Current account deficit widens 28.74% to $1.61b

Analysts say higher oil prices may increase gap by $100m per month

Analysts say higher oil prices may increase gap by $100m per month

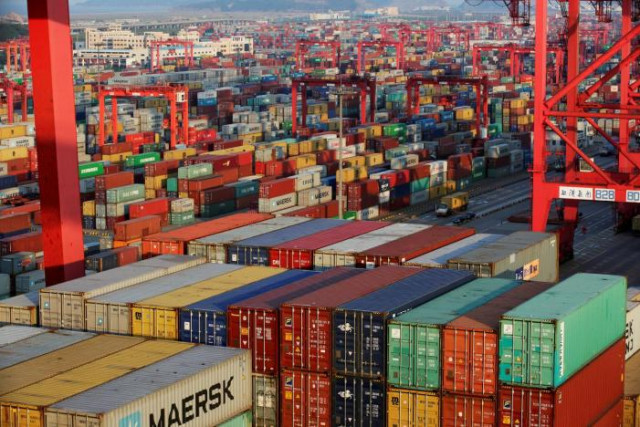

PHOTO: REUTERS

The government of Prime Minister Shahid Khaqan Abbasi devalued the rupee by around 5% against the US dollar in December in a bid to boost exports. It also slapped additional regulatory duty on imports of over 350 items to slow down the ballooning imports. The larger objective of the measures was to control the trade deficit.

Economic growth needs to be inclusive, sustainable, says report

Cumulatively, in the first seven months (July 2017 to January 2018) of the current fiscal year, the current account deficit, however, is seen shrinking in ‘percentage terms’ when compared with figures of the previous six months which might be due to revised numbers.

The deficit widened 48% in the first seven months of the current fiscal year to $9.15 billion. This is, however, lower than 59% ($7.41 billion) in the first six months (July-December 2017), according to the State Bank of Pakistan (SBP).

BMA Capital Economist Fawad Khan told The Express Tribune that the deficit may increase by an additional $100 million per month due to uptrend in international oil prices, as Pakistan remains a net oil and gas importing country.

Oil price in international markets recovered 43% to $64.5 per barrel from around $45 per barrel in June 2017.

Experts anticipated the government to further devalue the rupee against the greenback and other major currencies during the ongoing fiscal year to bring Pakistan’s rupee at par with world currencies and create some sort of balance in external trade and the overall economy.

They foresaw full fiscal year deficit at around $16 billion. This means a tough time for economic managers who will likely resort to short-term borrowing to maintain foreign exchange reserves. The central bank added that exports of goods increased 11.8% to $13.90 billion in the seven-month period compared to $12.44 billion in the same period last year.

The imports of goods surged 18% to $31.04 billion from $26.29 billion in the corresponding period last year.

The imports of goods remained on the higher side due to heavy imports of machinery and other construction material for multibillion dollar projects under the banner of the China-Pakistan Economic Corridor (CPEC).

SBP proposes changes in rules for foreign currency account holders

The trade deficit (of goods and services) increased 21.43% in the seven months to $20.09 billion from $16.54 billion.

Workers’ remittances increased 3.56% to $11.38 billion in the seven months from $10.99 billion in the same period last year, the central bank reported.

Foreign direct investment in the economy has slowed down to $1.48 billion compared to $1.53 billion. More importantly, a significant portion of the foreign investment in local businesses is coming from China for ongoing infrastructure and power projects under CPEC.

Published in The Express Tribune, February 21st, 2018.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ