Berkshire boosts Goldman, Teva stakes; buys more Apple

Investors closely watch Berkshire’s quarterly stock listings for signs about where they might see value

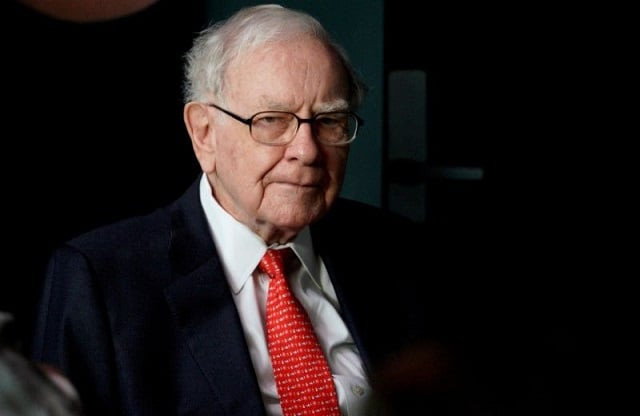

Warren Buffett, CEO of Berkshire Hathaway, pauses while playing bridge as part of the company annual meeting weekend in Omaha, Nebraska US May 6, 2018.

PHOTO: REUTERS

The changes were disclosed on Tuesday in a regulatory filing detailing Berkshire’s US-listed stock holdings as of June 30.

Investors closely watch Berkshire’s quarterly stock listings for signs about where Buffett and his investment managers Todd Combs and Ted Weschler might see value.

The filings do not say which managers bought which stocks. Berkshire spent $6.08 billion on equities in the quarter.

Apple could release four new iPhones this year

Berkshire boosted its Goldman stake by 21 per cent, owning roughly 13.3 million shares worth $2.92 billion on June 30, up from 11 million shares on March 31.

That stake had its origins in a profitable investment in Goldman preferred the stock that Berkshire made during the 2008 financial crisis.

The Teva stake grew 7 per cent to 43.25 million American depositary receipts worth about $1.05 billion. Teva’s ADRs rose 1.2 per cent after market hours.

Berkshire also said its Apple stake swelled to about 252 million shares worth close to $47 billion, up 5 per cent from 239.6 million shares three months earlier.

Berkshire owns roughly 5 per cent of Apple, whose market value surpassed $1 trillion last week.

Buffett, who turns 88 on August 30, often buys stock when he cannot find whole businesses to add to Berkshire’s stable of more than 90 companies in the insurance, energy, food and retail, industrial, railroad and other sectors.

The billionaire has gone 2-1/2 years since completing a major acquisition for Omaha, Nebraska-based Berkshire.

Several of the portfolio changes affected bank and airline stocks, reflecting Buffett’s usual policy not to own more than 10 per cent of a company’s shares.

Berkshire said it sometimes exceeds the 10 per cent cap when companies whose stock it owns repurchase their own shares, forcing it to sell some of its holdings.

Apple’s pricey iPhone X, subscriptions deliver earnings beat

Buffett does make exceptions, including for longtime holdings American Express and dialysis company DaVita.

In Tuesday’s filing, Berkshire reported higher stakes in Axalta Coating Systems, Bank of New York Mellon, Delta Air Lines, General Motors, Liberty Global, Southwest Airlines and US Bancorp.

It reported lower stakes in American Airlines, Charter Communications, Phillips 66, United Continental Holdings and Wells Fargo, and no longer reported a stake in data analytics company Verisk Analytics.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ