Weekly review: Bourse plummets to 15-week low

Negative triggers force foreigners to sell and locals on the sidelines.

The stock market fell to a 15-week low as escalating political tensions resulted in foreign outflows of $11.2 million during the week.

This largely contributed to the bearish sentiments and kept local participants in a state of unease.

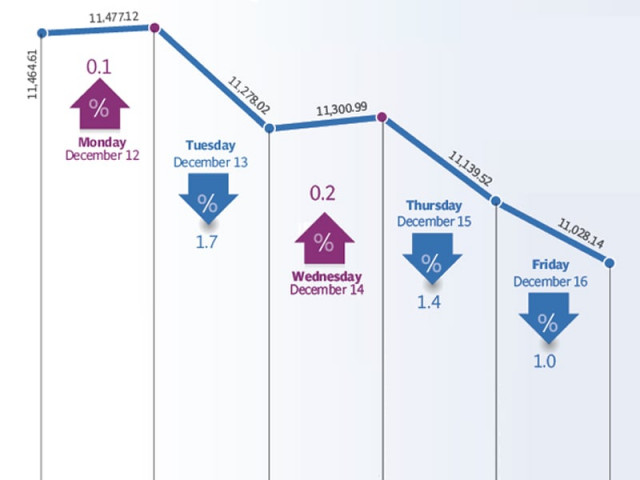

The Karachi Stock Exchange’s (KSE) benchmark 100-share index plummeted 3.81% or 436 points to end at 11,028 point level during the week ended December 16.

Temperatures rose to new heights after validation of the controversial memogate by Army Chief General Kayani and ISI Director General Shuja Pasha in their reply to the Supreme Court coupled with US decision to freeze aid worth $700 million to Pakistan.

As the possibility of foreign funding lines appeared to be drying up, the rupee-dollar parity reached an all-time low of 89.6 during the week.

Moreover, deteriorating external indicators also played its part to weaken investor sentiment.

Import growth of 20.2% outmatched growth in exports of 7.6% on a yearly basis owing to the rise in oil prices and fall in cotton prices. Overall, imports stood at $18.45 billion while exports were reported at $9.38 billion.

The week was a nightmare for the automobile sector as the government decided to ban import of CNG kits coupled with sales November numbers showing massive decline of 21% in sales.

Pak Suzuki Motor Company, the country’s largest automobile manufacturer, stock price fell 4.8% during the week.

Additionally, cement sales in November depicted a decline of 23.3% on a monthly basis to 2.26 million tons as seasonality and fewer working days in November took its toll. Oil stocks Pakistan Petroleum Limited and Pakistan Oilfields outperformed the market by 3% and 1%, respectively, on expectations of production enhancements.

Conversely, uncertainty on gas related issues resulted in Engro and Fauji Fertilizer Bin Qasim underperformed the market by 10% and 11%, respectively.

MSCI’s delayed decision on UAE and Qatar’s upgrade to MSCI Emerging Markets proved to be a non-event from Pakistan’s vantage point as the decision was again deferred till June 2012.

Average value and volumes during the week went down by 7.2% and 1.9%, respectively, to $29 million and 44 million shares.

Outlook

Fundamentals and valuations are expected to be temporarily pushed to the sidelines as the surge in foreign outflows is likely to take on added importance with investors questioning its persistent recurrence, according to KASB Securities.

The local political landscape also remains choppy and noise factor could build up when the Supreme Court resumes its hearing of the memogate scandal next week, says a KASB Securities research note. The possibility of stock specific rallies in anticipation of corporate results can be expected, although lack of volumes will continue to hamper the price discovery mechanism and add to stock price volatility, adds the note.

Stocks closed marginally higher in a volatile session as investors booked profits when the bourse was up almost 145 points at midday.Index giant Oil and Gas Development Company supported the benchmark index to close in the positive territory.

Bourse witnessed across the board selling after news that the US agreed to freeze aid worth $700 million to Pakistan.

Foreign institutional investors were net sellers of Rs226 million worth of shares, according to National Clearing Company of Pakistan Limited.

The stock market closed marginally higher with index heavyweights Oil and Gas Development Company and Fauji Fertilizer Company leading the way.

Weakening currency and slowdown in remittances growth bring macro concerns back in focus.

The stock market plummeted as investor sentiments fell and foreigners continued to pull their money out of the bourse.

Foreign institutional investors were net sellers of Rs174 million worth of shares, according to National Clearing Company of Pakistan Limited.

The stock market tumbled to a 16-week low as foreigners continue to pull out funds. The benchmark index did recover 100 odd points in the second half of the session as the market was down more than 200 points at midday.

Published in The Express Tribune, December 18th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ