Is Rs17,500 minimum wage sufficient amid heavy taxes?

Pay hike is insufficient considering massive rupee depreciation, accelerated inflation

CREATIVE: IBRAHIM YAHYAH

Concerned quarters, however, found the raise insufficient even for a small family.

“The increase in the minimum wage is insufficient…especially after the recent massive rupee depreciation and acceleration in inflation,” Pakistan Institute of Labour Education and Research (PILER) Executive Director Karamat Ali told The Express Tribune.

Even a small family of five members cannot conveniently run its kitchen and bear day-to-day minimum expenditure with the revised minimum wage of Rs17,500. “The number of members in an average-sized family is higher than five,” he said.

“The minimum wage must be fixed at Rs35,000 per month as per the predefined formula, which takes into account minimum requirements of a family,” he said.

The Rs35,000 does not include the impact of rupee depreciation and acceleration in inflation.

To recall, the State Bank of Pakistan (SBP) has let the rupee depreciate by around 44% since December 2017 and has estimated the average inflation at around 7.5% for the outgoing fiscal year.

“The devaluation and inflation have increased the cost of (essential) goods,” he said.

The goods covered in the minimum requirement include food, house, clothes, health care, and education.

He elaborated that the food segment included pulses, vegetables and sometimes meat. In addition to this, milk is needed for children and tea.

“Now, one has to buy drinking water as well as the essential item is either not available or not fit for consumption. A family may afford to buy fruits once in a while. This is the minimum requirement of any family,” he said.

Apart from this, families living in rented houses had to set aside a significant amount for paying the rent whereas inflated power bills consumed a hefty amount from the limited pocket of the minimum-wage earners, he added.

He recalled that the Sindh government had increased the minimum wage to Rs16,200 from Rs15,000 last year. However, the federal and other three provincial governments left the wage unchanged at Rs15,000.

Ali said there were three boards - comprising provincial government officials, employers, workers, and independent directors. Their job is to conduct a market survey and then determine the minimum wage.

However, the boards at provincial levels remained inactive as governments announced the wage without doing any homework.

Secondly, the implementation of the announced minimum wage at the factory level is a tough job. A recent survey of garment factories revealed that 85% of workers, who were skilled, were paid much lower than the minimum wage.

Male workers were being paid Rs10,000-11,000 per month while female workers were given only Rs6,500-7,000, he said.

Budget for the common man

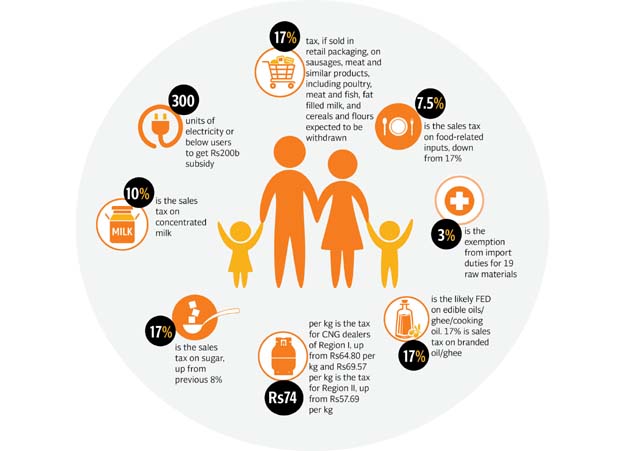

The recently presented budget has mostly made goods expensive for everyone and exorbitantly expensive for the larger poor segment of the society. While some of the goods were announced to be made cheaper, according to the budget documents for FY20.

The budget has made two essential goods ie sugar and ghee/cooking oil expensive. The government has increased the sales tax on sugar to 17% for FY20 compared to 8% in the preceding year FY19.

The tax measure would make sugar expensive by Rs3.50 per kilogram, Minister of State for Revenue Hammad Azhar said, while presenting budget 2019-20 in the national assembly on Tuesday (June 11).

The ghee/cooking oil becomes expensive following the government increasing federal excise duty (FED) to 17% at the retail level on the kitchen items.

The government has increased salaries by up to 10% for the government employees and kept wages for the employees in grade 21 and 22 unchanged. However, pay raise would not make a meaningful impact in their lives since the government has increased maximum rate of the income tax to 35% from 29% last year and introduced four more slabs to collect higher taxes.

The increase in the rate of income tax and more slabs would badly impact employees in the private sector as they are bound to pay the income tax at increased rates, but it remained uncertain whether their salaries would be revised up; when and how much.

The government has announced a subsidy amounting to a total of Rs216 billion for power consumers using a maximum of 300 units per month. However, the impact is set to be diluted as the government is considering increasing tariff for power and pipelined-gas consumers aggressively in the near future to win the International Monetary Fund’s (IMF) bailout package worth $6 billion.

The government has also made CNG fuel for cars expensive by 14% in the budget. Besides, it has pushed petrol price to an all-time high of over Rs113 per liter, as it has passed-on the increase in the international oil price to domestic consumers.

The government has announced reducing the cost of the goods including medicines, powdered milk, and mobile phones. However, it remains uncertain whether the government could implement the decision. There is a general practice that whenever things are announced to be made expensive the changes are made immediately, but businesses seldom drop prices.

A downward revision seems highly unlikely as every industry accounts in the impact of the increase in fuel/oil price, rupee depreciation, inflation, and key interest rate hikes and increases its product prices.

The worsening trend in the economic indicators remained a concern for each and every productive sector of the economy, as the government is determined to let the rupee devalue further and increase the interest rate to win IMF bailout.

The average rate of inflation is estimated at 13% in FY20 compared to an estimated 7.5% for the outgoing FY19. Accordingly, the key interest rate is feared to be hiked to a colossal 15% during the next year.

Published in The Express Tribune, June 13th, 2019.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ