‘Parliament can’t impose tax on provincial property’

SC says Federal Legislative List restricts power of federation

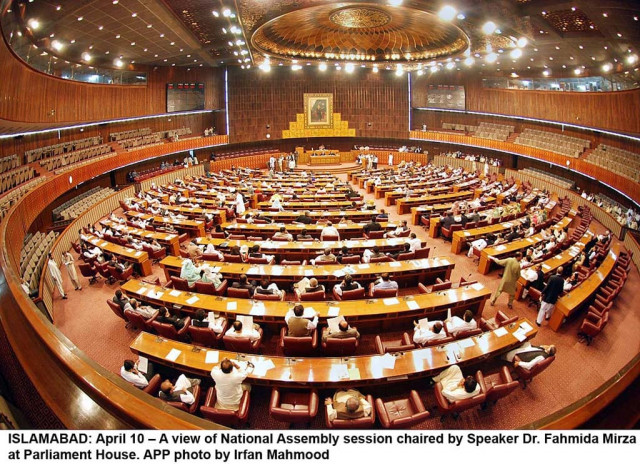

PHOTO: APP

In a landmark ruling overturning an earlier high court verdict on Friday, the Supreme Court made it clear that parliament cannot impose a tax on the property or income of a provincial government.

The judgment said the Constitution determines the rights, duties and obligations of the provinces with the federation, adding that Article 165 (1) of the Constitution stipulates that parliament cannot impose tax on the property or income of a provincial government.

Broadening tax net: Withholding tax on $50,000 worth of remittances likely

The order stated that the provincial government shall not, in respect of its property or income, be liable to taxation under a federal law, which in this case was Sales Tax Act.

“Therefore, the high court’s judgment is not sustainable and is set aside and the appeal is allowed with costs,” it said.

Justice Qazi Faez Isa authored a 10-page verdict in a case filed by the Punjab irrigation department against the imposition of sales tax by the federal excise & sales tax department over the sale of pitching stones.

Earlier in 2008, the Lahore High Court (LHC) rejected Punjab government’s appeal against the imposition of the tax. Later, the LHC’s order was challenged in the Supreme Court, where Additional Advocate General Khalid Abbasi argued on behalf of Punjab irrigation department.

Last month, a three-judge bench – headed by Justice Mushir Alam and comprising Justice Dost Muhammad Khan and Justice Isa – had reserved its judgment, which has now been released.

Budget 2016: Govt partially retreats from aggressive tax proposals

The judgment held that Article 142 of the Constitution stipulates that the provincial assemblies have the power to make laws in respect of all matters, which are not mentioned in the Federal Legislative List.

“The Federal Legislative List in the Fourth Schedule restricts the legislative power of the federation to mineral oil, natural gas and minerals for the use in generation of nuclear technology. Consequently, the power to legislate in respect of other minerals including stones/spawl falls within the domain of provincial assembly,” it said.

The judgment further held that stones/spawl are utilised or supplied by the irrigation department to other departments of Punjab for the use of public works. It said the Punjab government has enacted the Punjab Government Rules 2011 under which the irrigation department has the responsibility to construct and maintain barrages, rivers, canals and tube-wells, etc.

“The Punjab government carries out its business through the irrigation department; therefore, it cannot be viewed separately from the government and will squarely be within the terms of Article 165 (1) of the Constitution,” it said.

Facing the music: Property tax defaulters’ buildings to be sealed

The court said stones/spawl within the territory of the province of Punjab is owned by the government of Punjab, in respect whereof laws can only be made by the Punjab Assembly and the same are exempted from federal taxation as laid down in Article 165 (1) of the Constitution.

The order held that if a person albeit an officer of the provincial government, despite being exempted under the Constitution, mistakenly pays sales tax then he cannot be compelled to continue doing so.

“The exemption contained in the Constitution will prevail over any statute and it would be inconsequential that tax was earlier paid. There is no estoppel against the Constitution is also a well established principle,” it said.

Published in The Express Tribune, March 12th, 2016.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ