Remittances and hope

The study also calls for a bigger effort to channelise money coming home through the formal banking system.

The study offers us a better understanding of why so many people are determined to go abroad, sometimes putting their lives at risk to do so. We have heard accounts of stowaways and of those captured, or killed, by border guards while attempting to move across international frontiers. The small, dusty town of Taftan on the Balochistan-Iran border is a place where a number of such journeys begin. Some end not very far away. But the desperation of people to reach venues overseas remains unchanged, with a huge, illegal trade in the business flourishing in towns such as Gujranwala, where false documents of every kind are prepared.

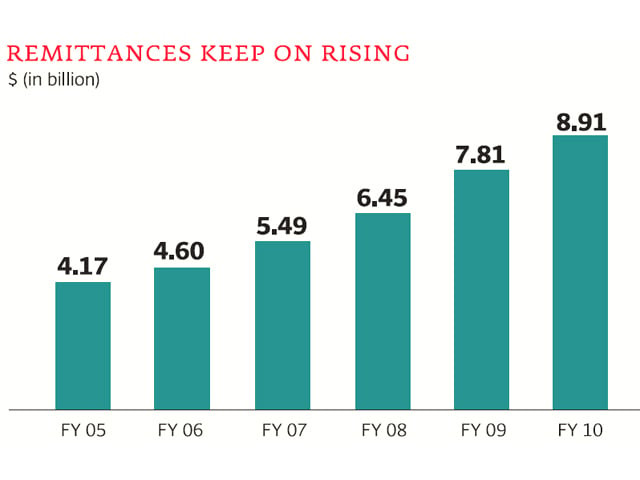

Given, however, the highly positive impact remittances can have on families, offering roads towards development and social progress, the report recommends policy steps for the government. It suggests that the process of migration be made simpler and steps be taken to limit the exploitative role of middlemen who bank on the desperation of people. The study also calls for a bigger effort to channelise money coming home through the formal banking system, rather than the ‘hundi’ networks favoured by many and points out that money sent in from Saudi Arabia and other countries can quite significantly alter the fortunes of those able to send a member of their family overseas, with even unskilled labourers earning far more than they would at home.

Published in The Express Tribune, February 24th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ