Federal Board of Revenue

More News

-

Road to (cash) recovery

Govt took four months to issue a simple notification that would allow FBR officials to look into foreign accounts

-

Budget measures slow down realty sector

Investors await clarity on revised rates of land to be announced by FBR

-

PTI plans to outsource airport management system

Aims to improve facilities at international airports that will attract tourism and investment

-

Zaidi assures businessmen of addressing concerns

Committee will be constituted to resolve problems of businessmen

-

Tax amnesty scheme

Only 130,000 or so people availed the scheme and paid just Rs60 billion in taxes

-

Cement supply slumps as dealers go on strike

Cement industry contributed Rs110 billion to the national exchequer in the last fiscal year

-

Amnesty attracts 95,000 people

He was of the view that tax return filing was the responsibility of every citizen to ensure growth

-

Tax-to-GDP ratio sinks to lowest in five years at 9.9%

Centre seeks help of provinces to broaden tax net

-

New rules have implications for Pakistani expats

Efforts should be made to minimise suffering for NRPs who provide remittances

-

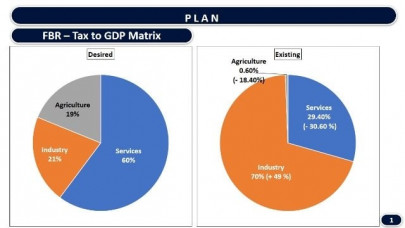

Govt aims to bring parity in tax collections from three sectors

Taxes on industry, services and agriculture sectors to be brought at par with their share in GDP

-

Tractor-makers seek import tax abolition

Lament sales tax refunds are not being released timely

-

Govt gives Rs20b tax relief to richest class

Reduces tax liability on inter-corporate dividends by amending Section 103C of IT Ord

-

Domestic consumers get commercial tax notices

Local traders say investors are shying away

-

FBR doubles service charges on goods clearance

Businessmen concerned as charges go up to Rs500 per goods declaration

-

Govt quietly offers tax amnesty to realty sector

Allows investors to legalise tax-evaded money at just 4% of property value

-

FBR working aggressively to broaden tax net

Will launch crackdown against people who have undeclared assets on July 1

-

Senate panel rejects most clauses in Finance Bill

Recommends fixing of exchange rate at Rs151 to a dollar, interest rate at 9%

-

PM’s tax amnesty scheme fails to attract people

Less than 250 people have so far opted for the scheme by paying around Rs450m

-

Govt intends to link FBR with Chinese tax dept

In a letter to foreign office, envoy in Beijing asks govt to build interdepartmental relations

-

FBR seeks amnesty scheme for cars stuck at port

Sends summary to government for clearance of over 1,000 refurbished cars

-

Govt mulls tax levy on middlemen’s income

Could also increase tax on interest income to 30%

-

Govt to make working group to implement FATF’s condition

Will monitor lawyers, chartered accountants, real estate dealers and DNFBPS

-

Govt proposes amnesty scheme for provinces

Officials suggest an asset declaration scheme should also be presented to the provincial governments

-

FBR calls for ending final income tax regime

Also proposes reduction in WHT on imported mobile phones

-

Cut in corporate tax may be reversed

Govt faces resistance over its plans to withdraw sales tax and income tax exemptions being availed by industrialists

-

Govt mulls GST hike, tax relief withdrawal

Looks to generate additional revenue to collect over Rs2tr through sales tax

-

FBR to introduce new border management plan

The decision is aimed at achieving the goals set by the Financial Action Task Force

-

Punjab finds it difficult to show Rs148b surplus this year

Says federal government has been unable to give province’s full share under divisible pool

-

FBR asks big businesses to declare hidden sales

Chairman urges them to opt for tax amnesty as only 11% are currently registered

-

Tractor producers demand abolition of GST on imports

Official says tax refunds are not being released timely

-

PTI govt withholds FBR chief’s appointment

Ministerial body to review Mujtaba Memon’s case

-

No point in reforming the irreformable

FBR is an organisation of the vested interests, by the vested interests and for the vested interests

-

FBR challenges ECP decision to declare its building as polling station

SHC directs RO to visit other public institutions in vicinity

-

AGP audits cigarette firms to stop revenue going up in smoke

Step taken following directive of PAC that took notice of Rs30b loss to exchequer

-

OGDCL chief gets philanthropy award

PCP awards OGDCL Chairman Zahid Muzaffar for humanitarian services

-

Covering more bases

Perhaps the most challenging task is to undertake a vigorous and across-the-board tax audit

-

Far graver issues to worry about

There is little point in igniting a national storm over dual nationality when there are far more important issues

-

Govt struggles to defend tax waiver to Chinese firm

Company gets second exemption from ECC in December

-

FBR promises refund payments from next week

Member says all legitimate issues of exporters will be resolved

-

Integrity of FBR top brass questioned

PM Office writes letter to chairman seeking detailed report

-

When food businesses eat up a chunk of tax revenue

Sector constitutes a big part of undocumented economy, says former FBR member inland revenue

-

Lawmakers want to rain hell on Paradise

But FBR cannot investigate cases more than five-year old, say experts

-

‘Major discrepancies’ found in NTS finances

FBR raid leaves testing service without main information servers, crippling their function

-

Non-filers set to enjoy lower withholding tax rate for another 3 months

FBR also likely to extend deadline for filing income tax returns as only 178,945 people complete task

-

FBR submits scathing report of ‘corruption, inefficiency’ in its department

Submits it to parliamentary body, reveals famous cases of undue favours and wrongdoings

-

FBR to announce sales tax refund policy soon

Next phase of refunds with claims of more than Rs1m on the cards

-

Fruit, vegetable exporters get threatening letters

Say tax complaints are based on concocted information

-

FBR to clear refund claims worth Rs1m

RPOs of amount more than Rs1 million to be paid by August 14

-

Dar’s pre-2007 tax record missing, says FBR

Board insists it has provided all available record to JIT

-

Panama Papers revelations: 400 cases assigned to pressure-prone FBR staff

Shifting of cases from FBR HQ to ‘inexperienced’ field formations raises eyebrows