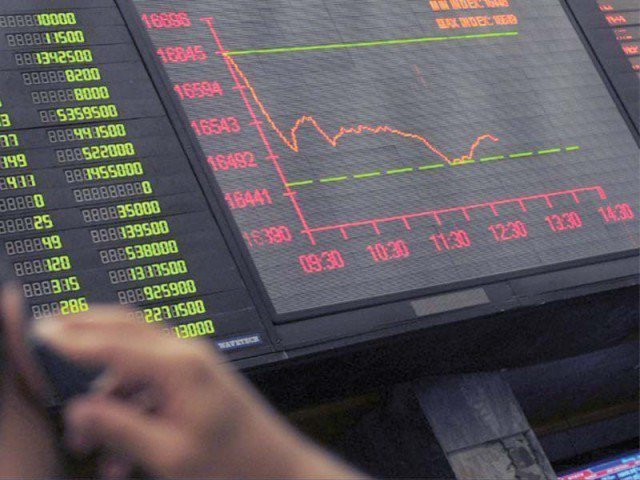

Market watch: Institutional buying helps steer index in the black

Benchmark KSE-100 index gains 222.10 points

Benchmark KSE-100 index gains 222.10 points. PHOTO: FILE

After a dull start, which saw the benchmark-100 index hover around 30,500, value buying kicked in to take stocks higher.

At close on Wednesday, the Pakistan Stock Exchange’s (PSX) benchmark KSE-100 index gained 222.10 points (0.73%) to end at 30,786.60.

Elixir Securities analyst Ali Raza said despite staging a sharp comeback on Tuesday, near session’s close, the wider market took a back foot in the morning and traded lacklustre on thin turnover for nearly two-thirds of the session.

“However, reported institutional buying in index names, primarily in fertilisers, cements and Pakistan Oilfields (POL PA 2.35%) along with bargain hunting in small and mid-caps from retail investors pulled broader market out of snooze.

“Power play Kot Addu Power Company (KAPCO PA 4.1%) contributed most points to the index gains after its earnings and pay-outs was well received by participants, while fertiliser stocks namely FAUJI FERTILIZER BIN QASIM LIMITED (FFBL PA +4.98%), Fauji Fertilizer Company (FFC PA +1.71%) and Engro Fertilizers Limited (EFERT PA 2.69%) closed higher on institutional value buying,” said Raza.

“We expect investors to closely track flows for the remainder of the week that will help sustain current momentum,” he added.

Meanwhile, JS Global analyst Arhum Ghous was of the view that investor interest was seen in both gas utility companies as Sui Southern Gas Company (SSGC) and Sui Northern Gas Pipeline (SNGP) closed +4.19% and +3.33%, respectively.

“Nishat Mills Limited (NML +1.14%) gained as the textile manufacturer announced 32% YoY growth in its 1HFY16 earnings. KAPCO (+4.06%) also gained as the company posted better-than-expected 1HFY16 earnings of Rs4.92/share along with a lucrative cash dividend of Rs4.25/share.”

“Going forward, we expect volatility to persist and we recommend investors to remain cautious,” said Ghous.

Trade volumes fell to 138 million shares compared with Tuesday’s tally of 172 million.

Shares of 334 companies were traded. At the end of the day, 224 stocks closed higher, 94 declined while 16 remained unchanged. The value of shares traded during the day was Rs6.6 billion.

Pak Elektron (R) was the volume leader with 13.5 million shares, gaining Rs0.64 to finish at Rs15.76. It was followed by TRG Pakistan Limited with 12.8 million shares, gaining Rs0.41 to close at Rs27.70 and Pak Elektron with 11.5 million shares, losing Rs2.32 to close at Rs55.89.

Foreign institutional investors were net sellers of Rs187 million worth of shares during the trading session, according to data compiled by the National Clearing Company of Pakistan Limited.

Published in The Express Tribune, February 25th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ