No free lunch: Oil price hikes: sifting fact from fiction

Succumbing to political realities, government finally took back decision to raise price of petroleum products.

No free lunch: Oil price hikes: sifting fact from fiction

Befitting a democratic culture, the political foes and friends of the government surmounted the pressure. For once, MQM parted ways (rejoining the coalition after the decision was reversed), PTI issued a call for civil disobedience and PML-N gave a 72-hour ultimatum.

All of this was triggered by the price increase of petrol and diesel, which is usually a routine, fortnightly regulatory announcement. It seems that for now, parliament and political forces have shown dominance over market forces.

Largely, three sets of arguments were presented in the debate surrounding the price hike. First, by the government and its supporters: ever since oil prices have been deregulated, fluctuations largely follow the international prices of crude oil.

Second, by politicians of opposition parties: the hike was not justified since it is due to government levies and taxes, not just international prices.

Third, by certain analysts: industry profit margins have continued to grow at the cost of other stakeholders of the oil business (consumers, for example) and this is the primary driver of high prices.

Let’s add some numbers to these arguments in order to separate the facts from fiction.

The government’s claim of having linked the prices of oil with that of crude oil is largely vindicated. Since last quarter of 2009, it has faithfully followed the international prices of crude oil, passing both costs and benefits to consumers.

It seems that the government has learned a hard lesson. Back in 2007, when it absorbed the international price escalation, everyone had to pay in the form of energy shortage – accentuated by rising circular debt.

In 2008, it did not pass on the benefits to consumers largely to offset circular debt, at least partially.

Finally, in 2009 it decided – most likely under IMF pressure – to synchronise domestic prices with international benchmarks. For now, all we can hope is that the episode of 2007 circular debt, started by the state absorbing the increase in international prices, will not be repeated.

The claim by the opposition about a high government tax on petroleum products, however, is not vindicated. In principle, a minimal government is a responsible one and thus a responsible and citizen-friendly government would always keep the tax rates low.

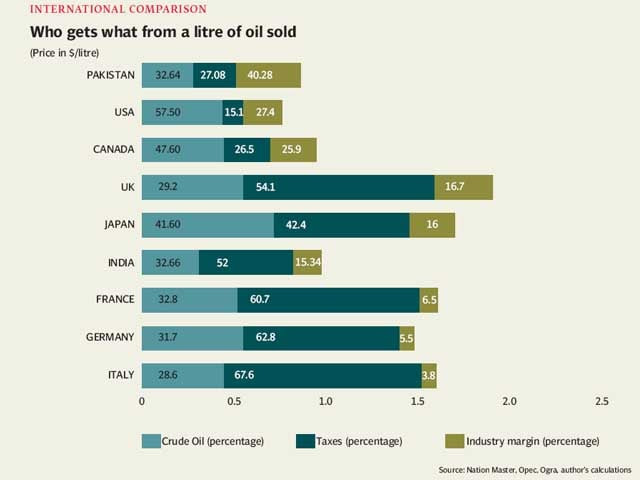

Contrary to popular perception, our government’s share in the sale of petroleum products is relatively small. At present, it collects 27 paisa on every Rs1 of petroleum sold. In comparison, the Indian government charges a behemoth 52 paisa on every rupee.

In OECD countries, the highest share of government in petroleum sales is by Italy, which is 67 per cent.

The US government, on the other hand, is most consumer-friendly since it keeps a bare 15 per cent. That is the sole reason of a relatively lower price in the US in the OECD block. Outside the oil producing nations, the US offers one of the lowest consumer prices for oil.

When it comes to industry margins, however, Pakistan tops the list of selected countries. These margins have been calculated largely from Oil and Gas Regulatory Authority (Ogra) sources and include all costs from the oil well to our engines.

Margins are distributed across oil importers, refineries, marketing companies and dealers. In fact, it seems that high industry margins actually drive higher prices in the country instead of fluctuations in international crude oil.

These supernormal profits in an industry like oil, which is driven worldwide on sales volume and not high margins, indicate potential concerns for competition. There is a huge arbitrage across the industry profit margins in above selected countries.

Such profits can be earned from large scale efficiency gains or monopoly over inventions. Is our oil industry more efficient than OECD industries? Is it more innovative? The obvious answer to these questions is in the negative.

This leaves us with the possibility of manipulations in the form of cartelisation or abuse of dominance. Healthy competition is a welcoming market characteristic: both producers and consumers win. Competition brings gains for the economy in the form of low and stable prices, innovation and efficiency.

The examination of the profit margins by the oil industry in Pakistan seems to be a job waiting to be undertaken by the Competition Commission of Pakistan (CCP).

It seems that politicians have been successful in putting a weak government on the back foot. However, the above analysis suggests that they have knocked down the wrong opponent. The fight should have been for a more competitive oil industry instead of influencing price announcements. The chief concern should then be competition and not welfare.

The author, an economic consultant, is Director Programme and Development at the Alternate Solutions Institute, Lahore. He can be contacted at ali@asinstitute.org

Published in The Express Tribune, January 10th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ