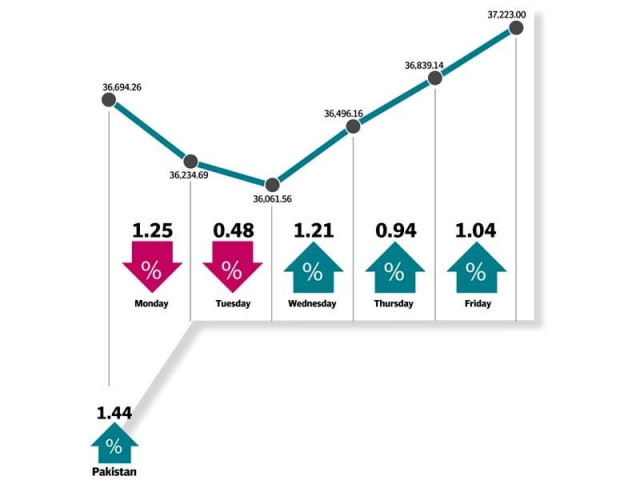

Weekly review: Index gains 529 points to end week at record high

Lost 632 points before gaining 1,161 during last three days

Lost 632 points before gaining 1,161 during last three days

Concerns regarding the implementation of the China Pakistan Economic Corridor and the closure of Fauji Cement’s plant weighed heavily on the market in the opening couple of sessions. However, a strong rally led by the oil and gas, cement and textile sectors led to a rebound in the latter half of the week.

The week started off on a negative note with oil prices falling below the $50 mark and concerns being raised about the implementation of the CPEC. Matters were made worse when news emerged that an explosion at Fauji Cement’s plant had resulted in major damage that would cause the plant’s closure for up to six months. The KSE-100 index fell 632 points during the two opening days of the week.

The mood changed completely Wednesday onwards with oil prices climbing due to OPEC meeting to discuss production cuts. Inflation numbers coming in lower-than-expected was a welcome surprise while expectations of a pro-business budget further bolstered investor sentiment.

Further excitement was created by the looming MSCI decision to include Pakistan in its Emerging Markets index. The KSE-100 rallied to end the week at 37,223 points, comfortably above the 37,000 points barrier and its highest close ever.

Oil prices continued to play a major role in determining the market’s direction. Oil prices declined during the first half of the week as oil supply picked up. However, during the second half of the week, OPEC convened a meeting to discuss production cuts, which resulted in prices returning near $50 per barrel by the end of the week.

The major shock of the week was news of the explosion at Fauji Cement’s plant which destroyed the plant’s main production line. Confirmation from the company that the plant would not be operational for six months resulted in a heavy sell-off in the company’s stock which remained on its lower circuit breaker for the majority of the week.

Fauji Cement’s loss was its competitor’s gain as cement manufacturers in the northern region would get to fulfill the supply gap left by Fauji Cement’s closure. The sector performed strongly during the market’s rally, contributing to the KSE-100’s gains.

Average daily volumes dropped slightly to 238.7 million shares traded per day, a 4.1% decline compared to the previous week. Average daily values remained steady and stood at Rs11.1 billion per day. The Pakistan Stock Exchange’s market capitalization stood at Rs7.53 trillion ($72 billion) at the end of the week.

Winners of the week

Feroze 1888

Feroze 1888 Mills Limited manufactures and sells a wide range of cotton towels and fabrics.

Hascol Petroleum Limited

Hascol Petroleum Limited is engaged in the purchase, storage and sale of petroleum products such as fuel oil, high speed diesel, gasoline, Jet A-1, LPG and lubricants.

Pioneer Cement

Pioneer Cement Limited produces ordinary portland cement and sulphate resistant cement.

Losers of the week

Fauji Cement

Fauji Cement Company Limited manufactures and sells cement.

Pakistan Tobacco Company

Pakistan Tobacco Company Limited manufactures and sells cigarettes.

Jahangir Siddiqui & Co

Jahangir Siddiqui & Company Limited is an investment company, offering share brokerage, money market, advisory and consultancy, underwriting and portfolio management services.

Published in The Express Tribune, June 5th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ