Business

More News

-

Tapping potential: Exploring women entrepreneurship

Foreign experts impart training to local businesswomen .

-

Smartphones: Debate rife over viability of manufacturing units in Pakistan

At present, such gadgets comprise only 10-15% of mobile phone sales.

-

Rescinded: The folly that was capacity tax

FBR’s collection took a hit, move was a result of large bottlers’ influence.

-

Back in the game: Sony tops console sales after eight years, says report

Sells 18.7m PS4 systems against Nintendo’s 16.31m.

-

Reassessment: Amid stricter scrutiny, GM recalls vehicles

Total number brought back now reaches 106,000.

-

Necessary: Pay more attention to agriculture, govt told

ICCI president says it is important to boost per acre yield.

-

Moving up: Taxi app valued at $17 billion

Highest-ever valuation for a tech start-up.

-

Industrialists reject property valuation tables

Split on rate of increase tax in proposals sent to province.

-

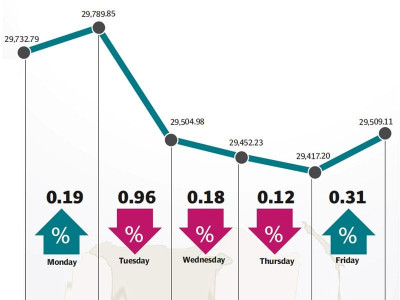

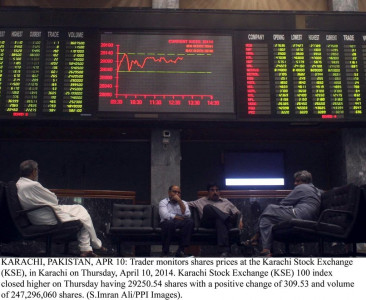

Weekly review: KSE-100 sheds 228 points during eventful week

Arrest of MQM chief takes shine off budget positives.

-

Bhoja Air tragedy: Families of victims demand Rs6b payout

Approach IHC for damages from airline, directors and insurance company.

-

Quest for competitive price: Talks break off with Qatar over LNG import

Govt waits to set benchmark before going ahead with negotiations.

-

Mou signed: China to assist with power plants

CM assures the delegation for full administrative facilities to help ensure timely completion.

-

Unhappy: Rice exporters unable to digest budget proposals

The industry is shocked over the government’s attitude of completely ignoring its budget proposals.

-

NJHPP: Duty exemption yet to be realised

Neelum Jhelum project to be completed in timely fashion, says CEO.

-

APTMA opposes increase in GIDC rate

Will cripple entire textile chain, says chairman.

-

Market watch: A black end to the week

Benchmark KSE-100 index gains 91.91 points.

-

SBP-IBA survey: Perceptions about economic conditions have improved

CCI reveals households expect inflationary pressure to ease.

-

Moving forward: China’s help for ‘smartphones made in Pakistan’

Will invest in manufacturing plant, to enjoy reduced income tax rates.

-

Pooling resources: Denmark assures assistance for wind power turbines

More green energy sought by Pakistani authorities.

-

Consumers could be forced to repay loans of power firms

Govt likely to raise tariff to recover Rs260b worth of borrowing .

-

Cigarettes, garments, leather: Tax increase comes into force before start of year

FBR begins collecting higher taxes to bridge revenue gap in outgoing year.

-

Widening tax base: Heavy taxes imposed on transfer of vehicle ownership

New rates equal to charges for registering a new vehicle; move likely to lead to surge in prices of used cars.

-

See-saw: Tax relief traded off with new tax

The government has imposed Rs250 tax on IMEI activation.

-

Forex: Reserves on the rise

The central bank’s foreign exchange reserves increased $33 million to $8,683 million.

-

Win-win: Move will benefit industry and government, says analysts

Government proposes to replace FED collection system.

-

Market watch: Amid Karachi unrest, index loses intra-day gains

Benchmark KSE-100 index falls 35.05 points.

-

UBL book-building prepared to move forward

Government to divest its residual shareholding.

-

‘Abolition of 10% FED only on local cars unfair move’

Dealers’ association complains govt favouring local assemblers.

-

Spiralling: Steel prices to rise after budgetary measures

Will go up Rs6,000 due to increase in taxes.

-

Number crunching: Finance Bill 2014 reveals budget as unfriendly

Telecom sector laments ‘high taxation rates’, to meet Dar soon.

-

Affordable: LPG may get cheaper as govt plans to fix prices

State could take over market control by rescinding deregulation.

-

Pakistan-China corridor: Two strategically vital projects approved

Overall, CDWP clears six development schemes costing Rs130b.

-

Dar downplays ‘pro-business’ tilt

Says influential segment has been brought under tax net for the first time.

-

Energy sector reforms: Japan agrees to give concessionary loan

“We are pleased to work with Pakistan to tackle this problem in cooperation with other development partner,”says envoy

-

Green light: FCCI terms budget business-friendly

Budget will help in streamlining the national economy in a permanent and sustained manner.

-

Powering through: Chinese company, APTMA sign MoU

Coal power plant to meet textile body’s energy needs.

-

Right direction: Despite reservations, OICCI terms budget ‘commendable’

Incentives mark substantial step towards economic growth.

-

Power outages dent pace of economic growth

Government plans to end load-shedding by 2018.

-

Construction industry hopeful after govt pledge

Plan to revive House Building Finance Company pleases sector.

-

Market watch: Bourse experiences post-budget uncertainty

Benchmark KSE-100 index falls 52.75 points.

-

Taxing away: Don’t blow up the proposal in smoke

Industry wants enforcement to discourage illicit trade.

-

Another blow: JJVL loses review petition, right to extract LPG

Second setback after project annulled due to irregularities in December 2013 .

-

Mortgage refinance: Company to be established in 2014-15, says Dar

Total paid-up capital to be Rs6b, govt to invest Rs1.2 billion.

-

Real estate and textile: Lobbies get tax plans changed in their favour

Ministers demand increase in salaries, PM rejects.

-

The mantra of every budget session: 'This budget is not people-friendly'

PPP Senator says budget has been prepared by industrialists for businessmen with no relief for common man.

-

2014-15: Fiscal year brings Rs231b in new taxes

Govt scraps Rs103b tax exemptions to broaden revenue base.

-

Index plunges before slight recovery

Benchmark KSE-100 index drops 284.87 points.

-

For less than 12 months: Proposal put forward to increase Capital Gains Tax to 12.5%

Tax not applicable on sale of stocks after holding period of 2 years.

-

Tax proposed on business class air passengers

Govt proposes 3% advance tax on business and club class air passengers in a bid to widen the tax net.

-

Telecom receives much-needed relief

FED removed, withholding tax reduced by 1%.