budget2011

More News

-

Dare we dream of reforms?

On Friday the minister laid out his agenda which was ambitious to say the least.

-

No direct incentives announced, but plenty of structural changes

Govt decides to fix regulatory structure of power.

-

Subsidies to be reduced by 58%

Electricity tariff, sugar prices at utility stores to rise.

-

Government increases development spending by 9% to Rs730b

Centre’s share to be Rs290 billion and provinces to get Rs430 billion.

-

Budget brings extra Rs106b into tax net

Tax on defence sales imposed, sales tax reduced to 16%, withholding tax on cash withdrawal cut to 0.2%.

-

Nisar forewarns of ‘tough time’ ahead for government

Opposition leader says PML-N losing patience with administration’s indifference.

-

NFC disbursements: Provinces to get Rs1.3t share in federal taxes

Provinces will receive Rs38.2 billion for development projects .

-

Fiscal allocations: NA gets Rs1.8b, Senate Rs1.04b

Rs541m set aside for Prime Minister Secretariat, Presidency allocations increased to Rs473m.

-

Sheikh outlines laissez-faire vision for economy

Minister lets his inner economist free, leaving the populists hanging.

-

Power sector: Govt to end tariff differential subsidy

Load-shedding in coming financial year threatens economic growth.

-

Special session: Cabinet approves budget

Dr Abdul Hafeez Shaikh briefed the prime minister and his cabinet colleagues about the budget proposals.

-

Employment benefits: Federal security apparatus gets Rs50b

About Rs4.7 billion has been set aside for salaries of the security personnel in the federal capital.

-

Budget 2011-2012: Defence spending up by 12%

The military establishment had sought an 18% increase.

-

Budget 2012: A predictable budget

Govt set to spend Rs2.8 trillion, removes several tax exemptions, restricts expenditure growth to below inflation.

-

Agriculture: New taxes on sector opposed by Sindh Chamber

Growers say new taxes will be detrimental to agricultural growth.

-

Pre-budget session turned into a resolution tussle over MPA’s kidnapping

PPP tries to appease MQM who threatens to walk out.

-

The health of the economy

Public sector investment crowding in the private sector investment has far-reaching implications for long-term growth.

-

Budget 2011-12: Same old story

The allocations in the federal budget for fiscal 2011-12 are more or less in line with those of previous years.

-

Government only interested in completing its tenure: Ch. Nisar

Nisar says opposition sloganeering to make government realise burdens on poor people.

-

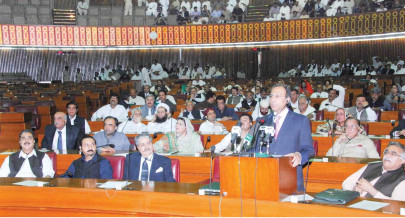

Finance Minister presents Budget 2011-12 amidst chaos

Budget for fiscal year 2011-12 announced with an outlay of Rs 2.5 trillion.

-

Environmental degradation: Rickshaws, motorbikes main culprits

According to 2010-11 economic survey, there are 3,329 CNG stations operating in the country.

-

Increasing literacy: Most of the education budget spent on non-development projects

Punjab has the highest literacy, followed by Sindh, Balochistan and K-P.

-

Economic Survey 2010-11: Infant and maternal mortality rate rising

Infant and maternal mortality rate has been on the rise in past several years.

-

Economic Survey 2010-11: Country sinks deeper into debt

The ratio of the country’s total debt to the size of its economy declined to 55.5% by the end of March 2011.

-

Economic Survey 2010-11: Agri sector growth likely to be far below target

Sector to grow 1.2% as floods damage rice and cotton crops.

-

Economic Survey 2010-11: Circular debt hampers oil and gas sector growth

The overall consumption of petroleum products declined by 0.97 per cent and gas fell by 2.03 per cent.

-

Economic Survey 2010-11: Has the real poverty rate hit 43%?

Government refuses to release poverty figure for third year in a row.

-

Economic Survey 2010-11: Industry struggles this year, the next looks brighter

Small-scale manufacturing does better than large-scale.

-

Economic Survey 2010-11: Govt gives Rs167b tax exemptions

The amount is Rs37b more than US aid for the year.

-

Last in economic, first in population growth

Eight were born, two died every minute on average in 2010, survey shows.

-

Without energy deregulation, high growth is impossible

The biggest obstacle to economic growth is the government's own inability to engage in structural reforms.

-

Cost of being a frontline state: $68b

2010-11 losses are the highest since Pakistan became the frontline state in the war against terrorism.

-

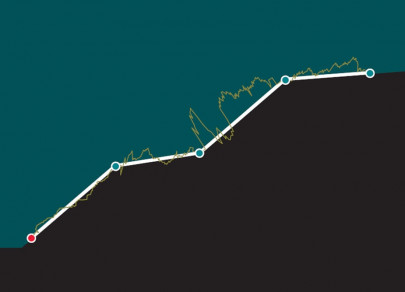

Economic Survey 2010-11: Floods, terrorism, oil price surge restrict growth to 2.4%

Hafeez Shaikh reveals missed targets; budget due today.

-

Wish list: For next budget, MQM puts its money on public transport

‘The energy crisis is the biggest obstacle to economic growth’.

-

Development: Sindh asks for Rs125b but likely to get Rs95b

Adviser says there is no more money for special packages for cities.

-

Ideas whose time never came

All of the promises made by Hafeez Sheikh at last years budget presentation have not been kept.

-

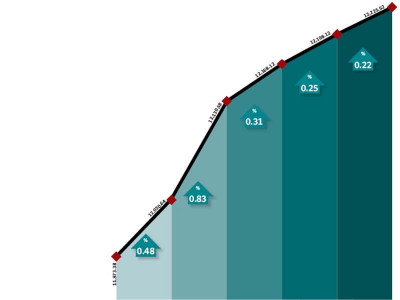

GDP growth: Falling short

Brining the fiscal deficit under control will be a challenge in fiscal year 2011-12.

-

Budget 2012: Economic team pressured to aid the poor in budget

Politicians fear an austere budget will hurt electioneering.

-

Govt borrows Rs135 billion at high rates

Bids for treasury bills were lower than the targets.

-

Against all odds: FBR surpasses tax collection target in May

Annual target of Rs1,588b now seems easy to achieve.

-

Upcoming budget: ‘More allocation for science and technology’

Minister says innovation is the key to economic competitiveness.

-

Budget? What budget?

Expect the budget speech to invoke emotions over the floods, the damage, and how our reserves and exports have grown.

-

Provincial budget allocation: Officials indecisive over outlay for development

Over 71% of last year’s development budget was not used: progress report.

-

Eleventh hour: Ordinance imposes 15% tax surcharge

The surcharge applies only to income earned in fiscal year ending June 30, 2011.

-

Budget 2012: Govt likely to slash social safety net funding

Only Rs45 billion is allocated to the Benazir Income Support Programme.

-

Why FBR has failed to raise the tax-GDP ratio

Tax collection needs to be revamped in the changing economic scenario.

-

Tax on luxury houses, cars, marriage halls proposed: Sources

Punjab government proposes taxes on luxury houses, vehicles, farm houses, marriage halls and parks for Budget 2011.

-

Budget 2012: ‘Govt will focus on fiscal self-reliance’

Businessmen agree that some tax exemptions should be removed.

-

Market rallies on positive budget related news

Removal of the Capital Gains Tax likely after meeting between PBC and government.

-

2011-12 Budget: Parliament session called on June 3

Federal Minister for Finance will present budget during the first sitting of lower house of parliament.