Weekly review: Global events dominate proceedings at bourses

Fears of a new recession resulted in a volatile week at KSE.

Global events took their toll on the country’s bourses as volatility prevailed throughout the week, amid fears of a new recession triggered by the downgrade of credit rating of the United States and the debt crisis in various countries of the European Union.

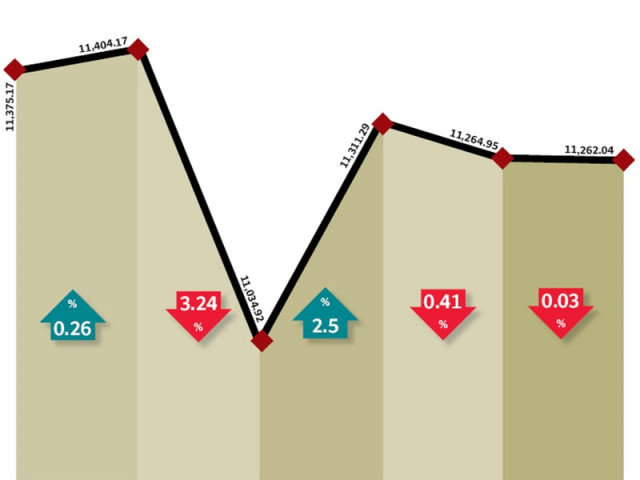

The benchmark KSE-100 index ended the week lower by one per cent (113 points) after toeing the line of global markets which swung sharply throughout the week. Investors actively participated in the market as the initial sell-off was followed by massive buying due to attractive valuations of various blue-chip companies.

The week started off on a muted note on Monday after the downgrade of the United States’ credit rating by Standard and Poor’s (S&P). However, events at the US markets saw one of the worst declines in Dow Industrial and S&P 500 indices, which triggered a worldwide sell-off of equities.

Almost all major global bourses, from the Nikkei to the FTSE, followed suit on Tuesday and dropped sharply. The KSE-100 index also shed 370 points that day and barely managed to stay above the 11,000-point barrier at the close of the session.

The following day saw a massive recovery in global equities and the KSE-100 also managed to recover most of its losses from the previous day by climbing 280 points. Yet, it was not the end of volatility as concerns arose over the financial health of eurozone in the wake of France’s debt fears, which resulted in a sharp decline on Thursday.

The impact of these new declines was, however, subdued and the KSE-100 index fared better than most of its regional peers and only shed 0.45 per cent (49 points) in the closing two sessions of the week. The index outperformed regional markets by 1.9 per cent during the week.

This performance was in part due to the ongoing corporate results season, as several blue-chip companies announced their earnings during the week. The Oil and Gas Development Company led the way with strong earnings of Rs14.77 per share, while Pakistan State Oil also surprised with better-than-expected earnings of Rs86.17 per share.

However, Engro Corporation disappointed investors with lower-than-expected earnings of Rs8.43 per share, following a torrid start to the year for its new urea manufacturing plant, Enven, and also due to the substantial financial cost incurred due to its massive debt. However, the stock is currently trading at very attractive valuations and remained amongst the volume leaders throughout the week.

Volumes increased sharply by 36 per cent and stood at 71 million shares. As investors flocked to buy blue-chip stocks, average daily value increased by an even higher 47.6 per cent and stood at Rs3.5 billion per day. The KSE’s market capitalisation barely managed to stay above Rs3 trillion at the end of the week.

What to expect?

With the prospect of a new recession looming large, global markets can be expected to remain in a flux. Concerns over the state of the US economy and stability of the eurozone will continue to dominate proceedings in global markets in the coming week and the KSE is likely to follow suit.

Monday, August 8

Despite an early fall, the stock market recovered enough to end the day in positive territory, defying the trend in other Asian markets. All other major Asian markets fell amid global concerns over the US credit downgrade by Standard and Poor’s and Europe’s continuing debt crisis.

Tuesday, August 9

The Karachi Stock Exchange (KSE) followed the global market trend and plummeted near the 11,000-point mark after a gap of almost 9 months amid panic selling. International market continued to plunge on US rating downgrade by S&P and fears of another global economic recession.

Wednesday, August 10

Investor confidence rose as the stock market came out of the dark and followed footsteps of other regional markets to sprint its way upwards. The bourse marked its best session since March 2011 as the index rebounded sharply after the US Federal Reserve assured investors to help aid economic recovery.

Thursday, August 11

After a steep slide in the early hours, the stock market recovered as value buying covered the losses. The bourse was down mainly because index heavyweights Oil and Gas Development Company and Nestle bore the brunt of the selling pressure and closed down 3.7% and 0.8%, respectively.

Friday, August 12

The stock market closed flat in a dull session on the last trading day of the week amid dismal volumes. The market witnessed buying in key stocks in the banking, power and oil sectors, however, profit taking in stocks such as Oil and Gas Development Company, Nestle and Unilever dragged the index down.

Published in The Express Tribune, August 14th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ