Business

More News

-

Trade policy: ECC to discuss cut in import tariffs

FBR, ministries of commerce, industries against the proposal.

-

Afghanistan Transit Trade: Pakistan to abolish cash guarantee clause for 60 days

Afghanistan asking to make this exemption permanent.

-

Career Guide: An assistant product manager's dilemma

Female employees’ personal obligations will always be taken as a sign of career non-seriousness.

-

Pakistani mobile users reluctant to switch services

Majority of subscribers are happy with their current operator: survey.

-

Tough economic times hit Indian property firms

Sales of prime real estate have dropped to 30-month lows.

-

India hungry for everyday Internet access

Lack of infrastructure like electricity a stumbling bock to growth.

-

Ineffective disintermediation: Punjab’s agricultural market committees rendered dysfunctional

Offices being used for political purposes by PML-N.

-

Turf war between OGRA and Industries Ministry

Regulator threatens to sue after ministry authorises 3 firms to conduct inspections.

-

Research in pharmaceutical sector: Pakistani companies lag behind their Indian, Chinese counterparts

India earned about $1.5 billion from sponsored clinical research in 2010.

-

Power tariff: Govt plans 14% increase in four phases

Four per cent immediate increase, removal of subsidy for slabs 1-100 and 100-300 units.

-

On the Pakistan India border – a cold peace

The trade, limited to 21 items, is small, hampered by the fact that it has to be done through a barter system.

-

US debt remains investor safe haven despite S&P downgrade

The gyrations on global stock exchanges this past week have only increased their attraction.

-

Conditionalities of (in)dependence

As Pakistan continues to dig deeper into foreign pockets, it further diminishes its autonomy in policy making.

-

Change in the system: Some small business owners welcome return of 2001 system

No one checks to see if government price lists are being followed any more.

-

Violation: Afghan Customs stops Pakistani trucks at border

Afghan Custom officials stopped transport of goods in violation of transit goods treaty.

-

Sales tax on services: FBR, Sindh officials to meet on Aug 16

Authorities will try to resolve issue and will also discuss tax on telecom services.

-

Chinese investment sought for Gwadar port

‘Pakistan and China support each other on UN reform among other issues’.

-

Strike in Karachi: Attendance remains thin

Trade representatives say almost all political parties threaten them on a strike day.

-

Airblue crash: Almost half of families yet to receive compensation

PIA achieved double-digit growth in revenue in last two years.

-

Gas companies seek tariff increase to finance development schemes

Ogra to conduct public hearing before taking a decision.

-

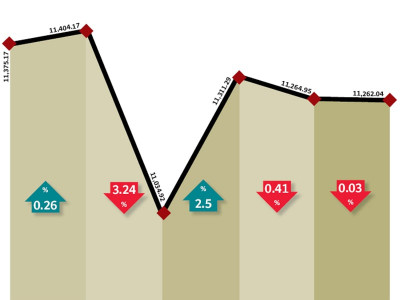

Weekly review: Global events dominate proceedings at bourses

Fears of a new recession resulted in a volatile week at KSE.

-

Rally: Farmers protest non-availability of urea

Urea price goes up from Rs850 to over Rs2,000 per bag.

-

Cases to be filed against fake refund claimants

Bogus input adjustment increasing.

-

Cold storage: Facilities fail to meet quality standards

Advanced methods to preserve commodities not being applied.

-

Energy sector: Tajik envoy calls for cooperation

Pakistan can get up to 2,000 megawatts of electricity through a project.

-

Market watch: Stock market ends range-bound

KSE-100 benchmark index loses three points.

-

Lobbies active again: PM rejects new OGDC MD

Petroleum ministry directed to resume interview process to appoint new head

-

KSE reshuffles 30-share index

Consumer giants Nestle and Unilever join the index.

-

Pak Railways ancillary outperforms parent organisation

Most PRACS projects are making profits, though major share goes to PR.

-

Cotton purchase: Govt to scrap withholding tax

Rs105 billion revenues collected in July 2011, 36% more than last year.

-

Corporate results: OGDC & Engro posts profits

OGDC's net profit rise 7% to Rs63.52 billion; Engro's profit rose Rs3.3 billion

-

Petroleum products: Decision on deregulating freight margin withdrawn

Strong opposition from political parties forces ministry to abandon the move.

-

Google, Facebook face-off in social games

The dueling social gaming announcements underscored what may emerge as a key battleground between the two Web giants.

-

New peak: Gold prices continue record breaking spree

Prices per tola (11.7 grams) of the precious metal rose to Rs57,800 on Thursday

-

Foreign exchange: Reserves fall to $17.97b from record high

Decline in reserves due to scheduled debt repayments: central bank.

-

Income tax: Filing of returns to be made mandatory

Kiosks will be set up at public places to help NTN holders file tax returns.

-

Up in smoke: Tobacco industry losing billions to tax evasion

Evasion in duties and taxes by illegal cigarette manufacturers has caused losses of over Rs55 billion in last 7 years

-

CCP issues show cause notice to 16 companies

Paint makers accused of indulging in deceptive marketing practices.

-

Market watch: Heavyweights pull stock market down

KSE-100 benchmark index loses 46 points.

-

Petrol sales jump to record high

Overall oil sales declined by 1.4% in July

-

Trade deficit shrinks on strong export growth

Country to focus on regional markets as demand from US and EU falls.

-

Car sales at two-year high

Market leader Suzuki leads the way.

-

New LNG policy: Govt to seek $35 million guarantee from developers

The draft of LNG Policy 2011 will soon be tabled before Economic Coordination Committee.

-

Cotton crisis: Roundtable conference to be held on 15th

Ijaz A Khokhar invites textile industry associations for a roundtable conference.

-

‘EOBI committed to the working community’

Chairman advises regional heads to involve themselves to the grassroots level.

-

Meezan becomes adviser to KAPCO’s Sukuks

The short-term Sukuk, an Islamic alternative to commercial bonds.

-

Target missed: Tax collection close to Rs1,550b last fiscal year

Collects Rs38 billion less than the target of Rs1,588 billion.

-

Punjab govt to sell seed packets for Rs50 each

Kitchen gardening programme to promote use of home-grown vegetables.

-

The winning eleven: Getting them while they’re young

TRG fed up with incompetent university grads; hires high school students and educates them its own way.

-

Faisalabad Dry Port: Customs authorities holding back billions in rebates

Exporters say dry port cargo service costs more than private cargo service.