Climb continues despite political uncertainty

The stock market continued to strengthen during the week ended January 7.

Gains were made despite several political events which could have long-lasting implications. Foremost amongst them was the withdrawal of the government’s biggest partner, the MQM, from the coalition citing the recent increase in petrol prices and plans to implement the reformed general sales tax (RGST) as reasons behind the move.

After several meetings and continued negotiations, the MQM did agree to rejoin the treasury benches by the end of the week but only after the government withdrew the petrol price hike and agreed on delaying the implementation of the RGST.

Withdrawal of the price hike means that the government will again be subsidising the cost of fuel for consumers, cited as a major factor behind the market crash of 2008. The withdrawal, along with the delay in enforcing the new tax, will not go down well with the International Monetary Fund (IMF) and other international donors who have set these as prerequisites for continued funding.

The assassination of Punjab Governor Salmaan Taseer also highlighted the fragile security situation of the country and the PML-N’s ultimatum to the government to implement its nine-point agenda indicated further strife. But investors chose to ignore these issues and the market climbed up to 12,389 points.

Gains were spearheaded by continued foreign buying at the bourses. After making net share purchases worth $522 million in 2010, foreigners picked up $11.3 million worth of equity in the first week of the new year.

According to a research report prepared by JS Global Capital, foreigners owned approximately 32 per cent of the free floating equity on the KSE-100 index as of December 31, 2010. Local banks supplemented foreign buying and picked up equity worth $22.4 million (net) during the week.

The oil sector was again the star performer as international crude prices hovered around $90 per barrel and news spread about oil discovery in the Tal exploration block. With several analysts predicting that oil prices will cross $100 per barrel in 2011, future earnings expectations of companies in this sector also increased.

Pakistan Oilfields (POL) posted a robust increase of 8.7 per cent, while the Oil and Gas Development Company (OGDCL) followed with a 5.8 per cent gain. The stocks are now priced at Rs321.7 and Rs180.66, respectively. POL is the top pick in the sector assuming higher oil prices.

Volumes also improved with the start of the new year and average daily turnover stood at 155 million shares, despite the fact that only 91 million shares were traded on the opening day (following MQM’s withdrawal). Market capitalisation also grew 2.5 per cent to Rs3.35 trillion by the end of the week.

What to expect?

With the earnings season approaching, the market can be expected to peak before profit-taking clips some of the gains. In coming weeks, foreign buying is likely to continue and stock-specific activity will be witnessed on hopes of better payouts.

In the long run, however, the situation is quite difficult to ascertain as the market has witnessed tremendous growth in the second half of the outgoing year despite the floods, three discount rate hikes, deteriorating security condition and continued political bickering. Based on this, investors should expect a significant correction over the coming months.

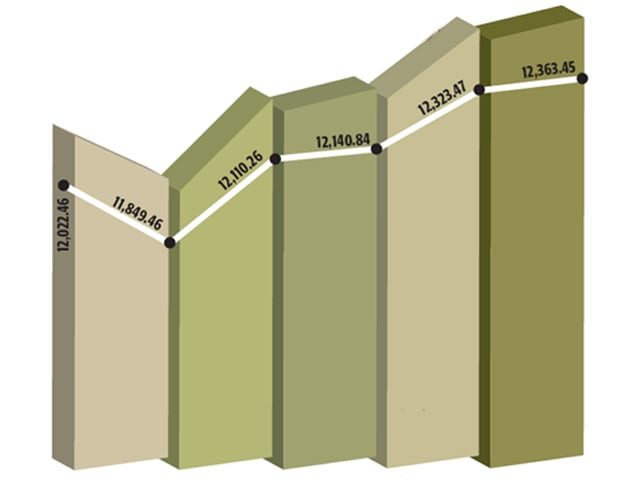

Monday, January 3

The local bourse welcomed the new year with anxiety after Sunday’s decision of key coalition partner, the Muttahida Qaumi Movement (MQM), to withdraw support from the government and sit on the opposition benches.

The benchmark 100-share index at the Karachi Stock Exchange (KSE) shed 173 points, or 1.44 per cent, to close below the 12,000 mark at 11,849.46 points.

Tuesday, January 4

The market rebounded on Tuesday after witnessing a bearish trend on the first trading day of 2011 as oil, fertiliser and textile stocks led the rally on the back of increasing commodity prices and margins, according to analysts.

The 100-share index jumped 260.8 points, or 2.2 per cent, to close at 12,110.26 points.

Wednesday, January 5

Expectations of strong result announcements kept investors active at the local bourse despite the negative sentiments generated by the assassination of Punjab Governor Salmaan Taseer on Tuesday.

The index recorded a mild gain of 30.58 points, or 0.25 per cent, to close at 12,140.84.

Thursday, January 6

The oil sector, mainly exploration and production (E&P) companies, led gains at the local bourse amidst hopes of better-than-expected results and rumours of possible discoveries by leading E&P concerns.

The benchmark index at KSE gained 182.63 points, or 1.5 per cent, to end Thursday’s trade at 12,323.47 points.

Friday, January 7

Investors remained cautious on Friday after the preceding day’s rally amid uncertainty over the outcome of Prime Minister Yousaf Raza Gilani’s meeting with MQM representatives.

The benchmark 100-share index at the KSE strengthened 39.98 points, or 0.32 per cent, to close at 12,363.45 points.

Published in The Express Tribune, January 9th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ