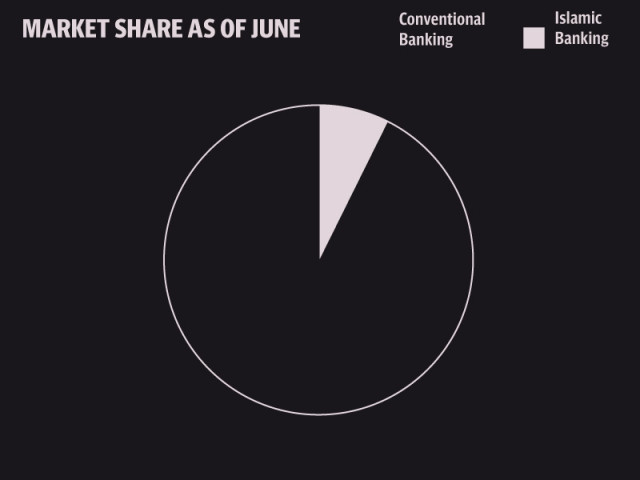

Islamic finance expands to 7% of banking sector

Has grown 30% annually over last six to seven years.

State Bank of Pakistan (SBP) Deputy Governor Muhammad Kamran Shehzad has said the Islamic banking industry is gradually increasing its share in the market and today it constitutes about 7.3 per cent of the overall banking system in Pakistan.

Addressing the closing ceremony on Friday of a five-day training programme on Islamic banking, jointly organised by SBP and Islamic Research and Training Institute (IRTI) at the National Institute of Banking and Finance (NIBAF) in Islamabad, he said the Islamic banking industry, which was re-launched in 2001, had maintained strong growth momentum with over 30 per cent average annual growth over the last six to seven years.

“Growth is likely to gather further momentum with increasing awareness and expansion of Islamic banking network in second and third tier cities,” he said.

There are five full-fledged Islamic banks and 12 conventional banks having Islamic banking branches with a network of over 840 branches in more than 70 districts across the country.

Highlighting the initiatives taken to develop and promote the industry, Shehzad said the central bank had developed a supportive regulatory and supervisory framework and was engaged in promotion, training and capacity-building of industry.

“To address the awareness and misconception issues, we have launched an awareness campaign whereby seminars and conferences are being organised for business community, academia, bankers and policymakers. A media campaign is being launched for mass awareness using electronic and print media,” he added.

According to the deputy governor, a number of initiatives have also been taken to build the industry’s human resource capacity and skills mix. Financial and technical support of reputed national and international institutions like Islamic Financial Services Board (IFSB) is also being mobilised to organise training and capacity-building programmes.

Shehzad stressed that the asset-backed nature of Islamic financial transactions, coupled with prohibition of sale of debt and investments in speculative activities, ensured growth of finance in tandem with the growth of real economy and thus lent prudence and stability to the financial system.

“The resilience of Islamic financial institutions during the recent financial crisis has testified the ability of Islamic economic and financial system,” he added.

Published in The Express Tribune, November 26th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ