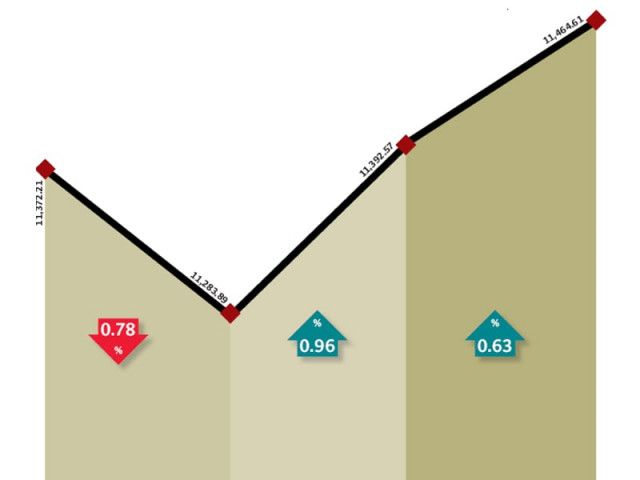

The market finally managed to breathe a sigh of relief as the benchmark KSE-100 index closed in the positive during the week ended December 9. However, the index managed to climb by 0.8% (92 points) as politics and adverse news for the fertiliser sector held it at bay.

The market opened on Wednesday, after the holidays on Monday and Tuesday on account of Ashura. The KSE-100 index opened negatively as news emerged that the President Asif Ali Zardari had suddenly flown off to Dubai to undergo medical treatment.

Rumours immediately started to circulate that the president was all set to resign and a political reshuffle was on the cards, creating panic at the bourses. However, the reports failed to materialise as it was confirmed that the president was undergoing medical tests and would return to the country once cleared by doctors.

The other major news came from the fertiliser sector, where gas supply was suspended by the Sui Northern Gas Pipelines Limited (SNGPL) due to the sudden increase in demand by domestic consumers, for heating purposes, as winter sets in.

Gas supply to Engro Fertilizer’s new plant Enven was halted and as a result, production at the plant was halted. The government had earlier this month assured urea manufacturers that gas supply would be maintained to all manufacturers on a rotational basis and convinced them to reduce fertiliser prices by Rs100 per bag.

However, with the sudden suspension of gas supply to Engro, it is likely that the price cut will be cancelled and the urea manufacturers may even increase prices further if the gas supply is not restored.

As the weather becomes even colder in the coming weeks, the demand supply gap of gas is likely to increase and it is unlikely that the government will be able to assure continuous gas supply to urea manufacturers.

The outflow of foreign funds continued in the current week as there was a net outflow of $4.8 million during the three trading sessions of the week. The rupee also continued to slide against the US dollar and stood at Rs89.1 per dollar in the interbank market, hitting a new historic low against the greenback.

Volumes improved slightly during the week and stood at 43.7 million shares traded per day, up by 17.7%. Volumes were restricted by the ongoing tussle between the Securities and Exchange Commission of Pakistan and the bourse over the minimum paid up capital requirement for brokerage houses and the amendment in the Capital Gains Tax collection rules.

What to expect?

As mentioned earlier, clarity regarding the gas supply issues to urea manufacturers will be a key determinant for the fertiliser sector and the whole market in the coming week. If the gas supply is not restored, then a price hike will be likely which will bode negatively for Engro (SNGPL network) and positively for Fauji Fertilizer Company (Mari Gas network).

Wednesday, December 7

The stock market fell after remaining closed for four days as negative political news from domestic and international fronts kept investors at bay. News of President Asif Ali Zardari flying to Dubai for a checkup and Nato attacks kept investors away from the market. The stock market remained closed on Monday and Tuesday on the occasion of Ashura holidays.

Thursday, December 8

Stocks rose nearly one per cent as bargain hunters accumulated fertiliser shares at attractive prices.

Consequently, Fauji Bin Qasim ended 4.29% higher at Rs52.70, while Engro Corp rose 1.3% to Rs118.45. Furthermore, amongst the top five traded companies during the day, three were from the fertiliser sector.

Friday, December 9

The market juggernaut Oil and Gas Development Company, the highest weighted stock, led the bourse upwards on the last trading session of the week. Oil and Gas Development Company jumped 2.6% after weekly numbers showed recovery in oil production from Mela field by 25% to 5,200 barrels per day and gas production from Qadirpur stabilising above the 500 million cubic feet per day mark, according to an analyst.

Published in The Express Tribune, December 11th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ