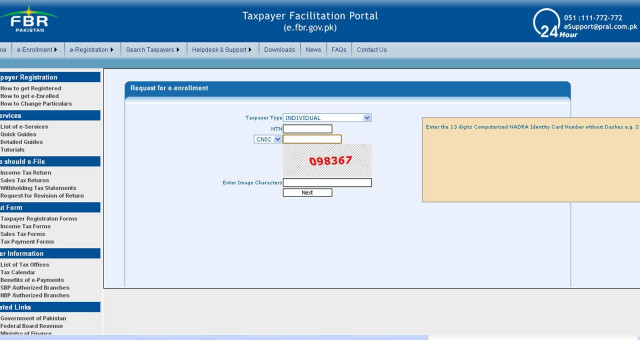

FBR’s web portal makes filing returns cumbersome

Businessmen want extension of deadline for filing sales tax returns for June.

Due to a technical glitch, the portal is not adjusting the 1% further tax that is payable on supplies made to unregistered persons.

Due to a technical glitch, the FBR web portal is not adjusting the 1% further tax that is payable on supplies made to unregistered persons on or after June 13. Since the 1% further tax is not being adjusted against the available input tax, taxpayers have to prepare a separate challan, making the entire process lengthy and cumbersome.

In his letter written to FBR Chairman Tariq Bajwa, Merchant said that the problem is exacerbated by the fact that annexure B and D of the sales tax return form – which declare the imports and exports, respectively – are not accepting the manual entries. “Only current months’ goods declarations are being automatically uploaded, which is causing unnecessary harassment to the taxpayers and is one of the reasons for the delay in the filing of sales tax returns,” Merchant said.

In some cases where the registered persons have issued debit notes to recover the differential of 1% on account of retrospective amendment by the parliament, Merchant noted, the sales tax return does not consider the debit note and the consequent increase in the liability.

He pointed out that the web portal does not currently enable taxpayers to pay federal excise duty on purchases made by the oil and ghee sector. Taxpayers will not be able to file their sales tax returns for June unless the problems with the FBR’s web portal are not resolved, he said. “We request that until these issues are resolved, the FBR should extend the date of filing of the sales tax return for June,” he demanded.

Published in The Express Tribune, August 1st, 2013.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ