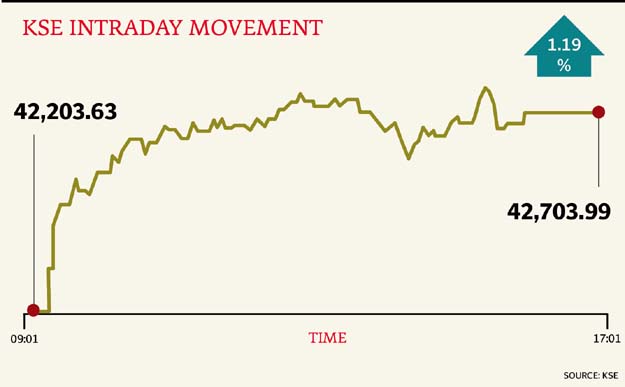

Market watch: Index closes at record high after 500-point gain

Benchmark KSE 100-share index ends at 42,703.99

Benchmark KSE 100-share index ends at 42,703.99.

At close on Thursday, the Pakistan Stock Exchange’s benchmark KSE 100-share index finished with a gain of 1.19% or 500.36 points to end at 42,703.99, a new record high.

Elixir Securities, in its report, stated stocks opened gap up, carrying the momentum from Wednesday evening and traded higher with many names crossing their 10-day average volumes.

“Financials and cements emerged as star performers on reported institutional buying and drove the benchmark KSE-100 index to new highs over the 42,700 level,” said analyst Ali Raza.

“Major contributors in the financial space were United Bank (UBL PA +3.7%), Habib Bank (HBL PA +2.1%) and MCB Bank (MCB PA +1.6%), while Lucky Cement (LUCK PA +1.8%), Maple Leaf Cement (MLCF PA +5%) and DG Khan Cement (DGKC PA +1.9%) were top gainers from the cement sector,” Raza remarked.

“Most volumes were focused in small and mid-cap plays that dominated volumes chart on retail participation,” he added.

Meanwhile, JS Global analyst Nabeel Haroon said positivity prevailed in the market as it rallied in-line with global markets post US election.

“Cement sector continued its positive momentum on the back of promising dispatch numbers released by APCMA for the month of October. MLCF (+5.0%) and KOHC (+3.7%) were top performers of the aforementioned sector,” said Haroon.

“PIAA gained for the second consecutive day to close on its upper circuit, on the back of news that Prime Minister Nawaz Sharif has constituted a committee to finalise the financial plan for Pakistan International Airlines (PIA) after the management’s request for finances to procure 13 new aircrafts,” he remarked.

“Moving forward, we recommend investors to stay cautious at current levels as correction in the market is long overdue,” the analyst added.

Trade volumes rose to 560 million shares compared with Wednesday’s tally of 553 million.

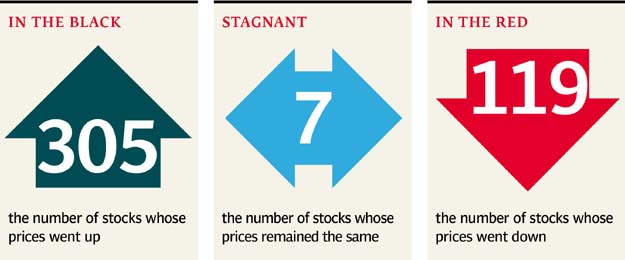

Shares of 431 companies were traded. At the end of the day, 305 stocks closed higher, 119 declined while 7 remained unchanged. The value of shares traded during the day was Rs20 billion.

Bank of Punjab was the volume leader with 68.4 million shares, losing Rs0.24 to finish at Rs20.13. It was followed by PIAC (A) with 51.3 million shares, gaining Rs0.92 to close at Rs10.44 and WorldCall Telecom with 28.4 million shares, gaining Rs0.24 to close at Rs2.92.

Foreign institutional investors were net sellers of Rs389 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, November 11th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ