Weekly review: Market makes gains as fertiliser sector takes centre stage

KSE-100’s 0.8% gain came mostly due to sharp increase in Nestle’s stock.

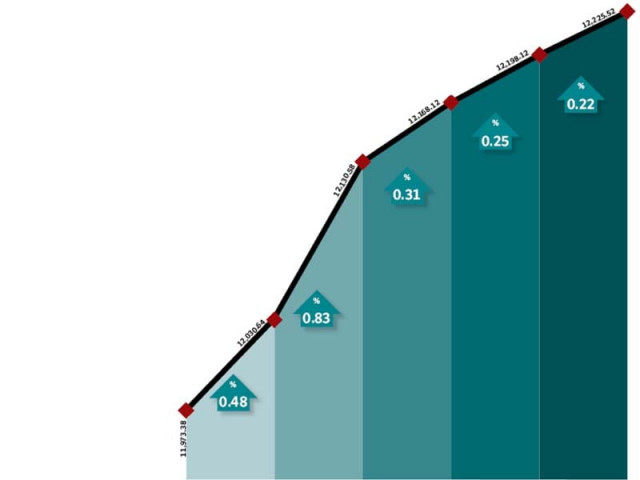

The country’s stock markets recorded light gains, despite stagnant activity due to a lack of triggers, during the week ended June 24. The benchmark KSE-100 index rose 0.8 per cent (103 points) as investors resorted to selective buying.

However, these gains were primarily due to a sharp rise in the price of Nestle Pakistan, which climbed 24 per cent during the week. The scrip is not actively traded and its average volumes during the week stood at a lowly 500 shares per day.

Yet, the company is heavily weighted in the stock exchange and has market capitalisation of Rs217 billion (as of June 24). Hence, the impact of the increase in its share price vastly overstated the gains made by the KSE-100 index during the week.

The fertiliser sector was in the limelight again as news regarding Engro Corporation’s woes at its new urea plant made rounds in the market. The plant has been continuously facing gas outages which have resulted in a delay in its commercial operation.

The news hit Engro’s share price hard and the stock dropped eight per cent before recovering slightly towards the end of the week. Engro’s stock was the most actively traded during the week and its average volumes stood at six million shares per day, making up 10 per cent of the total volumes of the market.

As a result of Engro’s troubles, it is expected that it will further increase the price of urea to compensate for the losses. Urea is selling at an 88 per cent discount in the local market when compared to the latest international prices and that provides Engro headroom to increase its price.

Given that Engro increases its price of urea, the biggest beneficiaries are expected to be Fauji Fertiliser Company (FFC) and Fatima Fertiliser, as both companies are supplied gas from the Mari gas network (unlike Engro, which is supplied by Sui). Both stocks made decent gains with FFC climbing 5.3 per cent and Fatima gaining 2.3 per cent by the end of the week.

In other news, Pakistan Petroleum Limited’s emergency board meeting disappointed investors as a cash payout of only Rs5 was announced, against expectations of Rs8-10. PPL’s share price declined 0.3 per cent as a result. Pakistan Oilfields, however, made solid gains of 3.6 per cent on improved production prospects from its Domail-II field.

Macro data until June 20 revealed that the government had collected tax amounting to Rs1.43 trillion for FY2011, leaving it to collect a further Rs158 billion in the last 10 days of June to meet the revenue target for the year. The International Monetary Fund has also refused to start talks with the government before actual numbers for the completed fiscal year are realised by next month.

Volumes improved slightly by 15 per cent, yet remained at abysmal levels of 61 million shares traded per day. Engro Corp’s volume leading status had an impact on the average traded value, which rose 86.3 per cent and stood at Rs3.54 billion per day. The index’s market capitalisation rose 0.7 per cent and stood at Rs3.29 trillion by the end of the week.

What to expect?

The market can be expected to remain in its dull state in the coming weeks as nothing of particular importance is expected. Sector-specific news can be expected to drive activity in their respective industries and foreign flows should be monitored as a possible indicator to the direction of the market.

Monday, June 20

The Karachi bourse witnessed across-the-board selling sparked by Engro that fell to its lower limit for the day on uncertainty over gas supply. Initial sentiments at the market took a hit after Engro Corporation stock touched its lower limit in early trade on reports of foreign fund selling.

Tuesday, June 21

Equities rebounded sharply from the preceding day’s steep fall led by the oil and consumer goods sectors. News flow suggested that Domail-II field – wholly owned by Pakistan Oilfields – entered its testing phase, leading to a surge in the stock with expectations of an oil and gas discovery

Wednesday, June 22

The bourse gained with oil and fertiliser stocks in the limelight. Fauji Fertiliser Company remained the best performer of the day by rising 3.3 per cent over expectations of another urea price hike of Rs65 to 70 per bag by Engro Corporation and rising international urea prices.

Thursday, June 23

Bulls turned up the heat at the Karachi Stock Exchange to close above 12,500 after a gap of five months with support of the fertiliser and oil sector. Aggressive buying was witnessed in the fertiliser sector following rumours of urea price hike and handsome payout expectations in the upcoming corporate results season.

Friday, June 24

Local bourse took a breather on the last trading session of the week as investors opted to take profits before the weekend. Investors opted to book profits ahead of the weekend after enjoying three per cent gain in the last few trading sessions.

Published in The Express Tribune, June 26th, 2011.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ