Punjab finds it difficult to show Rs148b surplus this year

Says federal government has been unable to give province’s full share under divisible pool

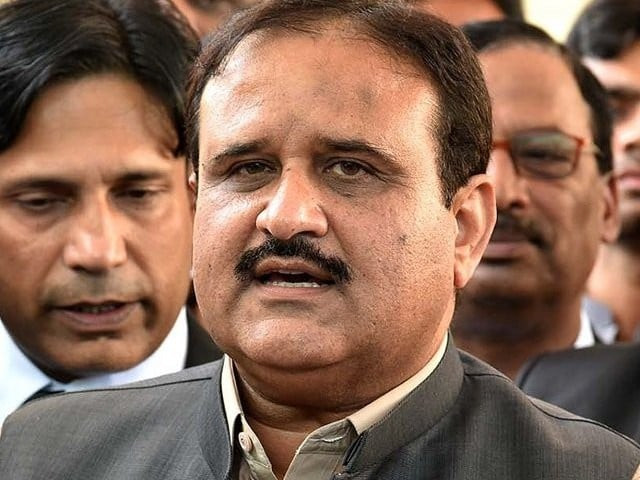

Punjab CM Usman Buzdar. PHOTO: INP

The primary reason behind this is the federal government itself, which has not been able to pass on the full share of Punjab under the federal divisible pool.

Punjab had estimated a share of Rs1.276 trillion from Islamabad for the ongoing fiscal year out of the general revenue receipts of Rs1.653 trillion. This slowdown in economic growth and a shortfall in tax collection by the Federal Board of Revenue (FBR) during 2018-19 can put Punjab in trouble to show a surplus amount in its account and also to allocate Annual Development Programme (ADP) funds for the next fiscal year.

Over 35% development funds to be allocated for southern Punjab

“The slowdown in the economy has impacted the overall tax collection in the country,” said Punjab Finance Minister Makhdoom Hashim Jawan Bakht, while talking to a group of journalists. If the FBR concludes their tax collection target at Rs4 trillion for this fiscal year, then Punjab could face a shortfall of over Rs120 billion under the Federal Divisible Pool; hence it would not be able to show a surplus amount to help Islamabad. “If the federal government transfers this amount to us then we will show the surplus of Rs148 billion, if they fail, we cannot,” the provincial finance minister said.

“We will keep the size of ADP for the next fiscal year higher than this year, but it could not be much higher as almost 75% of provincial revenues came through FDP and Islamabad is way behind revenue collection target,” he added.

According to Bakht, tax collection in the provincial tax collecting unit - Punjab Revenue Authority (PRA) - has also declined primarily in the past one year due to suspension in tax collection on telecom operators.

“Almost one-third of PRA revenues used to come from the telecom sector, which has declined especially in the prepaid-card category,” he said. Apart from the telecom sector decline, the drop in ADP spending also affected the tax collection.

Senate panel stresses more funds for south Punjab

“The government’s economic stimulus and its own public spending do collect some taxes and when mega projects and international loans land in the province, the government also charges tax on them. These things were missing in the past one year and when ADP falls short, it also impacts tax collections,” the minister said.

Nevertheless, Bakht said, for the upcoming fiscal year, they have devised some strategies to increase the provincial tax base. “For the next year, we are being quite innovative as we are keeping in view the affluence level to which we should propose tax measures and also review the existing ones,” Bakht said adding, “We will also keep in view the ignored areas, where we may bring betterment in terms of tax collection.”

Talking about the budget, he said the upcoming budget will focus on the agriculture sector, and the construction sector, primarily to feed the Prime Minister’s initiative of low-income housing schemes.

He said, “We will focus on healthy economy by focusing on social sectors. The big change this time will be the balancing act to ensure regional equalisation for the province of 110-million population.”

Published in The Express Tribune, May 23rd, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ