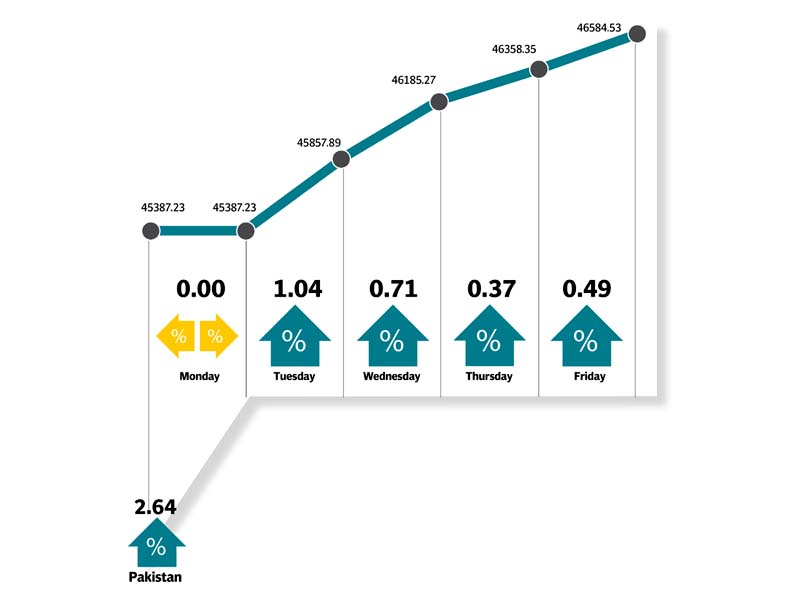

The bullish run saw the index gain 2.6% or 1,197 points week-on-week, closing at 46,584 with local institutions leading the charge where companies, banks and mutual funds cumulatively mopping up shares worth $54 million.

The ongoing bidding process for divestment of Pakistan Stock Exchange along with recovery in global oil prices after the agreement reached on supply cut among oil producing countries and strong liquidity position of local investors proved to be a significant stimulus.

Exploration and production continued to lead the gains, followed by banks which surged 3%.

Pakistan Oil Fields (13.3%), Oil and Gas Development Company (6.5%) and Pakistan Petroleum Limited (PPL, 13.3%) cumulatively contributed 471 points to the surge, tracking gains in international oil prices while rally in PPL was further augmented by news flow regarding extension of Sui lease with improved pricing.

Hubco (+8%) contributed 133 points to the gains on the back of news of its 330-megawatt mine mouth plant getting Nepra’s nod along with the latest stock filing that suggested the second 660 megawatt is also likely to go through.

The government’s decision to reverse the gas price cut turned investors’ attention towards SSGC with the stock performing in the last session.

Fecto and Kohat Cement notified of participation in bidding process of Dewan Cement’s (DCL) plant which led to both scripts posting strong gains along with DCL.

US Federal Reserve’s decision to increase interest rates which came in during the second half of the week was largely a non-event for the bourse as overall growth theme in the backdrop of China-Pakistan Economic Corridor (CPEC) remains intact.

Most of the strong rally in the stocks can be attributed to continued interest from local mutual funds as their buying spree continued during this week as well $29 million bought during the week). Individuals on the other hand, remained skeptical of index levels and continued to book profits at fresh highs recorded during the week.

Average daily volumes for the outgoing week posted a decrease of 9% week-on-week to 358 million shares while average daily value increased 7% week-on-week to Rs20 billion/$190 million over the week.

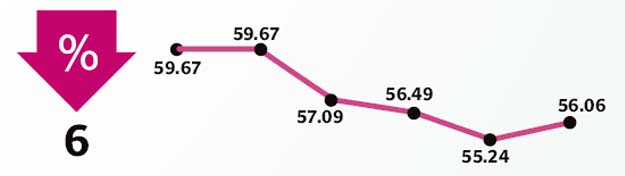

Foreigners remained net sellers of $46.8 million during the week.

Winners of the week

Mari Gas

Mari Gas Company Limited specialises in the drilling, production and selling of natural gas.

Pakistan Oilfields

Pakistan Oilfields Limited specialises in the exploration, drilling, production and transmission of petroleum. The company also markets Liquefied Petroleum Gas (LPG).

Pakistan Petroleum

Pakistan Petroleum Limited specialises in the exploration and production of crude oil and natural gas. The company also sells liquefied petroleum gas and condensates.

Losers of the week

Nishat Power Ltd

Nishat Power Limited is an independent power producer that supplies electricity to the national grid in Pakistan.

Allied Rental Modaraba

Allied Rental Modaraba operates an equipment rental company. The company rents branded power generators, material handling equipment and construction machines for all types of applications.

Engro Fertilizers

Engro Fertilizers Ltd manufactures agricultural fertilisers. The company produces nitrogenous, phosphatic, and blended fertilisers for balanced crop nutrition and increased yield.

Published in The Express Tribune, December 18th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ