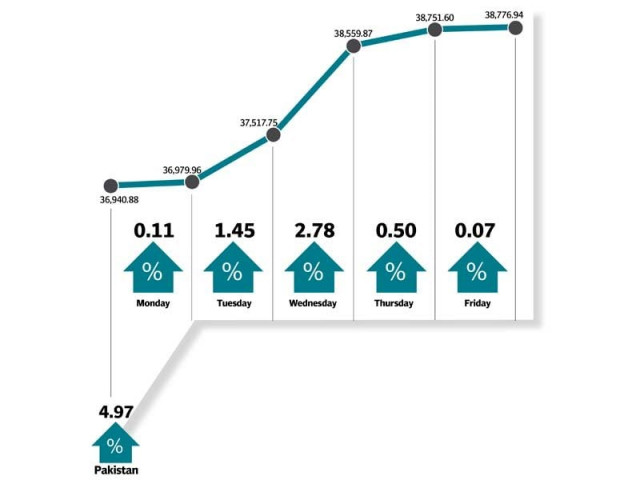

Weekly review: Index posts maximum weekly gain since 2013

Bourse ends at 38,776.94 as MSCI reclassification takes stocks higher

Bourse ends at 38,776.94 as MSCI reclassification takes stocks higher .

The reclassification, which would take effect next year, helped the market rally up 1,000 points on Wednesday with the next two days being rather subdued. Nevertheless, the index gained 5.0% (1,836 points), for its highest weekly gain since the first week of July 2013.

The news drove broad based buying interest and the market witnessed historic highs during the week with key interest in the list of stocks to be included in both small-cap and main index. Amidst euphoric trading sessions, the market completely disregarded negativities such as Pak-Afghan border tensions and turbulence in the political landscape.

The MSCI reclassification and Senate’s approval of corporate restructuring Companies bill 2016 meant that the banking sector remained in the limelight during the week, posting 13.1% return during the week with Habib Bank Limited, MCB and United Bank Limited posting double digit return of 20.9%, 14.8% and 12% respectively. Furthermore, HBL, MCB and UBL cumulatively added 901pts in the index.

The cement sector followed on as it increased 6.2%. Engineering was among the underperformers as it fell 1.3% during the week.

Moreover, investors also showed insensitivity towards 6% week-on-week decline in international crude oil prices as observed from 0.4% week-on-week increase in index heavyweight oil and gas sector.

Dawood Hercules Corporation accumulated 97 points on the back of substantial holding in Engro, another MSCI EM constituent, which helped scrip remain in the limelight.

Additionally latest news sources confirm the Economic Coordination Committee (ECC) has ordered an increase in the price of RLNG by US$1.2/mmbtu, allowing a series of factors that were previously rejected by Oil and Gas Regulatory Authority (OGRA).

Foreigners also continued to make thematic investments (pertaining to MSCI and China Pakistan Economic Corridor) during the week with net inflow recorded at $19.6 million.

The average traded volume jumped 21% week-on-week to 183 million shares while average traded value increased by 57% week-on-week to $124 million.

Average daily volume increased 21% to 183.4 million shares, coupled with 57% rise in average daily value to Rs13.0 billion/$124.1million.

Winners of the week

Habib Bank Limited

Habib Bank Ltd operates commercial bank in Pakistan. The bank offers commercial, corporate, Investment, retail and International Group Banking.

Pak Services

Pakistan Services Limited is the holding company for Pearl Continental Hotels (Private) Limited, which constructs, operates and manages hotels. The group also owns a number of smaller companies that provide rent-a-car, travel arrangements and tour packages.

National Refinery Limited

National Refinery Limited manufactures and distributes lube base oils and petroleum fuels. The company markets its products to customers throughout Pakistan.

Losers of the week

EFU Life Assurance

EFU Life Assurance Ltd provides a variety of insurance services. The company’s services include loan protection plan, savings plan, executive pension plan and education plan.

International Steels Limited

International Steels Ltd manufactures steel. The company produces cold rolled sheet, and hot dipped galvanised sheet steels. International Steels serves the construction, appliances, automotive, agricultural implements, and packaging industries.

Indus Dyeing

Indus Dyeing & Manufacturing Company Ltd manufactures and

sells yarn.

Published in The Express Tribune, June 19th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ