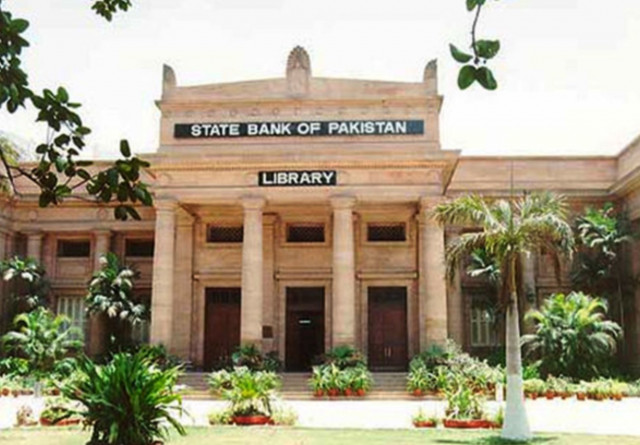

Waived off loans: Give us the record or face the music, CJ warns State Bank

Court can go to any extent to ensure the return of the nation's wealth, says CJ.

The State Bank’s counsel Iqbal Haider admitted before the bench that more than fifty thousand people had their loans written off in violation of rules and regulation since 1971.

Justice Sair Ali asked for details of loans written off from 1971 to date. The court denied Haider’s request to constitute a commission for compiling the record of the loans written off by various banks.

A four-member bench of the apex court headed by Chief Justice Iftikhar Muhammad Chaudhry resumed the hearing of a suo motu case.

It is the State Bank’s responsibility to protect the commercial banks’ interests under section 40-A of the Banking Companies’ Ordinance. However, it is bound to take action against the banks if their activities are detrimental to the public interest in pursuance of section 41, Justice Ramday remarked.

“We would like to assist the State Bank but it appears that our help is not wanted,” the Chief Justice observed. It is worrisome that the State Bank has yet to raise this issue with commercial banks.

The Chief Justice said that Redco Textiles and Indus Sugar Mills will be taken as test cases.

“The court can go to any extent to ensure the return of the nation’s wealth,” the Chief Justice remarked during the course of hearing. “It is not as if those who got their loans waived off are dying of hunger; their businesses are flourishing.” If the law and order is to improve, the economy has to be strengthened, The Chief Justice said.

The court adjourned the hearing till February 14.

Published in The Express Tribune, February 8th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ