Weekly review: Bourse depressed amid political noise, subdued oil prices

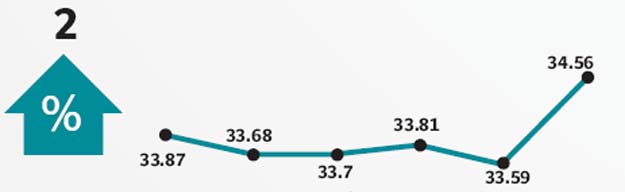

Benchmark-100 Index down 1,419 points, 3.44% week-on-week

PHOTO: ONLINE

Negative sentiment prevailed among market participants following the attack in Quetta and escalating tension on the political front. Investor sentiment was further dented on the back of the rollover week for future contracts.

Across-the-board selling meant most sectors remained under pressure with financial and the oil and gas sectors leading the attrition, cumulatively contributing a loss of 533 points.

Despite strong results posted by major blue chip stocks, underperformance of a few select scribes kept sentiments passive.

During the week, the cement sector witnessed interest in select stocks, where news of a possible price increase by players in the north in the wake of higher coal prices, led the sentiment.

Pioneer Cement remained the top favorite on strong 1QFY17 earnings announcement. PSO, Indus Motor was also able to gain investors’ attention after posting higher-than-expected earnings.

The news of Engro Fertilizers being granted a stay order on GIDC payments along with its positive result led to a brief rally.

Steel sector, on the other hand, remained a major loser during the week on volatile scrap prices taking its toll on margins of steel players where Amreli steel lost 15% over the week. Subdued activity was also witnessed in second and third-tier stocks as retail investors traded cautiously amid political uncertainty. Massive selling was witnessed from local individuals - $35 million - opening up the possibility of bottom fishing for local mutual funds and foreign investors, who after a long selling spree turned up as net buyers of $14 million during the outgoing week.

Despite several positive moments, notably IMF Chief Christine Lagarde saying Pakistan is out of the economic crisis and the country being recognised as one of the top ten economies on making the biggest improvements in business regulations, political uncertainty did not allow the index to recover.

Average daily volumes for the outgoing week went down by 28% week-on-week to 341 million shares while average daily value decreased 22% week-on-week to Rs12 billion/$110 million over the week.

Winners of the week

Philip Morris Pak Ltd

Philip Morris Pakistan Limited manufactures and sells tobacco and cigarettes.

Fauji Cement

Fauji Cement Company Limited manufactures and sells cement.

Pioneer Cement

Pioneer Cement Limited produces ordinary portland cement and sulphate resistant cement.

Losers of the week

Shell Pakistan

Shell Pakistan Limited markets petroleum and petrochemical products. The company also blends and markets different types of lubricating oils.

The Bank of Punjab

The Bank of Punjab (Pakistan) operates under the status of a scheduled bank in Pakistan. The bank provides commercial banking services.

Cherat Packaging Limited

Cherat Packaging Limited manufactures and markets paper bags for the construction industry. The company manufactures various types of paper bags using clupak sack kraft paper imported from Austria, Sweden and the Czech Republic.

Published in The Express Tribune, October 30th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ