budget 2019-20

More News

-

Is Rs17,500 minimum wage sufficient amid heavy taxes?

Pay hike is insufficient considering massive rupee depreciation, accelerated inflation

-

With reforms, current account deficit may hit $7b

PFC chief terms budget balanced and development-oriented

-

PTI govt to go all out for Rs5.5 trillion tax

Hafeez Shaikh says he is ready to 'offend people' to meet revenue target

-

Budget 2019-20

The government has not only increased the cost of living, but it has also increased the cost of surviving

-

Govt projects Rs3.98tr spending on public debt

Spends Rs2.91tr on public debt retirement in outgoing fiscal year

-

PTI govt unveils tax loaded and bloated budget

8.2% deficit projected. Income tax threshold slashed. Customs duty on 2,400 tariff lines up.

-

Rs17.43 billion set aside for GB development projects

Rs2.435 billion for twelve continuing and new plans in the federal Public Sector Development Programme (PSDP)

-

PTI govt proposes 10% increase in pensions

Slashes salaries of ministers by 10%; people earning Rs50,000 per month will have to pay tax

-

Separate ministry of poverty alleviation formed

Task will be to devise, implement programmes for social protection

-

Tax loaded and bloated budget

Pay, pensions rise; income tax threshold slashed; FBR collection target set at Rs5.5t; 8.2% budget deficit projected

-

Rs113bn earmarked for railways

According to the budget draft, Rs29.51b have been earmarked for salaries and Rs33.37b pensioners

-

Rs190b apportioned for Ministry of Water Resources

Amount of Rs120bn have been reserved for the ongoing hydel power projects and Rs697m for new projects

-

Opposition rejects ‘anti-people’ budget

Announces to launch protest ‘at all forums’ against govt’s vengeful policies

-

Rs7.5b recommended for climate change projects

Rs64.2 million earmarked for the four ongoing projects

-

Budget presented in Senate amid protest

As the opposition senators shouted slogans against the budget, the chairman adjourned the session till Friday

-

Subsidies swell 55% for energy, commodities

Govt will provide Rs271.5 billion in FY20

-

Rs287m reserved for Rangers’ CPEC security wing

Rs15.383 million allocated for 500 police barracks in Islamabad

-

Rs280b package announced for agriculture sector

Funds will be utilised to improve water productivity, crop yields

-

Budget 2019-20 proposes 18.8% hike in PM Office funds

Govt allocates Rs1.171 billion against the outgoing year’s revised estimate of Rs980m

-

PTI govt withdraws zero-rated status for major exporters

Govt imposes 17% sales tax on textile, leather, carpet, sports goods and surgical instrument sectors

-

Pakistan introduces FED slabs for auto sector

Duty levied on cars of all engine capacities

-

PTI govt lifts curbs on property purchase

Govt withdraws 3% tax on price differential to close window for legalising black money

-

Pakistan sets lower revenue targets for oil, gas firms

Govt eyes collection of Rs359b against Rs486b in previous year

-

PTI govt slaps Rs516b ‘unprecedented’ taxes

Proposes harsh, inflationary taxation measures to qualify for IMF programme

-

Income tax: What the salaried class will pay now

The Express Tribune reviews new taxes proposed in FY20 and imposed in previous years

-

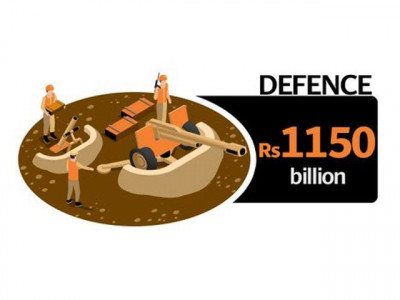

Defence budget jacked up by 4.7%

Comparing to last few years when defense budget grew by average 11%, current raise is nominal

-

PM Imran to form ‘high-powered commission’ to probe massive increase in Pakistan’s debt

Govt is coming after all those who looted public wealth, says Imran Khan

-

Khusro Bakhtiar draws PM Imran's ire over 'irresponsible attitude'

Planning and development minister vents anger on his servant after forgetting important budget file at home

-

Govt earmarks Rs701b for next year's development programme

Amount is insufficient for Rs8tr worth of ongoing and new projects that will take 12 years

-

PTI govt unveils Rs7.02tr budget for FY20

Minister of State for Revenue Hammad Azhar presents the budget

-

PTI govt set to present first annual budget

Minister of State for Revenue Hammad Azhar will be brief parliament on the budgetory proposals

-

Economic survey: the way forward

PM Khan’s iteration of Pakistan being one of the most charitable nations is quite a paradox

-

Moving beyond defence budget cuts

The key is to carefully differentiate between wasteful and necessary govt expenditure and undertake some bold reforms

-

Agriculture sector falls way short of growth target

Grows just 0.85% due to water shortage in FY19 compared to 3.8% target

-

A few segments shine amid dismal industrial growth

Improvement seen in electronics, engineering and wood products

-

Installed power production capacity rises

It comes mainly due to setting up of new CPEC power plants

-

FBR opposes tax relief for industry’s revival

Commerce adviser meets PM to seek incentives under tariff rationalisation policy

-

Survey strikes a sour note

Finance minister makes pitch for toughest ever budget

-

Pakistan’s stock, currency markets jolted

PSX hits three-year low at 34,567.55 points; rupee drops to 150.10

-

Pakistan loses record Rs972.4b in tax exemptions

Significant amount will now be recovered under a deal with the IMF

-

SBP reserves drop 1.85%, go below $8b mark

The decline in reserves was attributed to payments on account of external debt servicing

-

Public debt swells to Rs28.6tr by March-end

Major increase of Rs1.2tr in public debt came from 44% rupee depreciation

-

Survey strikes a sour note

Finance adviser makes pitch for toughest ever budget

-

Cost of war against terror glossed over

China Development Bank provides $2.23b worth of commercial loans

-

PTI unveils its first economic survey

Major challenges during current fiscal year were runaway imports, swelling trade and current account deficits

-

Shehbaz convenes PML-N meeting as PTI govt prepares to launch economic survey

Another meeting scheduled for Wednesday to discuss post Budget 2019-20 strategy

-

Govt mulls tax levy on middlemen’s income

Could also increase tax on interest income to 30%

-

PTI govt to provide relief, improve tax receipts

ADB, World Bank expected to provide $2-3b in assistance

-

Punjab to trim some taxes

Minister insists provinces must mobilise own resources

-

FBR to simplify tax regime to broaden tax base

Proposes to offer educational institutions, jewellers, SMEs, builders to pay lower than standard tax rates