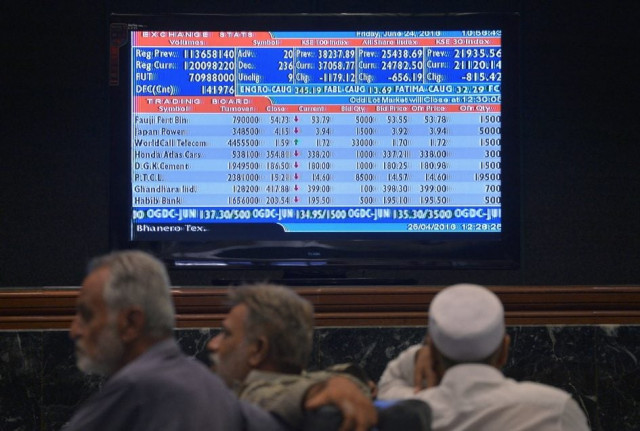

Market watch: Index continues its negative ride

Benchmark KSE 100-share Index loses 70.91 points

Benchmark KSE 100-share Index loses 70.91 points. PHOTO: FILE

At close on Thursday, the Pakistan Stock Exchange’s benchmark index recorded a fall of 0.18% or 70.91 points to end at 39,738.67.

Elixir Securities analyst Ali Raza said equities closed the third consecutive session negative after trading in a narrow range with oils, cements and select financials primarily denting the benchmark KSE-100 index.

“Market opened on a positive note led by gains in autos and consumer plays,” said Raza. “However, the benchmark index couldn’t carry the momentum as oils turned out to be a major drag early on following overnight losses in global crude.”

According to Raza, lower-than-consensus inflation reading of 3.56% year-on-year for August failed to ignite any interest as participants remained wary of direction of flows.

“Mid-day negativity also came from Engro Foods (EFOODS,-2.5%) that tanked on reports of aggressive foreign selling while rumours of a possible extension in public tender offer also ran wild.

“Cements also remained under pressure with most stocks closing in the red including Lucky Cement (LUCK,-1.8%) that failed to attract any buying interest despite posting earnings slightly higher than street estimates.”

JS Global analyst Ahmed Saeed Khan said volatility prevailed as the index juggled between +90 points and -87 points.

“The oil sector remained under pressure throughout the day on the back of declining crude oil prices after US inventories reached the highest in at least 3 decades.

“The top index movers of the aforementioned sector were Pakistan Petroleum Limited (-0.51%) and Pakistan Oilfields Limited (-1.28%).

“On the other hand, a rally was witnessed in the automobile sector due to Japanese Yen continuing its negative trajectory, where top performers of the sector were Honda Atlas (+5.00%) and ATLH (+2.79%).”

Khan said concerns over the possibility of a future oversupply situation in the cement sector hampered sector’s sentiment as 8 out of 17 listed cement companies have already announced expansions.

Trade volumes increased to 366 million shares compared with Wednesday’s tally of 351 million.

Shares of 444 companies were traded. At the end of the day, 226 stocks closed higher, 203 declined while 15 remained unchanged. The value of shares traded during the day was Rs13.7 billion.

K-Electric Limited was the volume leader with 27.3 million shares, losing 0.09 to close at Rs9.12. It was followed by Byco Petroleum with 26.2 million shares, gaining Rs1.21 to close at Rs26.05 and Aisha Steel Mills with 23.6 million shares, gaining Rs0.76 to close at Rs12.31.

Foreign institutional investors were net sellers of Rs418 million during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, September 2nd, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ