Govt may tilt tax system to favour the poor

The government may increase the limit of taxable income by 50 per cent for the salaried persons and a 100 per cent for the business class in the upcoming budget, according to sources. Authorities are considering two proposals to provide relief to the inflation stricken masses, said sources who did not want be named. The first proposal for the salaried class suggests that individuals with annual income less than Rs300,000 be exempted from the income tax. The current taxable income is above Rs200,000.

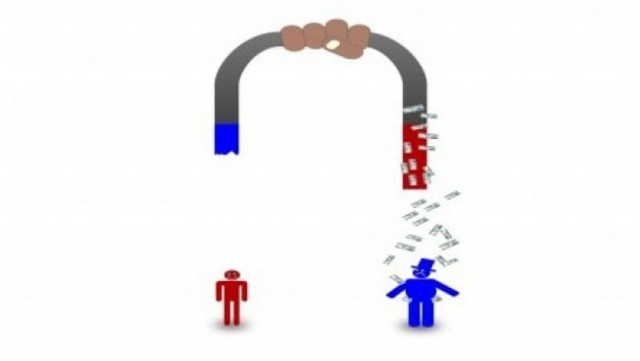

The second proposal suggests, reducing the income tax rate for the next three slabs instead of increasing the taxable income limit. “The idea is to shift the tax burden from lower income groups to higher ones” said a senior official of the Federal Board of Revenue. He said that the next slab’s tax rate would either be increased marginally or it will be merged with the next one to offset the financial impact of providing relief to the lowest category. For taxing incomes, taxpayers have been divided into twenty categories.

The highest category consists of those people whose annual income is more than Rs8.6 million. These people would pay a 20 per cent income tax. “So far, no proposal to increase income tax rate for the highest slab is under consideration,” said officials. For the non-salaried class, the taxable income is over Rs100,000. According to the budget proposal the taxable income for the nonsalaried class would be above Rs200,000, said sources.

Finance Bill 2009 states that employees with an annual income between Rs200,000 and Rs250,000 pays a 0.5 per cent income tax. The third category consists of those employees whose annual income is more than Rs 250,000 but up to Rs 350,000. This class pays 0.75 per cent income tax. Employees earning between Rs 350,000 and Rs 400,000 pay a 1.5 per cent income tax. According to official statistics, as many as 1.168 million employees are liable to pay tax. The total number of employees is more than 3.4 million.

The registered non-salary individuals are 0.58 million in the country, according to Federal Board of Revenue (FBR) data. The tax authorities on Friday also reviewed the impacts of the Value-Added- Tax. The government has given a commitment to the International Monetary Fund to levy VAT from July 1st at a rate of 15 per cent. According to Federal Board of Revenue’s provisional estimates, General Sales Tax on goods’ replacement with VAT may add Rs53.8 billion in the national exchequer.

The provinces may get Rs72 billion by levying VAT on services. The official statistics show that the gross revenue generation of VAT will be Rs110.5 billion. However, the transitional cost of reducing consumption tax rate from 16 to 15 per cent and introducing a universal consumption tax rate would be Rs56.7 billion. By withdrawing tax exemptions on fertiliser, pesticides, pharmaceuticals and tractors Rs29 billion revenue would be generated.

The FBR has estimated to collect Rs7.7 billion in taxes by levying 15 per cent tax on sales of fertilisers, on pesticides Rs 1.95 billion, on pharmaceuticals excluding life saving drugs Rs 3.1 billion, and Rs 16 billion will be generated by levying 15 per cent tax on sale of tractors. The government is still sceptical about both the inflationary impact and actual revenues. The task of calculating the net impact of VAT has been given to Pakistan Institute of Development Economics and Institute of Business Administration.

Under the proposed VAT bill tax exemption on sale of various types of machinery will be withdrawn. It may add Rs 17 billion in revenue and withdrawal of zero-rating from apparel, textile and footwear would fetch in Rs 10 billion. On the other hand, by rationalising tax rate on CNG sale the government would lose Rs 3.9 billion in revenue.

The official statistics show that a reduction of one per cent in consumption tax rate will result in Rs 31 billion less revenue. An amount of Rs 14.4 billion will be lost at the import stage and Rs 16.53 billion at the domestic stage. Currently the government is charging a 21 per cent tax on sales of plastic. Six per cent reduction in tax rate will cause a loss of Rs 4.3 billion on this account, show the official statistics.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ