Market watch: Stocks recover, led by pharmaceutical sector

Benchmark KSE 100-share Index gains 130.01 points

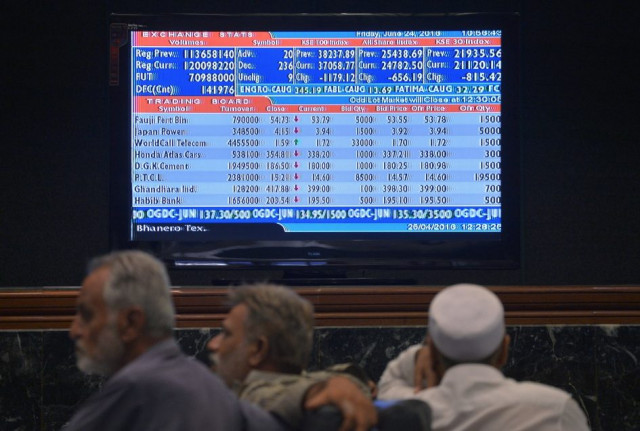

Benchmark KSE 100-share Index gains 130.01 points. PHOTO: FILE

At close, the Pakistan Stock Exchange’s (PSX) benchmark KSE 100-share Index recorded an increase of 130.01 points (0.33%) to end at 39,147.33.

Elixir Securities, in its report, said the market opened in the red zone, pulled lower by the index-heavy exploration and production (E&P) stocks. Oil and Gas Development Company (-0.8%), Pakistan Petroleum Limited (-0.2%) and Pakistan Oilfields (-1.5%) all opened gap down tracking the global crude that dropped and stood close to three-month lows.

“However, the benchmark index soon recovered and gained steadily during the day to test 39,200 points with participants cherry-picking index names on earnings excitement,” Elixir said.

“United Bank (+2.1%) contributed the most points to the KSE-100 index after it announced earnings that beat market estimates. Habib Bank (+0.8%), Engro Corp (+1%) and Pakistan State Oil (+1.5%) also contributed to the gains.”

Meanwhile, the news of drug price increase in the range of 1-2% near the session’s close resulted in the entire pharma sector moving higher with Searle (+4.8%) finishing the day at its upper price limit, the report said.

“Expect the market to be guided by flows and earnings-related excitement in the near term, with the benchmark KSE-100 index likely to move in the range of 300-500 points,” remarked Elixir Securities analyst Ali Raza.

JS Global analyst Ahmed Saeed Khan said the index was led by the pharmaceutical sector that rallied after the news circulated that a notification for an increase in prices of drugs had been issued by the Drug Regulatory Authority of Pakistan. Searl and Abbott Laboratories (+2.08%) were the biggest index movers in the sector.

“Mixed sentiments prevailed in the banking sector where most banks stayed in the red zone, although UBL rallied after the announcement of its half-year results that were better than market expectation.”

The oil sector remained under pressure on the back of declining global crude oil prices. On the other hand, positivity was seen in the oil marketing sector as PSO and Shell rallied 1.53% and 3.33% respectively.

“Moving forward, we remain bullish on the market, but advise caution in the on-going results season,” said Khan.

Trading volumes rose to 197 million shares compared with Monday’s tally of 166 million.

Shares of 349 companies were traded. At the end of the day, 157 stocks closed higher, 171 declined while 21 remained unchanged. The value of shares traded during the day was Rs11.4 billion.

Pakistan International Bulk Terminal was the volume leader with 22.5 million shares gaining Rs0.66 to finish at Rs33.11. It was followed by Dewan Cement with 16.3 million shares gaining Rs0.28 to close at Rs16.40 and Pak Elektron with 12.4 million shares gaining Rs0.99 to close at Rs71.25.

Foreign institutional investors were net buyers of Rs147 billion during the trading session, according to data maintained by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, July 27th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ