Flood tax only after coalition agrees

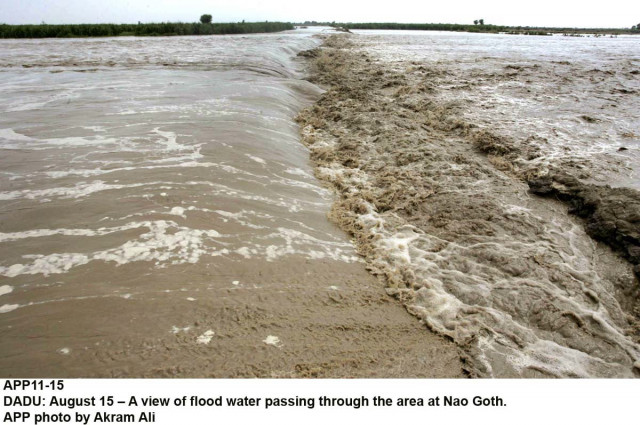

Sindh agrees to levy one-time tax in addition to present taxes, during a high-level meeting with President Zardari.

The purpose of the tax is said to be to provide money for the rehabilitation and reconstruction of the flood-hit districts of the province.

It was decided that Flood Surcharge will be collected on agricultural land, registration of vehicles with 1300 cc or heavier engines, arms licenses and houses larger than 500 yards. The meeting was held at Bilawal House and it was attended by Chief Minister Syed Qaim Ali Shah and key members of his cabinet as well as other officials.

Talking to journalists after the meeting, Dr Kaiser Bengali, advisor to the CM, said that the final approval for the implementation of the Flood Surcharge will be taken by the Sindh cabinet after consultations with coalition parties.

However, the Muttahida Qaumi Movement (MQM) has, on its part, protested that it was not taken into confidence regarding the imposition of the new tax.

Sindh Health Minister Dr Sagheer Ahmed in his meeting with the president expressed reservations on behalf of his party, MQM, regarding the imposing of a tax without taking them on board. He further complained to the president that when the MQM suggests a solution to any issue it is not valued by the PPP-led government.

The president has directed the CM to hold a separate meeting with the MQM to resolve differences and overcome reservations. “Soon there will be a meeting with CM to discuss the implications of flood tax. The president has not given approval of flood tax unless our doubts are cleared,” claimed Syed Faisal Subzwari, deputy parliamentary leader of the MQM in Sindh Assembly.

He further added that why the tax was being imposed on people who already came under the tax net why not the super elite class. “Initially it was announced by the president that the people on the left bank would also come under the tax net but later it was withdrawn. Our argument is that the non-taxed sector should come under this proposed tax net,” Subzwari added.

The president was also briefed in detail regarding the losses suffered by Sindh.

The Sindh Health Minister Dr Sagheer Ahmed talking to the media outside Bilawal house after his meeting with the president said that the health department had suffered the most. “We discussed the rehabilitation and losses suffered by the health department. Around 165 Basic Health Units (BHUs) were damaged while 105 need to be totally rebuilt. We informed the president that Rs3.6 billion is needed to rehabilitate the BHUs,” Ahmed revealed.

The Minister for works and services Manzoor Wassan informed the president that 4,060 kilometers of roads in districts were damaged while 1,925 kms of inter-provincial roads were severely damaged. “Communication is very essential to carry out rehabilitation work. Around Rs17 billion are needed to repair and reconstruct these roads,” Wassan said.

Dr Bengali summarized the overall situation in terms of losses in and revealed that Sindh suffered around Rs450 billion in losses. Of this, Rs102 billion was suffered due to agriculture. He further informed that 2,243,000 acres of land was inundated while Rabi crop production was nearly impossible. However, he informed the president that a Rabi plan is being prepared by agriculture department to at least produce a major chunk in the season.

Published in The Express Tribune, October 5th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ