%) and Pakistan Oilfields (POL,+3.8%) on reported local institutional buying.”

JS Global analyst Nabeel Haroon said positivity prevailed as the exploration and production sector led the gains as the sector closed +4.3% as crude oil prices surged to trade above $52/bbl.”

Cement sector also rallied as investor anticipate strong dispatch numbers for November, said Haroon.

“Additionally, fertiliser sector also continued its positive momentum on the back of surge in international urea prices as well as on the ECC’s decision to cut gas prices by Rs200/mmbtu for industrial consumers, which is also applicable on gas fuel for fertiliser industry.”

Trading volumes fell to 345 million shares compared with Friday’s tally of 375 million.

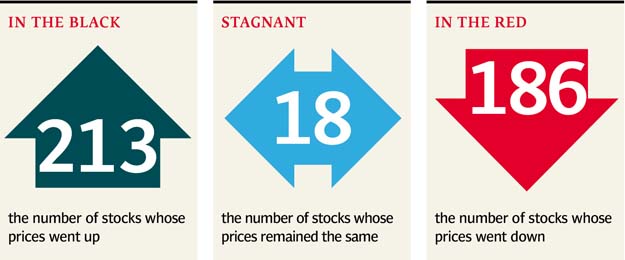

Shares of 417 companies were traded. At the end of the day, 213 stocks closed higher, 186 declined while 18 remained unchanged. The value of shares traded during the day was Rs14.1 billion.

Azgard Nine was the volume leader with 27.1 million shares, losing Rs0.43 to finish at Rs9.21. It was followed by NIB Bank with 22.3 million shares, gaining Rs0.07 to close at Rs2.22 and WorldCall Telecom with 11.5 million shares, losing Rs0.06 to close at Rs3.13.

Foreign institutional investors were net buyers of Rs86 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, December 6th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ